The central bank in the U.S., the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates, which the Federal Reserve Open Market Committee does during scheduled meetings. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

Much of the bank’s vast universe of data, compiled from more than 100 U.S. government and international sources, is available to the public and easily searchable. From gold prices to wood pulp prices, the bank offers more than 815,000 data series. In addition to being a reliable source of economic data, the bank publishes a semi-regular report journalists covering a range of beats — from business, to education, to city and county government — should know about: The Beige Book.

The Beige Book is an anecdotal counterpart to the bank’s suite of hard numbers. It offers a high-level glimpse of the current economic sentiment in each region, based on reports from Federal Reserve district directors and interviews and surveys with business owners large and small, community groups and economists. Individuals surveyed are called contacts. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts culled from surveys and wide-ranging conversations.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

Formally known as the “Summary of Commentary on Current Economic Conditions,” the Beige Book comes out eight times yearly. Each district summary includes write-ups on nationally important topics, like employment and wage conditions, prices, consumer spending and manufacturing. Some districts include industries that are regionally important. For example, the Atlanta district summarizes economic conditions in the regional transportation sector, since it includes major shipping ports and rail yards along the Atlantic and Gulf coasts, as well as Hartsfield-Jackson, the nation’s busiest airport.

Economists and analysts at district banks seek to cultivate contacts that can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with other contacts representing a variety of industries and company sizes. As a general overview of the economy in each district, the Beige Book is a contrast to other Federal Reserve informational products. It’s not the place to turn for average mortgage rates — but, each Beige Book release contains germs for story ideas.

Sometimes, story ideas can be unearthed from a single sentence buried in a district summary. During COVID-19, the Beige Book is especially valuable for business journalists, or any journalist assigned to cover business topics, because national and regional economies are changing rapidly.

Take the July 14 release, which discusses economic conditions from late May to early July. The U.S. economy was generally strengthening as millions more Americans got the COVID vaccine. The big story then? Overall optimism, but there were labor shortages across the board and particularly for in-person jobs like retail and restaurants, where workers were demanding higher wages.

Compare that sentiment with the Sept. 8 release, which covered early July through August. Since July, the Delta variant has torn through parts of the U.S. with relatively low COVID-19 vaccination rates. Labor scarcity remained pronounced and a major barrier to overall business growth. A microchip shortage continued to put a dent in auto sales, despite high demand. The economic outlook in nearly every district continued to improve, but was tamped by the prospect of a pandemic with no clear end in sight.

“Some Districts noted that return-to-work schedules were pushed back due to the increase in the Delta variant,” according to the September release. “With persistent and extensive labor shortages, a number of Districts reported an acceleration in wages, and most characterized wage growth as strong — including all of the midwestern and western regions. Several Districts noted particularly brisk wage gains among lower-wage workers.”

Keep reading for quick summaries and story tips from each district, based on the September Beige Book.

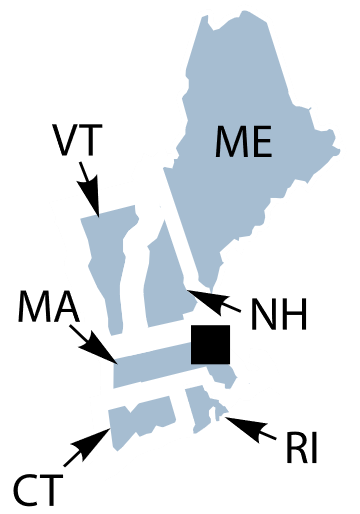

District 1, Boston

A ‘golden age’ for semiconductors

Homeowners looking to sell are enjoying a market experiencing “exceptional strength characterized by high prices and low inventories,” according to the September Beige Book. The outlook is less rosy for those looking to rent out office space, with “slow and even ‘anemic’ conditions” in that market.

Employers are more concerned with unfilled positions than workers demanding higher wages. Some employers reported that “hiring was equally difficult for high wage workers and workers in states which had discontinued [unemployment insurance].” The logistics industry could be particularly strong for job seekers: “One contact said that pay had doubled for logistics specialties.”

Story tip: Auto dealers in several other districts are seeing weaker sales. That’s in large part because of a global microchip shortage limiting the production of new cars. But, in District 1, companies “connected to the semiconductor industry reported exceptional strength with one referring to the current period as a ‘golden age’ for the industry.” Reach out to semiconductor manufacturers to see if there’s a story worth exploring on the flipside of the microchip shortage.

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

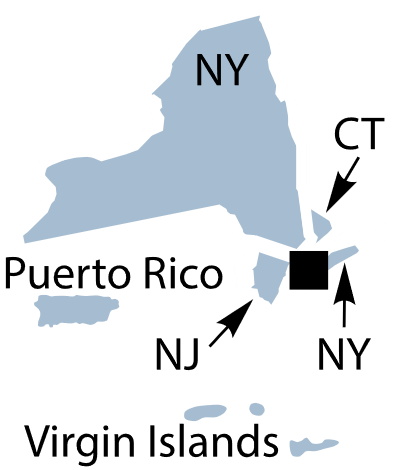

District 2, New York

The (still) evolving future of work

Businesses across the district want to add employees, but in New York City, job seekers are looking for higher compensation and flexible hybrid work options. Sales positions are in demand in upstate New York, with one employment agency there indicating “a slight increase in hiring activity — particularly for salespeople,” while noting generally that businesses “have been increasingly looking outside the region for candidates.” Auto dealers are facing a “severe shortage of auto inventories” because of microchip scarcity.

Tourist dollars slowed a bit in some parts of the district since the July Beige Book, but in upstate New York, “outdoor events, such as the state fair, have been well attended, contributing to a brisk summer tourism season.” In New York City, some major events, like the International Auto Show at the Jacob K. Javits Convention Center, were cancelled over concerns about the Delta variant and federal restrictions on foreign travel.

Story tip: The office market in New York City is weak, with “record-high sublet space available and rents still trending down.” But while many firms “have reduced their footprint in Manhattan or plan to do so,” some “large tech companies” have picked up leases. Could the future of office viability in the city lie with those tech firms? New York Federal Reserve analyst Jason Bram, who produces regional Beige Book reports and researches commuting patterns, would be a good source to find out more.

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

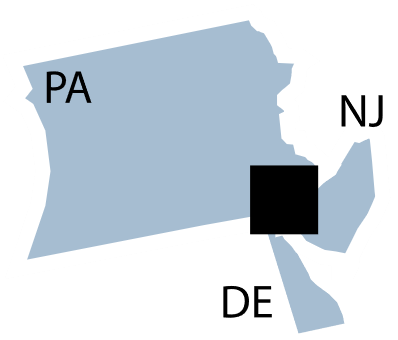

District 3, Philadelphia

‘Belligerent customers’

Workers and employers alike are burned out, with the labor shortage forcing “smaller retail and restaurant owners back to the register, the kitchen, and the dish room.” Logistics are a problem for business owners. One restaurant chain had to rent refrigerated trucks to make deliveries after major delays from its regular distributors.

Firms are still figuring out how to match wages they can afford with wages employees want. Some manufacturers are turning to automation in lieu of hiring humans. “Two manufacturing firms reported opposing results from offering a $20 an hour wage — one noted improved hiring at all locations, another reported no applicants.”

The microchip shortage significantly cut into new auto sales. “Contacts opined that the situation may continue until at least next summer.”

Story tip: Some contacts from firms that sell goods and services directly to the public “noted a rising number of belligerent customers.” Ask local restaurants and other public-facing service employers whether customers are becoming increasingly hostile. If so, why?

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

More frequent raises — and higher prices?

Many employers aren’t sure they’ll be able to staff up in the coming months, even for higher-skill jobs. “One producer of industrial robots expected it would take four to five months to hire 20 semi-skilled manufacturing techs, a timeline which would be far longer than typical.”

Home prices are high in the district and the market for buyers is competitive, but “homebuilders were concerned that persistent supply chain disruptions were inhibiting new home construction.” In-store retail business has ticked upward in recent weeks for general merchandise and apparel stores. With schools returning to in-person learning, “back-to-school sales were stronger than in 2020 and were in line with 2019 sales,” according to a department store contact.

Story tip: Raises are happening more often, with one trucking firm reporting “it had already given five pay raises this year.” Will prices rise along with wages and other costs? “Many contacts indicated they were passing through higher labor costs to customers, not just higher costs for materials and freight services as in recent surveys.”

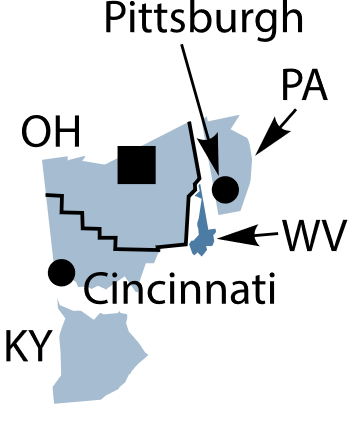

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Follow the wedding dresses

Raises are happening here, too, with one manufacturer reporting that “they not only increased starting wages but also offered guaranteed raises after three and six months.”

A major region for shipping, rail delays combined with a lack of truck drivers meant some freight containers were left sitting at ports for “an extended period of time” before moving inland. Months back, passenger planes were being used for cargo. But with air travel picking up, the number of cargo flights has dropped.

Story idea: Consumers in the district want to buy furniture and other home goods, as well as clothing, but retailers “noted shortages of and increased lead times for merchandise, particularly on foreign-made goods. One contact reported refunding several bridal parties because dresses did not arrive on time for weddings.” Find out if this is a trend — are local wedding shops having trouble keeping enough inventory? If so, how are couples dealing with wedding dress snafus?

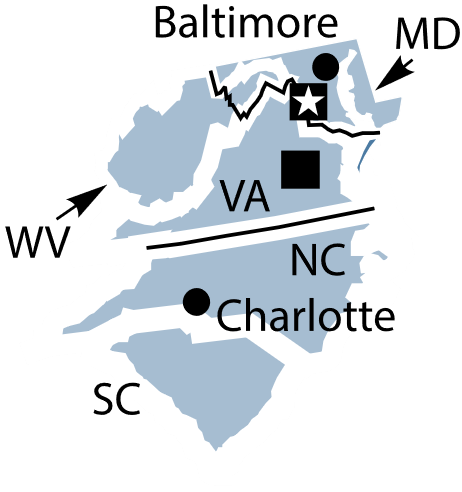

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

The ‘gray wave’ and ‘ghosting coasting’

The lack of workers is leading to real problems for businesses, with “projects placed on hold, store hours reduced” and restaurant menus being “slimmed down.” Employees juggling their jobs and young children may be facing challenges. Some childcare centers that are struggling to hire have closed their infant rooms “because they require a greater number of caregivers.”

There were “record container volumes of imported goods” at regional ports, along with “robust freight shipments” for trucking companies and increased demand for rail, even as “dwell times in rail yards increased.” Air cargo demand was “steady” but “there was growing uncertainty surrounding the impact of COVID-19 outbreaks on activity.” Supply chain contacts think logistics disruptions will persist for up to another six months.

The prognosis for Florida fruit: “On a month-over-month basis, the production forecast for Florida’s orange crop was up in July while the grapefruit production forecast was unchanged; both forecasts remained below last year’s production levels.”

Story idea: Why are employees “ghosting coasting” and how is the practice affecting businesses? Ghosting coasting is when “a new hire works for a few days and moves on to the next restaurant,” without giving notice, according to the September release. Plus, as hospitals strain to keep up with COVID patients, some health providers may be contending with a “‘gray wave’ of early retirements, particularly among nurses.”

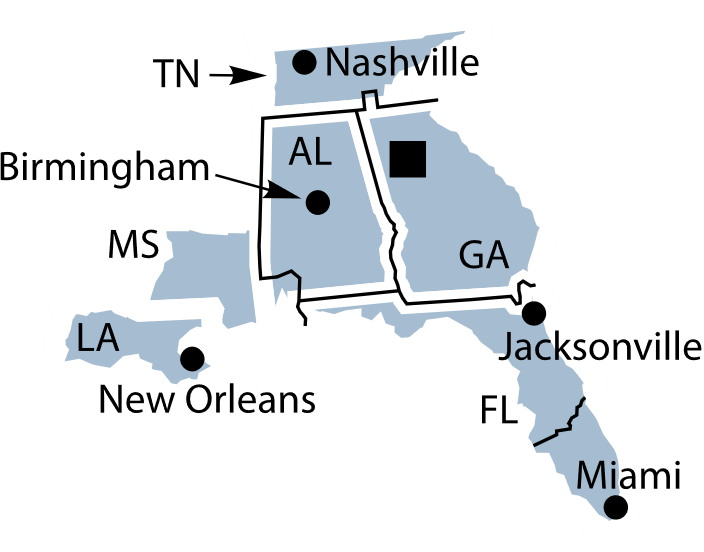

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Shortage of farm equipment parts could mean soy, corn delays

Back-to-school shopping was strong, and milk producers facing “lower margins as transportation costs rose” were hopeful that “reopening schools would boost bottled milk demand.”

A “service that analyzes consumer foot traffic in brick-and-mortar stores indicated that activity in the Midwest had recovered to pre-pandemic levels.” Consumer prices are up “robustly,” related to higher energy, labor and transportation costs.

“Most manufacturing contacts reported that business was above pre-pandemic levels, and many were running at full capacity.” Still, some manufacturers lack basic supplies, including “aluminum, steel, copper, plastics, paints, pallets, paper, glue,” and, yes, microchips.

Story idea: Corn and soybean harvests were “expected to be near record levels,” but there could be trouble getting those crops to consumers. “Concerns grew that strained logistics would lead to shortages of parts for farm equipment during harvest and clog the movement of crops to markets.” Which parts specifically are in short supply? What’s the supply chain story — are the parts made of a raw material that is being held up?

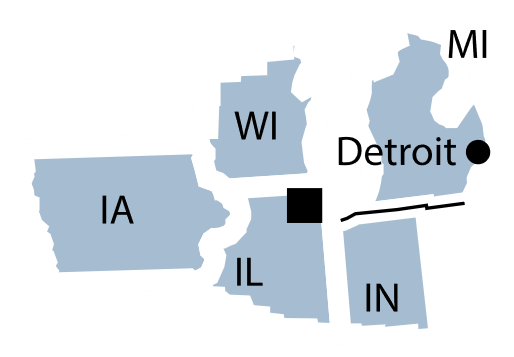

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

The worker shortage and consumer protection

Six in 10 employers contacted had raised wages, “well above historical values.” A starting wage of $17 an hour wasn’t enough for one manufacturer to attract the number of workers it needed.

One construction contact reported prices for concrete are up 20%, “and the price for electric wire has rapidly increased.” Costs of other input materials, like polycarbonate, aluminum, steel, wood and electrical parts are “skyrocketing,” according to an electrical sign and billboard sales firm.

Relevant to an economic region where beer is big business, one brewery “reported that their supplier increased prices twice between order and delivery for a pallet of aluminum.”

Story idea: Could the worker shortage be affecting consumer safety? A paucity of employees has “led to issues in quality control, with surges in retail returns and auto repairs due to product defects.” Are retail shops and auto sellers dealing with more returned products than usual?

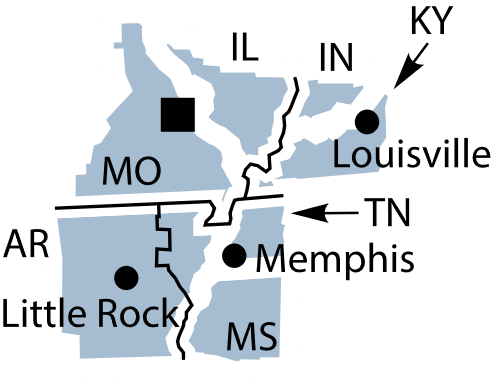

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

Not enough hay

While firms generally “reported continued difficulty attracting labor,” companies were also “upbeat regarding future hiring. A mid-August survey of construction firms across the District found that 70 percent have been hiring in some capacity of late.”

Still, the overall lack of workers is causing burnout among those who have a job, with some feeling “overworked and tired.” In the Twin Cities, low-wage workers are stressed about their ability to pay for food, housing and utilities. In Montana, job seekers are worried about housing and childcare affordability. An auto dealer there reported “solid” demand but low inventory, like in many other districts.

Story idea: Severe drought is weighing on the minds of livestock and dairy farmers. They’re particularly “suffering from the drought’s impact on hay availability and pasture conditions, while corn and soybean crop conditions were deteriorating.” Is there a visual story to tell of how the drought is affecting livestock and dairy farmers?

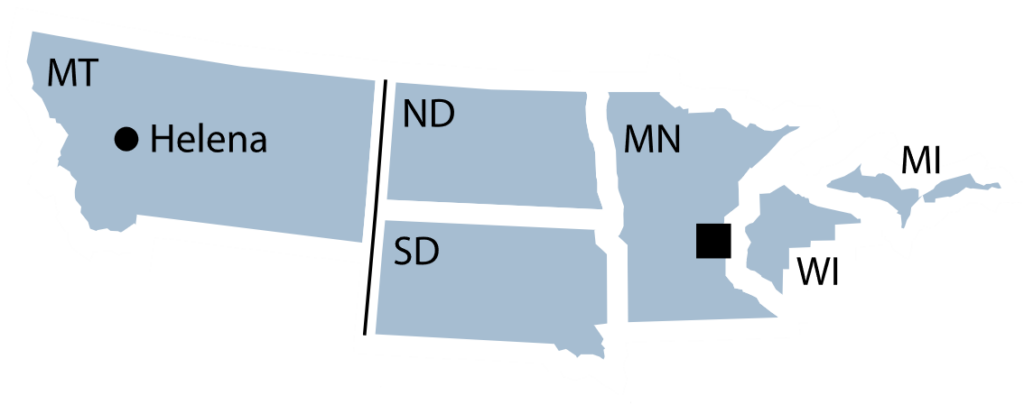

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

High on the hog, low on the cow

Manufacturing employees continued to leave their jobs for better pay at other firms, or were retiring. Manufacturing firms looking to hire “noted that the number of applications for open positions was low, and that applicants often lacked requisite qualifications or were not willing to accept offered levels of compensation.”

Food manufacturers slowed production because they lacked workers, despite high demand. While restaurants and hotels did well in July and August, “several contacts noted that reservations were down in recent weeks more than anticipated,” and rising COVID rates could slow their sales in the coming months.

Story idea: A tale of two agricultural sectors. Prices for pig products “remained at multi-year highs,” but “profit opportunities for cattle producers remained limited.” Meat packers can’t hire enough workers and have had to limit production. Then there’s the drought, which has led to poor conditions for almost two-thirds of pasture and range land in Wyoming, “compared with about 30% in Colorado and New Mexico and 20% or less in all other states” in the district.

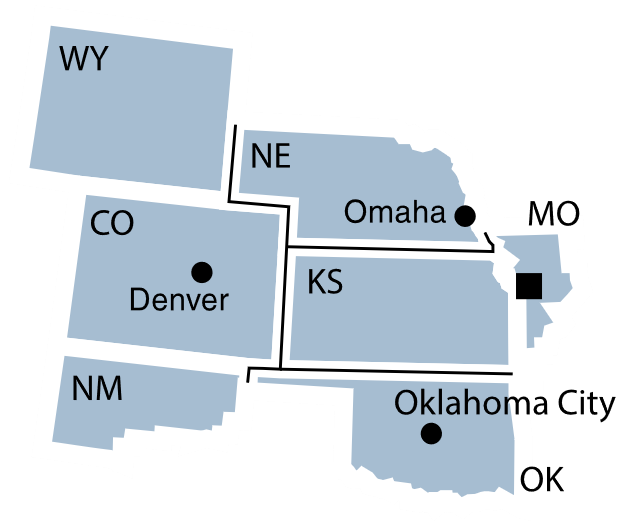

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Health care staffing problems in COVID hot spots

Leisure and hospitality firms remained “positive” on their short-term outlooks, but were “less optimistic in August than in prior periods as the surging Delta variant, persistent labor and supply shortages, and rising costs are expected to dampen the economic recovery.”

A lack of interest in office space will remain an issue, “due to the fallout from work-from home policies, and contacts do not expect much improvement in the near term.” While companies are not necessarily rushing back to the office, many are still looking to hire. A survey the Dallas Federal Reserve took of more than 350 Texas businesses “showed that about 70% were trying to hire in August, and the vast majority named a lack of applicants as an impediment.”

The district is a major energy producer, and orders are up for new oil drilling equipment. “Contacts generally felt that current oil and gas prices are sufficient for producers to meet capital expenditures goals and even slightly grow production.”

Story idea: For a region where health care systems have been overwhelmed by recent COVID cases, the news could get grimmer still because of hospital staffing issues, especially nurses. “Hospitals also reported a lack of a large-scale return of applicants for low-wage positions, despite the end of federal unemployment benefits,” according to the September Beige Book.

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

SPAC party over?

It’s a job seeker’s market with “contacts in the transportation, manufacturing, construction, hospitality, and retail sectors mentioned having many unfilled positions.”

But turnover is high, “with one contact in the hospitality sector observing that almost half of new employees quit after only one or two months on the job.” Prices are rising, too, with producers passing along higher logistics and labor costs to consumers.

The Pacific Northwest is facing a “shortage of undeveloped land” for homes, according to several contacts surveyed. Sawmills there have “curtailed hours and shifts in the past several weeks” with lumber supply outstripping demand after “a year of strong growth.”

Story idea: Special Purpose Acquisition Companies have made for hot business stories in recent months. SPACs, as they’re known, are companies that do nothing but raise money by going public on a stock exchange — with an eye toward purchasing an existing company. The concept has been around for years but turned popular in 2020. Could the SPAC trend be slowing? “A contact in Southern California observed that while SPAC activity decreased dramatically in recent months, investor interest in sustainability and clean energy technology remained high,” according to the September release.

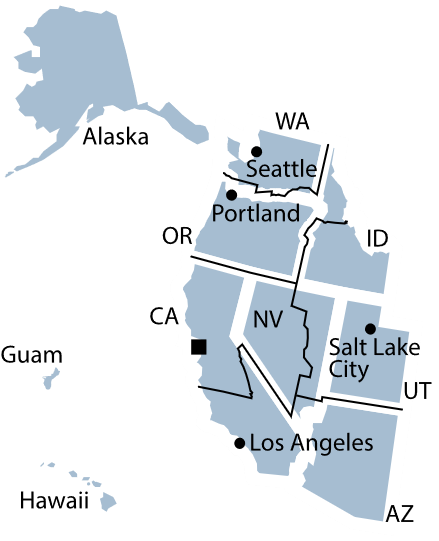

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary