The U.S. central banking system, the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

The Federal Reserve’s Beige Book offers a high-level, anecdotal glimpse of current economic sentiment in each of the central bank’s 12 regions. For journalists, it can serve as an extensive tip sheet with insights on local, regional and national story angles.

The Beige Book is valuable for journalists reporting on economic issues, because national and regional economic conditions can change rapidly. The edition published in December offers story ideas for reporters covering business as well as those covering agriculture, transportation, housing and more.

The Beige Book was first publicly published in the 1980s with a beige cover. Find the archives here.

The book is compiled from reports from Federal Reserve district directors along with interviews and surveys of business owners, community groups and economists.

The authors of the book refer to individuals surveyed as “contacts,” and they are quoted anonymously. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts culled from surveys and wide-ranging conversations among “a diverse set of sources that can provide accurate and objective information about a broad range of economic activities,” according to the book.

Economists and analysts at district banks seek to cultivate contacts who can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with contacts representing a variety of industries and company sizes.

Research from the Federal Reserve Bank of St. Louis suggests the anecdotes in the Beige Book accurately reflect what’s happening with employment and inflation the U.S. economy. After performing a simple textual analysis of every Beige Book from 2000 to April 2022, those authors find, for example, that mentions of rising prices tend to closely track with official inflation data.

“Of course, the Beige Book — with its emphasis on qualitative and anecdotal information — is written with the belief that those anecdotes provide a deeper understanding of the economy, which simple word counts cannot capture,” write St. Louis Fed senior economist Charles Gascon and research associate Devin Warner in their June 2022 analysis.

The Beige Book published on Dec. 4 includes information gathered during October and November. Across districts, prices rose “only at a modest pace” while profit margins for firms were down due to rising input prices — those are costs for the materials and labor needed to make goods.

One interesting national trend is a slowdown in home furnishing sales, related to homeowners being less willing to put their homes on the market considering the relatively high interest rates they’d have to incur to buy again. Keep reading for quick summaries and ideas for story pitches from the latest Beige Book release.

District 1, Boston

Calling all managers

A warm and dry fall “crimped” cold-weather clothing and snowmobile sales in District 1, while overall economic activity was slightly down from the previous reporting period.

While retailers were “concerned about recent weakness in sales” they remained “optimistic that more seasonable weather would contribute to firmer sales for the holiday season.”

There was low demand for office leases in Boston, but a small increase in high-tech firms interested in office space there. Real estate investors were looking toward multifamily housing, but cities and towns are pushing back against new multifamily construction. Interest rates for commercial real estate were up, along with “concerns of a possible resurgence in inflation in construction costs” from one contact.

Story idea: Demand for labor held steady in District 1, but restaurateurs in particular were pleased to see an increase in job applicants — while lamenting a lack of qualified applicants for managerial roles. This suggests people are interested in working in restaurants but perhaps less interested in staying in the industry long enough to gain managerial experience. Or it could suggest that most restaurant managers are happy in their current roles and not looking for new opportunities. Jessica Muradian of the Massachusetts Restaurant Association could be a good first contact for help figuring out whether the managerial labor shortage is worth covering for your audiences.

Boston Federal Reserve Regional Data

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

Social determinants of health

Labor supply outpaced demand in District 2, with special difficulty among manufacturing firms looking for skilled workers. While worker demand “continued to soften slightly,” the uncertain outcome of the presidential election “had led to a pause in decision making, though contacts anticipated hiring would pick up again.”

Tourism in New York City was strong during the fall, with hotels filling up “at or above pre-pandemic levels.” But sales in restaurant and theater industries were tepid, “with hybrid work arrangements contributing to reduced attendance by suburban visitors.”

Credit costs slowed real estate construction across District 2, with one upstate New York contact noting that high costs, such as for labor and lumber, were holding back new home builds.

Story idea: Last year, the federal government introduced guidance allowing states more flexibility to use Medicaid dollars toward addressing social determinants of health. According to KFF, a nonprofit nonpartisan health policy research organization, the social determinants of health “include factors like economic stability, education, neighborhood and physical environment, employment, and social support networks, as well as access to health care.” Those federal dollars are now reaching social service providers to incorporate things like mental health and addiction services into their overall services. If you cover health-related nonprofits in District 2, it would be a good time to see whether and how they are using this Medicaid money.

New York Federal Reserve Regional Data

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

A tale of two housing markets

Prices for goods and services rose slightly in District 3, while manufacturers expect to keep raising prices over the next six months — and “a significant number of firms expressed the concern that tariffs would drive prices higher.”

Manufacturers expect growth in new orders and shipments over the next six months, though capital expenditure plans did not change. Capital expenditures are investments in physical property, such as equipment and buildings. When firms invest in capital expenditures it’s a signal that they expect demand to be strong in the long term.

Retailers other than auto sellers marked no change in sales. Auto dealers have turned to incentives to spur sales, but still “vehicles are accumulating on lots — raising dealers’ floor plan costs and further cutting into profits.”

Story idea: With mortgage rates still high compared with recent years, there aren’t many existing single-family homes on the market — and accepted bids are often above the asking price. Conversely, the many new multifamily apartment buildings built in recent years are easing housing challenges for renters in District 3 and is “fostering competition for renters with an increase in signing incentives.” So: A lack of supply leads to higher prices for home buyers, while more supply leads to lower prices for renters. These real-world examples could be used in an explainer on the market dynamics of housing, to improve audience understanding of the economic forces that shape where and how people live.

Philadelphia Federal Reserve Regional Data

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Childcare staffing crunch

Some manufacturers reported margin compression led them to reduce workforce by cutting hours or not rehiring after people quit. Margin compression refers to input prices — those are costs, such as employee wages, needed to make a good — rising faster than sale prices.

But, overall, firms in District 4 expect to hire a bit more in the next few months, with particular sectors preparing to ramp up: “Business services contacts indicated that they were hiring for growth, and auto dealers added mechanics to meet increased demand for vehicle repair work.”

District 4 consumers, as in other parts of the country, are becoming quite sensitive to price increases, with one manufacturer offering, “I’m not sure the U.S. consumer can handle more pricing at this point.” Yet across sectors, firms reported higher prices with an eye toward better profit margins. This included a law firm that saw no pushback from clients after raising fees, and construction and manufacturing firms that have increased prices because of rising raw material and labor costs.

Story idea: The price of daycare could be rising in District 4, with one provider reporting difficulties finding qualified employees and expecting to raise fees by up to 40% to make up for falling enrollment. Another contact in the industry “explained that fewer childcare providers in rural communities contributed to lower workforce participation for women.” Start by reaching out to the Ohio Association of Child Care Providers for insights into staffing challenges and to develop sources in the industry.

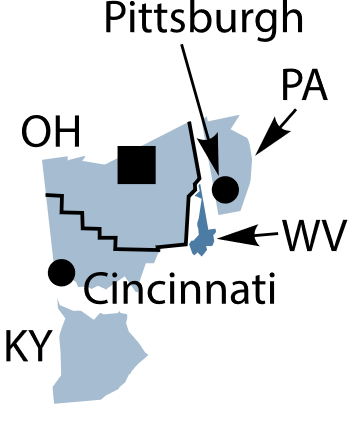

Cleveland Federal Reserve Regional Data

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Getting creative for faster zoning

Leisure travel and overall consumer spending were down where Hurricane Helen hit in September — parts of South Carolina, North Carolina and Virginia in District 5 — but spending on repair services and hotel stays were up, spurred by out-of-town workers brought in to make repairs. One food manufacturer “lost five production days, infrastructure, and livestock due to the hurricane and estimated six-to-nine months to become fully operational.”

Manufacturers overall in the district were less able to pass along rising input costs, such as from wages, “and therefore profit margins were declining.” Firms were also concerned about supply chain disruptions from the early October strike at the Port of Virginia, though it lasted only three days. The strike did not substantially impact port operations, but “carriers have diverted some cargo routes to the West Coast” with contract negotiations expected to pick up again in January.

Story idea: Real estate agents observed that residential construction projects were continuing, with several agents reporting developers “getting creative with designs and density to speed up the local government zoning processes.” How are developers “getting creative” to obtain building permits? Explore data from and reach out to government agencies, such as the Richmond Zoning Administration, and trade associations, such as the Home Builders Association of Virginia, to begin digging into this question.

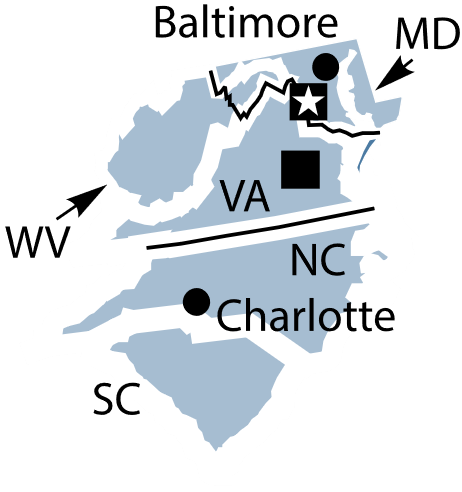

Richmond Federal Reserve Regional Data

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Energy infrastructure

There’s a glut of entry-level employees looking for work in District 6, along with “increased interest among retirees in finding work to supplement incomes.” Employers, in turn, are “confident” they will be able to hire the workers they need.

Retail sales were up, but less expensive value brands were increasingly popular among consumers, with consumers at all incomes recoiling from higher prices. That said, “customers were more willing to spend if the price was right” and many firms “were increasingly optimistic for a solid 2025” with retailers increasing their inventories.

Story idea: Renewable energy and electricity demand in District 6 is “very strong and growing,” but it’s unclear whether existing infrastructure can keep up, with utilities reporting that growing national demand for electricity means “significant grid modernization” is necessary. So, can existing energy infrastructure keep up with demand? What happens to the regional economy if it can’t? It’s an important story to cover, considering several cities in District 6 are among the fastest growing in the country.

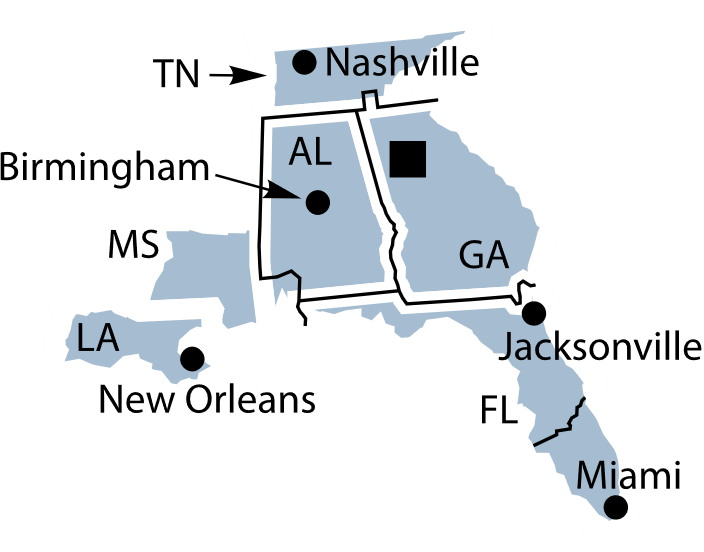

Atlanta Federal Reserve Regional Data

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Best tomatoes ever

Cost of living pushed wages up for some District 7 retail workers, though “there were reports of forgone cost of living adjustments in manufacturing and lower holiday bonuses for workers in trucking.” But overall employment was up a tick from the previous reporting period, and many firms expected much of the same through 2025.

As in other districts, District 7 consumers were sensitive to price increases, with one grocery store contact reporting “consumers were now shopping around for basic items such as canned goods,” while discount stores saw better sales.

With the potential for higher tariffs under a second Trump administration, many retailers were aiming to stock up their inventory. One contact at a firm that sells computers reported higher sales recently, “as business clients pulled ahead replacement plans to avoid expected higher prices for imported electronics.”

Story idea: Though low prices for corn and soybeans has been hurting agricultural income, the quality of many crops in District 7 was high during the past growing season — tomatoes in particular “resulting in a ‘best ever’ crop according to industry contacts.” What makes for the “best ever” tomato crop in the district? What’s different in how those tomatoes look and taste? Have consumers noticed? The Illinois Specialty Growers Association could be a good first contact. (Tomatoes are specialty crops, according to the U.S. Department of Agriculture.)

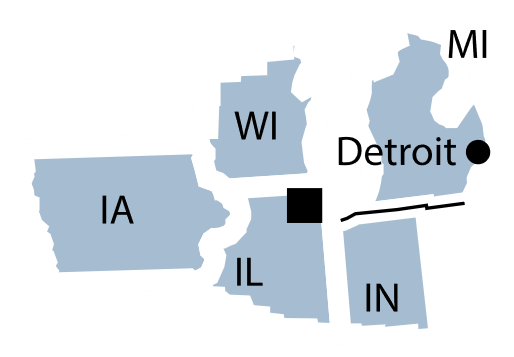

Chicago Federal Reserve Regional Data

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

‘Tis the season

Spending fell across industries and income brackets in District 8. One oil change business reported consumers favoring basic motor oil over more expensive synthetics. Auto sales in Missouri were down, but in Arkansas auto dealers enjoyed a flood of purchases after the presidential election. Sales for lower-ticket retail items were down “as consumers seem to be more cautious and less willing to spend discretionary funds.”

Prices for single-family homes in the district remained elevated along with interest rates, with “slightly higher” inventories than last year. A realtor in Kentucky noted “houses are still priced too high and will need to come down to generate more movement in the market.”

Farmers were worried in the medium term about whether federal legislators would pass a new farm bill and, in the shorter term, about crop yields, as soybean crop quality was degraded after heavy rains.

Story idea: Apparently the most festive house on the cul-de-sac doesn’t decorate itself: “A holiday decorator noted that their wealthy clients were opting to decorate without using their services and were not purchasing new décor, as they usually do.” Reach out to professional holiday decorators for help understanding the market and for an interesting story about a high-end service many people have never heard of. Also feature the voices of on-the-ground employees, who are likely far less wealthy than their clients.

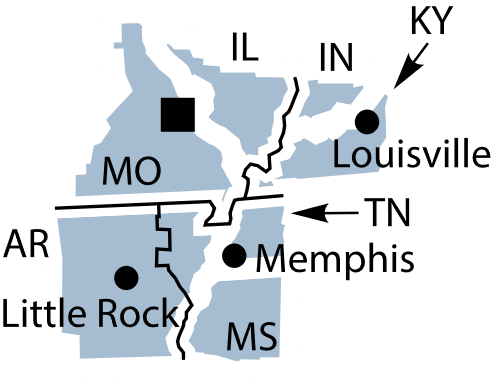

St. Louis Federal Reserve Regional Data

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

Have vacancy, will travel

In suburban Minnesota, a contact from a bakery reported workers were willing to quit if they didn’t get wages they wanted. While workers were not in high demand among manufacturing firms — with agricultural equipment producers particularly dinged by low demand — financial services and health care firms were generally looking to hire.

Some parts of the district saw increases in air passengers of 10% or more, while hotel stays were also sought, especially in Montana, South Dakota and Wisconsin. Chocolate makers were looking forward to Christmas, while snow removal companies were “hoping for one covered in white.”

The agriculture sector in the district was “weak” with many farms reporting lower incomes in the third quarter of 2024 compared with last year, “as productive harvests were not sufficient to offset low commodity prices and elevated operating costs.”

Story idea: Hiring was challenging for rural businesses, with one grocery store owner in Montana going so far as to leave the state “to hire immigrant workers with the promise of providing housing.” Is this something you’ve heard of happening in your rural coverage area? It would be good to find out. If so, an anecdote like this could serve as a compelling narrative anchor for a wider look at regional effects of federal immigration policy. The Transactional Records Access Clearinghouse from Syracuse University is always a good source of immigration data.

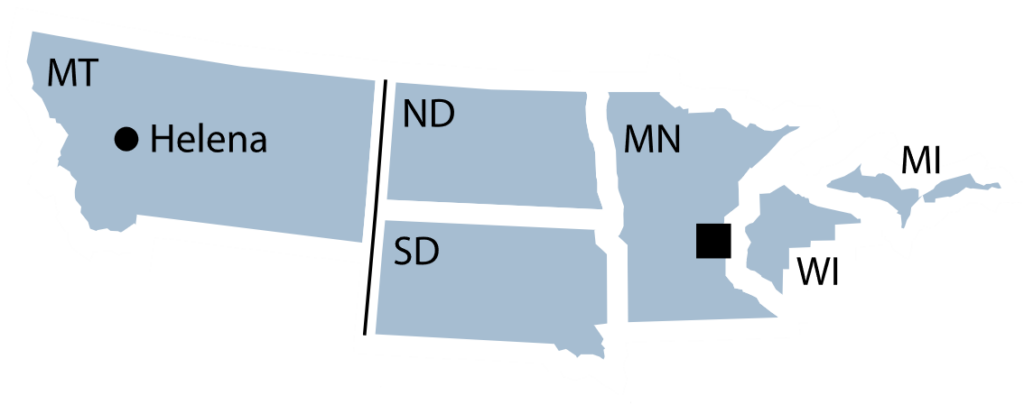

Minneapolis Federal Reserve Regional Data

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

Job hoppers

There wasn’t much new hiring across industries in District 10, with “nearly all businesses” relaying that “worker turnover was abnormally low.” Workers at firms in professional services (think lawyers and accountants) and at technology firms saw quicker pay growth, but across sectors “most contacts indicated they do not plan to raise wages substantially over the next year.”

Other than in Oklahoma, corn and soybean crop production outpaced the five-year average, though “pockets of drought also hindered crop production in certain areas” and farms in general were worried about their finances in 2025 due to high interest rates.

Story idea: Job hopping — quickly moving from one job to the next — is one way that workers can quickly increase their pay. Despite overall low turnover in District 10, “workers in [low-wage] jobs were still finding wage gains from job hopping.” Who is job hopping? Why and how long have they been job hopping? Use social media groups to find job hoppers, though keep in mind they might request anonymity or may not want to talk about their current workplaces. Experts at the Massachusetts Institute of Technology Institute for Work and Employment Research can discuss academic research on job hopping among low-wage workers.

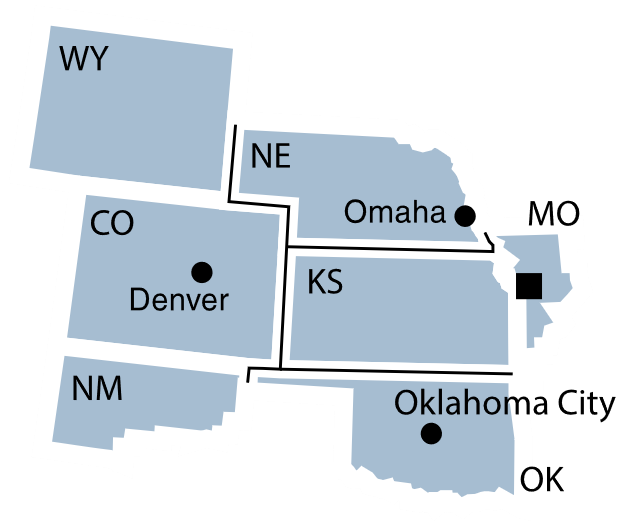

Kansas City Federal Reserve Regional Data

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Executive order fallout

Business air travel increased in District 11, “up notably from last year with more people traveling for work,” but still lagging pre-pandemic volume. Overall, airlines were in high demand with some industry contacts reporting “record revenues.” Retailers, meanwhile, were optimistic about 2025, “though some expressed concern over potential tariffs and how retaliatory tariffs could hamper their international sales.”

Residential and commercial real estate loan delinquencies ticked up. Still, lenders were looking forward to “a significant improvement in loan demand and business activity six months from now,” despite loan volumes falling in November.

Oil and gas producers were concerned prices might not be high as predicted in 2025, potentially leading to less capital spending. But industry contacts also “expressed optimism” that a federal pause on exporting liquefied natural gas to other countries would be “lifted soon” leading to “more natural gas infrastructure and LNG export investment over the next several years.”

Story idea: Social service nonprofits have “noted an increase in demand for social services by immigrants,” with one contact reporting that Texas Executive Order GA-46, which Gov. Greg Abbott signed in August and went into effect in November, “has prompted fear in the immigrant community and that some families are not seeking the medical care they need because of it, even if they are in the U.S. legally.” The order directs hospitals that receive public funding to collect citizenship information from patients — but the issue of publicly funded health care for migrants is much bigger than a single executive order. Read our primer published in July on the topic to get up to speed and for a wealth of resources that will inform your reporting.

Dallas Federal Reserve Regional Data

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

Sour grapes for California wine sales

Some firms reduced coverage of mental health services for their workers, blaming rising insurance costs. Demand was also “elevated” for organizations providing mental health services and food assistance, while nonprofits focused on sustainable growth and financial literacy reported an uptick in public sector funding. Broadly, contacts across District 12 reported affordable housing shortages were linked to “increases in housing insecurity and homelessness.”

Rents fell in some District 12 markets as multifamily housing projects were completed, while “large homebuilders began preparing for a pickup in new construction starts in anticipation of lower financing costs over the coming months.” The supply of single-family homes, however, couldn’t keep up with demand.

Story idea: Sales of California wine have been “dampened by lower demand from Asian markets.” For industry sales data, reach out to the Wine Institute and to analysts from Gomberg Frederickson to understand the share of sales to Asia that make up the California wine market — and why demand might be dropping from those countries in particular. The answers could provide nuance and insight into a broader wine industry downturn, which Esther Mobley, the San Francisco Chronicle’s senior wine critic, reported in May.

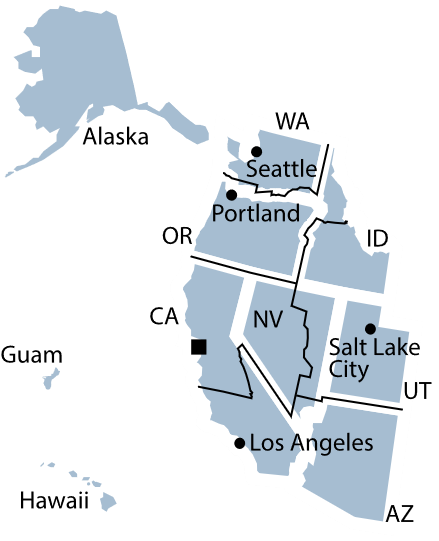

San Francisco Federal Reserve Regional Data

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary