From a worker shortage delaying delivery of federal food benefits in New York to an impending cut in cotton production in Texas to rural transportation challenges in the Southeast keeping some people from looking for jobs, the final Federal Reserve Beige Book of 2022 is a trove of story ideas for journalists across beats.

Economists at the Federal Reserve’s district banks — there are 12 across the country — regularly analyze local and regional data to provide research insights on specialized topics, such as economic inequality. The central bank also coalesces those insights in the Beige Book, a high-level, anecdotal glimpse of economic sentiment in each district.

This is the fourth in our occasional series revealing story nuggets within the Beige Book, which comes out eight times yearly. The final Beige Book of 2022 was published on Nov. 30. The Journalist’s Resource previously explored the September 2021, March 2022 and July 2022 editions.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

The Beige Book is especially valuable for journalists covering business topics, as national and regional economies adjust to high inflation amid the winter holiday spending season, and the ongoing risk that the U.S. could fall into a recession. The Beige Book is compiled from reports from Federal Reserve district directors along with interviews and surveys of business owners, community groups and economists.

Individuals surveyed are referred to as “contacts,” and are quoted anonymously. There is no particular number of contacts needed to produce a Beige Book, but each release is based on insights from hundreds of contacts culled from those surveys and wide-ranging conversations.

Research from the Federal Reserve Bank of St. Louis suggests the anecdotes in the Beige Book accurately reflect what’s happening with employment and inflation in the U.S. economy.

After performing a simple textual analysis of every Beige Book from January 2000 to April 2022, the authors find, for example, that mentions of rising prices tend to closely track with official inflation data.

“Of course, the Beige Book — with its emphasis on qualitative and anecdotal information — is written with the belief that those anecdotes provide a deeper understanding of the economy, which simple word counts cannot capture,” write St. Louis Fed senior economist Charles Gascon and senior research associate Devin Werner in their June 2022 analysis.

According to the Nov. 30 release, high mortgage rates spurred by months of Federal Reserve rate hikes cooled the housing market nationally, with home sales falling “steeply” in some parts of the country. Despite inflation rates touching levels last seen in the 1980s, demand for restaurants and luxury hospitality services was strong.

Firms had a slightly easier time hiring, and there were notable layoffs in tech, finance and real estate, but overall “some contacts expressed a reluctance to shed workers in light of hiring difficulties, even though their labor needs were diminishing.” Still, hundreds of thousands of jobs are being added to the economy each month, the unemployment rate is low — 3.7% in November — and Federal Reserve leaders have publicly stated rate hikes are almost certain to continue over the coming months.

Federal Reserve Chair Jerome Powell, in discussing future rate increases during a speech Nov. 30 at the Brookings Institution, said it is “likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

The latest edition of the Beige Book compiles information gathered through Nov. 23. Keep reading for quick summaries and story ideas for each district.

District 1, Boston

Fresh profit hit for restaurants

Semiconductor manufacturers in District 1 experienced varied economic realities, “as one contact in that field said that demand was incredibly strong while another perceived that the industry had entered a recession.” Entry-level workers at convention centers were highly sought after, as were nurses due to the ongoing flu season.

Recession fears and higher mortgage rates meant single family home sales slowed across the district, while there was “a substantial deceleration for condos.” Going out to eat got more expensive as menu prices kept pace with inflation, increasing 8% from last year but holding steady since the third quarter of 2022 “as contacts noted food prices levelled off after an earlier period of steep increases.”

Story idea: With restaurants facing “a fresh hit to profits from increases in credit card fees,” which were announced earlier in the year, how have local businesses in your coverage area responded? Have they passed those costs onto consumers or are they choosing to absorb the higher fees to avoid reduced sales? Have different types of restaurants — for example, casual versus high-end — responded differently?

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

Discontented retail winter

The hospitality sector in New York City had a strong October and early November, “reflecting leisure visitors extending weekends with remote work and a gradual rebound in business travelers.” Visits from international tourists and business travelers increased there, “though the strong dollar has reportedly reduced spending per visitor.”

Expensive real estate sales were particularly slow in the city and surrounding area, but, on the whole, prices there have not significantly fallen in response to higher mortgage rates. Many store owners “reported that business has edged down and expressed widespread pessimism about the upcoming holiday season.”

Homelessness is up across District 2, as eviction moratoria enacted during the pandemic lapsed. Food insecurity was a problem, with some households “forgoing healthier and more expensive food items to buy less costly bulk items, and the use of food pantries continues to increase.”

Story idea: Applications rose for the Supplemental Nutrition Assistance Program — SNAP — the federal program that helps eligible households with their food budgets, “but staff shortages have impeded processing of these applications.” There are a lot of story ideas to unpack. How are worker shortages, which have plagued employers of all stripes this past year, trickling down to delay delivery of services vital for District 2 families with lower incomes?

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

Calls for rental help

Over the coming year, District 3 businesses surveyed across industries expect to raise compensation by 5.1% per employee, down from an expected 5.8% during third quarter surveys, with firms making “preparations for a potential recession” but “hesitant to lay off employees, given recent hiring difficulties.”

Residential real estate sales “fell steeply in most markets,” with industry contacts blaming “high prices combined with rising interest rates” for “reduced housing affordability” and for driving “potential buyers from the market.”

Things were a bit less bleak in commercial real estate, with contacts relaying “steady construction activity” despite a “slight decline in leasing activity,” though they were unsure what demand for office space will look like over the coming year.

Story idea: Use data on types of calls to 211 — a number anyone can call to connect with community services across the country — to understand pressing needs of individuals in your coverage area. If you track this data over time, you can identify trends in calls related to particular needs, which can spur ideas for investigations or bolster existing investigations. In District 3, these calls were mostly about getting help for housing issues, according to the Beige Book. Of the 31% of calls related to housing assistance, 42% were about getting help paying rent, “as landlords continued raising rents.”

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Shrinking housing supply

There are still more workers than positions in District 4, making for a tight labor market, but the balance is beginning to level out. The proportion of contacts at firms across industries that reported raising worker pay over the past two months dropped below 50% for the first time since early 2021.

As in District 2, some District 4 retailers are unsure whether holiday sales will make up for retail sale declines over recent weeks, though an extended recent period of warm weather was a boon for firms in the restaurant and tourist industries. High interest rates and high prices hurt auto sales.

Story idea: This story has been covered before, but it is almost always worth re-exploring: Housing crunches hit households with lower incomes first, and often hardest. And here is a potential new angle: Nonprofit housing developers reported the supply of lower-income housing will shrink due to higher overall materials and labor costs. A construction contact in Ohio relayed that there will be fewer housing units built over the coming months, not just because of higher costs, but because of “unpredictability of costs.”

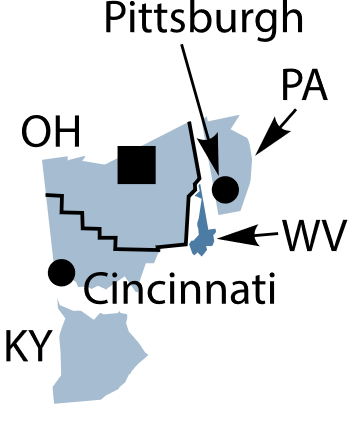

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Office space incentives

Freight volume in and out of District 5 ports was down overall. While import volumes increased a bit, “loaded exports continued trending down” while the “volume of empty containers leaving the ports was robust.” Among the most imported items: furniture, sporting goods and heavy equipment.

Home prices across the district plateaued, with sellers “offering more concessions, such as temporary rate buydowns or paying closing costs, to complete sales.” High construction costs and recession fears made builders reluctant to snatch up new lots.

Business and leisure travel was steady during the fall months, though a winter resort in West Virginia “was concerned that labor shortages would limit their ability to provide the full range of services for this holiday travel season.”

Story idea: During the first two years of the pandemic, work-from-home exploded for employees with jobs amenable to remote work. Over recent weeks in District 5, there was strong demand for high-end offices, “especially in suburban markets, as companies were paying to upgrade to nicer workplaces in order to persuade employees to return back to the office.” What specific office incentives are employers offering? Fancy coffee machines? Decorative water features? On-site childcare? Are these incentives enough to convince District 5 remote workers to take up their commutes again?

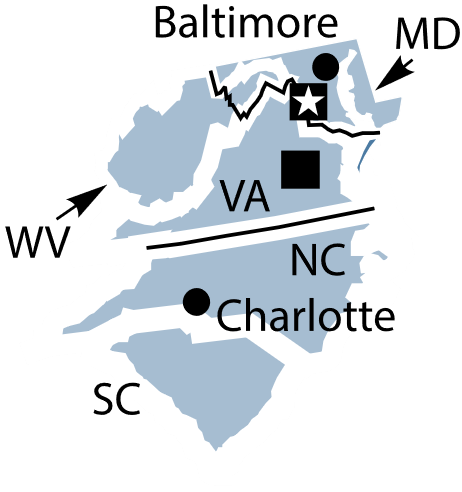

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Rural labor woes

Economic growth was “tepid” in District 6 from October through mid-November, with households earning low-to-moderate incomes seeing “declines in financial well-being as the rising cost of living strained household budgets.” Cost inflation in groceries, fuel and rents “strained household budgets, resulting in increasing demand for food pantries and rental assistance programs.” Cash buyers squeezed low-to-moderate income households out of home buying markets.

Hurricane Ian made landfall in late September and caused tens of billions of dollars of damage in Florida, “with agriculture and tourism being the sectors most impacted.”

Firms across industries found it “nearly impossible” to hire qualified candidates, so they invested more heavily in training, with the “most acute” labor shortages happening in construction, childcare, education and healthcare.

Story idea: Declining labor force participation is a decades-long national story with many narrative threads, including that people are, in general, living longer now than in years past and spending more years in retirement. Other reasons for the labor shortage vary by region: In District 6, one labor shortage angle worth exploring is the lack of affordable childcare and public transportation, “particularly in rural areas.” These problems have “worsened since the pandemic” and are preventing people from job seeking.

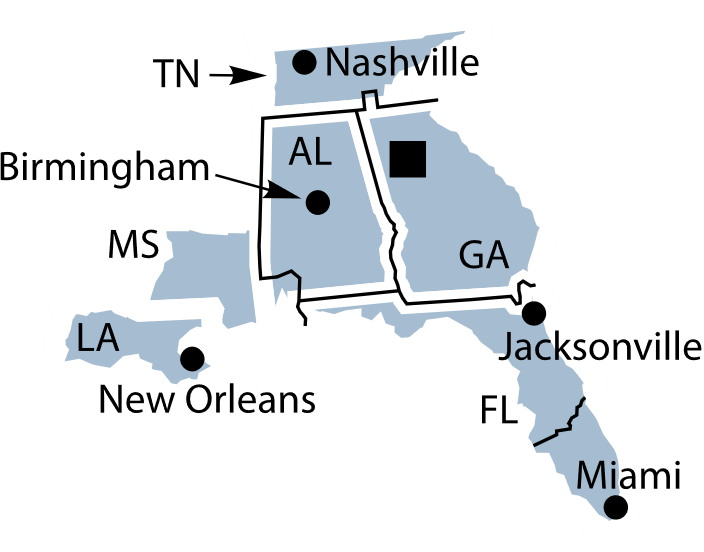

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

‘Tough choices’ for nonprofits

Homebuyers were caught off guard by rising mortgage rates — they were, in fact, “shocked” by rising rates, according to a residential real estate contact. Accordingly, home values fell a bit, as did mortgage lending volumes, meaning fewer people were in a position to ask a bank for a home loan. Rents, meanwhile, “were up again.”

There were some pockets of drought, but some farmers did well, with corn and soybean production “close to records set in 2021.” The problem remains in moving crops to where they are needed, as barges are “constrained due to low water levels on the Mississippi, pushing up shipping costs, limiting exports, and reducing the availability of chemicals and fertilizers.”

Story idea: Across the U.S., local community services often come from nonprofit groups that work to help people with food and housing. While there has been extensive coverage of how rising prices are hurting the budgets of individual families, there is less coverage of those nonprofits, which also often operate on a shoestring. Inflation is both “straining budgets” of nonprofits in District 7, as well as driving people to seek their services more, and “nonprofit leaders were making tough choices on which services to provide and which to cut.” Here is an opportunity for a story or series on how and why those tough choices are made.

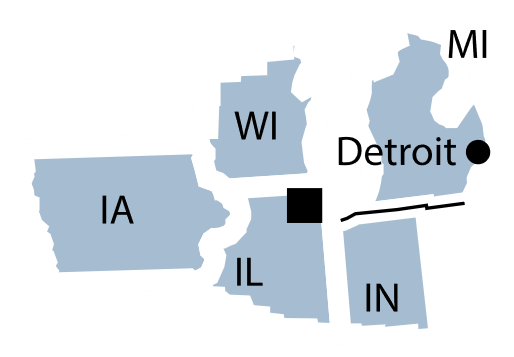

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

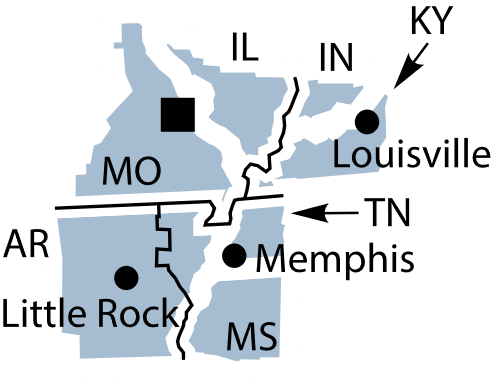

Rural hospitals turn to urban investment

Restaurants in Little Rock, Arkansas, rejoiced with 50% more customers than this time last year and “they are optimistic about the end of 2022 and the beginning of 2023.” Hospitality firms in St. Louis were also busier over the past month compared with other recent months, but they were “uncertain” about the economic outlook moving forward.

Also in Little Rock, over the past quarter people were using their credit and debit cards less at major retailers that offer groceries in favor of using SNAP benefits via electronic benefits transfer card payments. Coal production decreased in District 8 in October, but is up 5.4% compared with the same time last year.

Story idea: In Mississippi, rural health care providers “have continued to shrink and rely on investment from medical institutions in urban areas.” There is a story or series to be done here about what it means for rural hospitals to rely on funding from larger health systems in cities, including whether the health services being funded by urban hospitals meet the needs of rural patients.

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

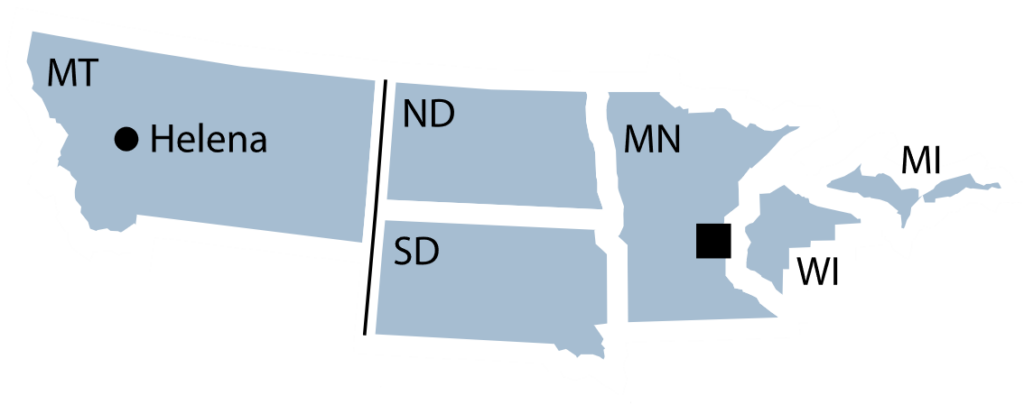

District 9, Minneapolis

Tribal casinos need blackjack dealers

Entry-level, seasonal shelf-stocking jobs peaked at $25 an hour in some cases, with a contact at a staffing firm referring to such pay rates as “craziness.” While many business contacts across industries reported “they were increasing wages and salaries for most job categories, and increases were larger than in the past,” Native American-owned businesses “reported disproportionately acute challenges with labor availability and input costs.”

Residential real estate sales have ticked sharply down across District 9, particularly in Minnesota, where sales volumes fell 31% compared with last year. While agriculture income was up from July to September over the previous year, cattle ranchers in Montana have reduced their herds because of “high feed costs and lack of available hay in the drought-stricken state,” while “reportedly reducing their planned capital expenditures for 2023.”

Story idea: Casinos are critical economic engines for Native American tribes, but some in District 9 are having trouble hiring and retaining workers: “A tribal leader shared that despite offering wages above $30 an hour, casinos were having difficulties attracting blackjack dealers and were paying for the few inexperienced applicants to take classes.” How is this labor crunch affecting tribal casino revenues as well as overall reservation budgets, and what are tribes doing to manage?

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

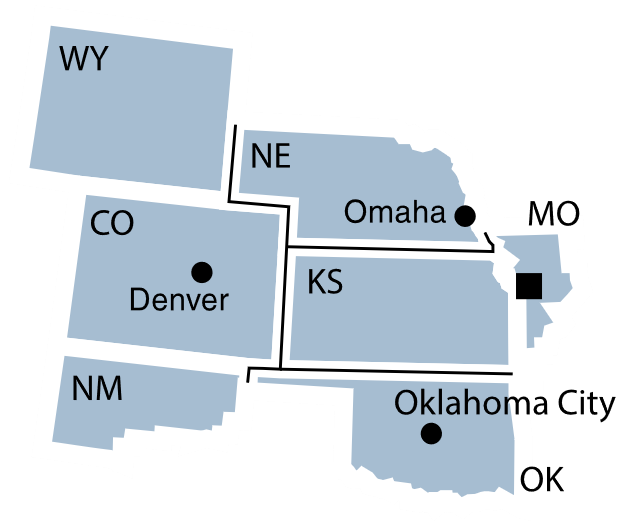

District 10, Kansas City

Community financing time bomb?

In perhaps a promising sign for the nation’s inflation future, many manufacturing contacts expect prices of the materials they use to continue to rise over the next half year, but “a larger number of manufacturing businesses expected price pressures to ease somewhat over the medium-term.” Housing rental costs “remained a significant source of inflationary pressure for households” in District 10.

Consistent with other districts, demand fell for lower-end consumer goods and common services, such as haircuts, while “high-end entertainment venues and travel resorts reported ongoing strength.” As drought parches the Midwest, hay production has suffered and livestock producers expect to face higher feed costs.

Story idea: Just as some home buyers nationwide are turning to riskier mortgage products, like adjustable-rate mortgages, so, too, are some businesses in District 10. Contacts at community development financial institutions — which, among other things, lend to entrepreneurs in economically distressed areas — report more business owners using “non-traditional financing methods such as unsecured lines of credit and online finance firms that require higher interest rates, shorter terms, and more onerous repayment terms.” Depending on how widespread the trend is, these alternative types of credit could be a ticking time bomb for District 10 businesses. Search for community development financial institutions in your area to begin building a contact list.

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Cotton slump ahead

In yet more signs of these tight labor market times, there are “numerous reports” from District 11 firms facing hiring challenges, with one manufacturer of fabricated metals going so far as to say that “the firm was operating by prayer these days.” Among the industries facing short labor supply: healthcare, commercial trucking, auto repair, restaurants and oil extraction. But tech firms in District 11 laid off workers, and some mortgage bankers had frozen hiring.

During the first year or so of the pandemic there was a housing boom in Austin, Texas, with huge asking (and selling) prices, historically speaking. Things have changed. Austin is now the “roughest market” in District 11 with sellers having to offer incentives and cut asking prices in order to close. Overall, residential real estate contacts in District 11 expect a “further erosion in sales and home starts in the near term.”

Story idea: Agriculture reporters, keep a close eye on the “unprecedented volatility” in cotton markets. Cotton prices right now are quite a bit lower than grain prices, according to District 11 agriculture contacts, which “may prompt a significant drop in cotton acreage next year.” A good portion of the nation’s cotton production happens in District 11 — how are growers preparing for a slack 2023?

District 11 includes Texas, northern Louisiana and southern New Mexico.

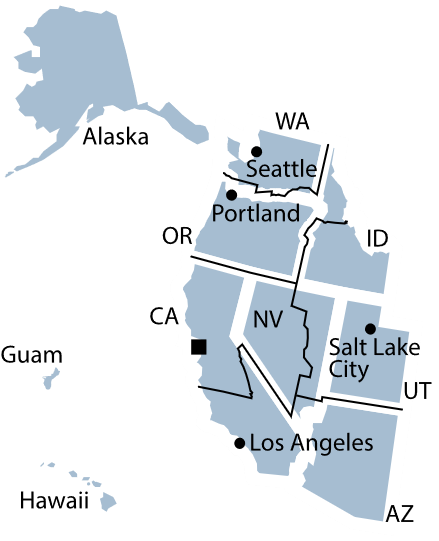

District 12, San Francisco

‘A sharp drop in donations’

Some people looking to buy homes in southern California have decided to rent instead, while in northern California a residential real estate contact “reported a change in scope for some single-family construction projects, now built to rent rather than to sell.”

Getting high-tech electrical components to equipment manufacturers has been a challenge because of “pandemic containment measures in Asia,” with supply chain bottlenecks also affecting agricultural producers.

Also on the agriculture front, there is good international and U.S. demand for dairy products and nuts, but the strong dollar overseas is dampening overall international demand for agricultural products produced in the U.S. A lack of rain across California hurt the summer tomato crop, “and is threatening expectations for various winter crops, especially leafy greens.”

Story idea: Here is another opportunity for a systems story exploring the critical roles nonprofit organizations play at the local level — and why they are on the frontlines of economic downturns. Across District 12, nonprofits that provide services related to behavioral health, substance use and housing have noticed “a sharp drop in donations from both individuals and corporations in recent weeks,” with some community service providers having to shutter because they could not meet their operational costs and staffing needs.

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary