From vacant lab space in Boston to inexperienced oil rig workers in Dallas to utility bill hikes in Atlanta, the July 2022 edition of the Federal Reserve’s Beige Book is a trove of story ideas for journalists across beats and coverage areas.

Economists at the Federal Reserve’s district banks — there are 12 across the country — regularly analyze local and regional data to provide research insights on specialized topics, such as economic inequality. The central bank also coalesces those insights in the Beige Book, a high-level, anecdotal glimpse of economic sentiment in each district.

This is the third in our occasional series revealing story nuggets within the Beige Book, which comes out eight times yearly. We previously explored the March 2022 and September 2021 editions.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

The Beige Book is especially valuable for any journalist covering business topics, as national and regional economies continue to adjust amid high fuel prices and inflation and as COVID-19 continues to infect tens of thousands of people in the U.S. The Beige Book is compiled from reports from Federal Reserve district directors along with interviews and surveys of business owners, community groups and economists.

Individuals surveyed are referred to as “contacts,” and are quoted anonymously. There is no particular number of contacts needed to produce a Beige Book, but each release is based on insights from hundreds of contacts culled from those surveys and wide-ranging conversations.

Economists and analysts at district banks seek to cultivate contacts that can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with other contacts representing a variety of industries and company sizes.

Recent research from the Federal Reserve Bank of St. Louis suggests the anecdotes in the Beige Book accurately reflect what’s happening with employment and inflation in the U.S. economy.

After performing a simple textual analysis of every Beige Book from January 2000 to April 2022, the authors find, for example, that mentions of rising prices tend to closely track with official inflation data.

“Of course, the Beige Book — with its emphasis on qualitative and anecdotal information — is written with the belief that those anecdotes provide a deeper understanding of the economy, which simple word counts cannot capture,” write St. Louis Fed senior economist Charles Gascon and research associate Devin Werner in their June 2022 analysis.

According to the July 13 release, consumer spending fell across much of the country as personal income increasingly went toward higher food and gas costs. Wages have also risen for some, with one-third of districts indicating that “employers were considering or had given employees bonuses” to help workers deal with higher everyday prices. Several contacts were worried about cooling consumer demand in the months ahead. Still, in sectors like travel and hospitality, “firms were successful in passing through sizable price increases to customers with little to no pushback.”

The latest edition of the Beige Book compiles information gathered from late May through July 13. Keep reading for quick summaries of the July 13 Beige Book release, along with story ideas for each district.

District 1, Boston

Lab space lull

While employment levels held steady during the reporting period, wage increases paced higher than usual. So did prices, with some firms across a variety of sectors putting forward “large or very large price increases” and others “planning to impose new mark-ups soon.”

To wit: year-over-year, frozen fish prices were up 30%. Hotel room rates in Boston were up 87% from February to May 2022, much higher than usual seasonal changes in hotel rates. Cruise ship passenger volume remained below half of what it was in 2019, but June 2022 airline passenger traffic achieved 90% of June 2019 levels.

Many contacts were worried about high inflation, along with “its implications for consumer demand and for their own profit margins.”

Story idea: With world-class universities and more than 1,700 biotech companies in greater Boston, life sciences are a major employer and economic hub for the region. But some investors, facing high inflation and high interest rates, “are looking to put their money elsewhere — perhaps in investments with steadier, more guaranteed returns,” WBUR’s Yasmin Amir reported in May. This is playing out in the commercial real estate market for life sciences, with July Beige Book contacts relaying “concerns about tenants’ creditworthiness and a looming glut of space.”

Will Boston-area labs face the same fate as the American mall, huge structures left vacant or repurposed? Reach out to owners of vacant real estate dedicated to the life sciences to find out whether they are sticking with the industry or ready to jump ship. Trade groups such as the Massachusetts chapter of NAIOP, formerly known as the National Association for Industrial and Office Parks, and the Greater Boston Real Estate Board, have staff familiar with the regional commercial real estate landscape. Ask them for help finding sources who rent space to life sciences firms. Also check out our coverage of academic research on abandoned, or “zombie” properties.

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

Negotiating higher salaries

New and used auto sales were slow in upstate New York, “largely reflecting the ongoing lack of inventory, as well as affordability issues.” Other retailers, meanwhile, reported flat or weaker sales. But overall, consumer confidence in the state has rebounded since the start of the pandemic and is “fairly high by historical standards.”

Outside of New York City, leisure and hospitality firms “noted a pause in growth.” But in the city, “tourism has continued to flourish” with one expert noting “both business travel and international visitors have picked up to a surprising degree in recent weeks,” in part due to loosening inbound travel restrictions. Hotel rates have, in turn, risen to over $300 per night on average, higher than before the pandemic.

The housing market weakened for sellers but remained favorable for landlords. In upstate New York, real estate contacts “characterize the market as strong,” but less robust than in the recent past. For example, “bidding wars still occur but with fewer bidders competing and some sellers have lowered their asking prices.” Residential rents, meanwhile, have risen upstate. In New York City, rents reached all-time highs in the second quarter of 2022 with “vacancy rates at a 20-year low.”

No specific anecdotes were reported for areas outside the New York metropolitan region and upstate.

Story idea: Workers in the second district continue to benefit from labor shortages, with especially strong hiring demand in technology and health care. Hiring was also strong in trade, information, transportation, and professional and business services. Call centers are also bringing on new workers, according to one contact. An employment agency relayed that “more employees are using counteroffers to raise their salaries in their current jobs.”

For many workers, particularly those in non-unionized industries, it may be a new experience to be in a position to negotiate higher salaries. How are they doing it? Social media is one way to find employees who have made successful counteroffers to their bosses.

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

Home equity slump

Since April, about 60% of contacts from firms outside manufacturing have encountered increasing wage and benefit costs per employee. For the first time since early 2021, restaurants and retailers other than auto dealers faced falling sales, with contacts seeing “either less customer traffic or smaller purchases per visit, if not both.”

Meanwhile, about 60% of manufacturers are looking ahead to higher materials prices over the rest of the year, down from an all-time high of 80% in January. Overall manufacturing activity declined as “shipments and new orders fell significantly, with new orders turning negative.”

Story idea: Bank lending other than credit cards “grew moderately” at “a similar pace as seen during the same period in 2019.” But the shape of lending in the third district is now more uneven. Home mortgages and commercial and industrial lending “grew at a moderate to strong pace” but growth has been “virtually eliminated” in the commercial real estate and home equity sectors, due to rising interest rates and uncertainty about the economy in the near future.

Some borrowers use home equity to maintain their homes, including for major expenses — like a new roof or kitchen remodel — that can substantially increase a home’s value. Is housing stock quality poised to suffer because high interest rates are making it unpalatable for homeowners to draw on their home equity? Lenders, like the Philadelphia Federal Credit Union, and trade groups, like the Building Industry Association of Philadelphia, may be good places to turn to get a lay of the home equity landscape in the third district.

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Lieu of wages

Most firms contended with higher production costs, excluding labor costs. Oil and electricity price hikes “have pushed up prices for an array of inputs such as drywall, lubricants and asphalt.” Most firms in the fourth district “raised prices as they attempted to keep up with rising costs.” Bucking the trend in at least one sector, “some manufacturers passed through lower steel costs to customers.”

As in the second district, home sales in the fourth district have taken a knock recently, with one real estate agent noting sustained high demand at the same time that high interest rates have “priced some buyers out of the market, which reduced the number of competing offers on listings.” Rising interest rates are also expected to continue to weaken demand in nonresidential construction and real estate, according to contacts.

While demand for freight “weakened” due to declining imports in part stemming from COVID-19 lockdowns in China, there were slightly more freight drivers available even as “overall, the supply of drivers remained tight.” Here’s our coverage of research on the truck driver shortage and the trucking industry workforce.

Story idea: The percentage of employers that raised wages has fallen from 70% at the end of 2021 to about 50% now. What incentives are employers in your coverage area offering in lieu of higher wages? One manufacturer, citing employee concerns about food and fuel costs, reported “she was considering offering them memberships to warehouse clubs to help reduce these expenses.” Staff at one bank are pushing for remote work, with the contact there also relaying that “the firm was considering providing transit benefits.”

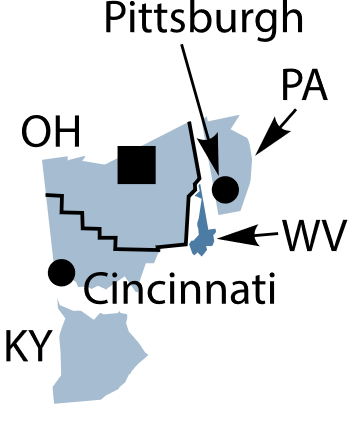

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Upcoming grain demand

Employers were increasingly able to match job vacancies with appropriately skilled candidates, with firms by and large still offering higher wages to attract and retain employees. Jobs were especially flush in leisure and hospitality, “where firms reported an increase in tourism and conference activity.”

Trucking demand “remained strong,” but surcharges due to high fuel prices ate up most savings from falling short-term shipping rates. As in District 4, many trucking firms “indicated that drivers have become more available and turnover has decreased due to increased wages and benefits and a return of independent owner-operator drivers to freight lines.” Some trucking firms are having trouble “obtaining parts to service their existing fleet.”

Leisure and business travel “remained strong” with hotel occupancy and daily room prices ticking up over the last few weeks. Airports also saw an uptick in passengers “but there remained issues with flight cancellations due to lack of flight crews.”

Story idea: Ukraine and Russia have reached reach an agreement to allow Ukraine, the world’s fourth-largest grain exporter, to start moving shipments through the Black Sea. Still, the months-long blockade of grain is one way District 4 has felt the ripple effects from the war in Ukraine. Though grain and feed exports fell during the current reporting period, “ports expect volumes to increase this summer due to the decreased supply to other countries from Eastern Europe.” Are exporters and agricultural producers prepared to meet higher export demand?

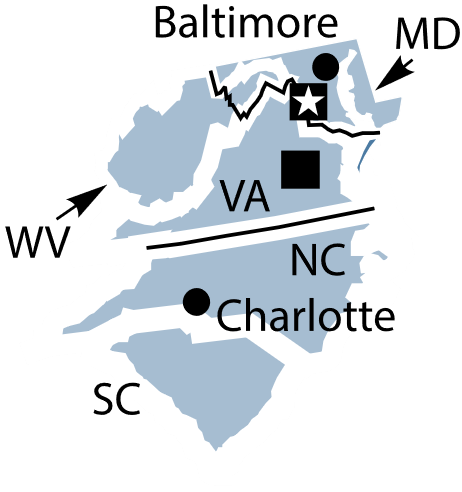

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Utility bill hikes

Reflecting high fuel prices in the U.S. and swaths of Europe in the process of cutting oil and gas imports from Russia, refineries in District 6 were “at historically high production levels.” Natural gas production was also elevated. Exports of natural gas in particular “soared amid increasing global demand.” Financing for renewable energy also “remained robust, particularly in solar and offshore wind, as well as recently announced carbon capture facilities in the district.”

Several contacts working in commercial real estate were worried about declining values, in addition to noting more buyers “seeking concessions, shrinking pools of buyers, and declining prices in some property sectors.”

Orange production in Florida beat recent forecasts, but “was still well below last season’s production.” Farmers yielded higher prices for “cattle corn, cotton, eggs, milk soybeans, rice and broilers,” year over year. Cattle prices didn’t budge.

Story idea: Some utilities are “at high risk of interrupted service due to heightened demand and insufficient generation capacity.” In the middle of a heat wave, and in addition to potential service disruptions, consumers may ultimately pay the price, with utilities facing “higher fuel and power costs which are expected to eventually result in higher utility bills for customers.” This could be an appropriate time for a story featuring customers sounding off about paying more for lower-quality energy service — and exploring whether the current energy system in the district is sustainable.

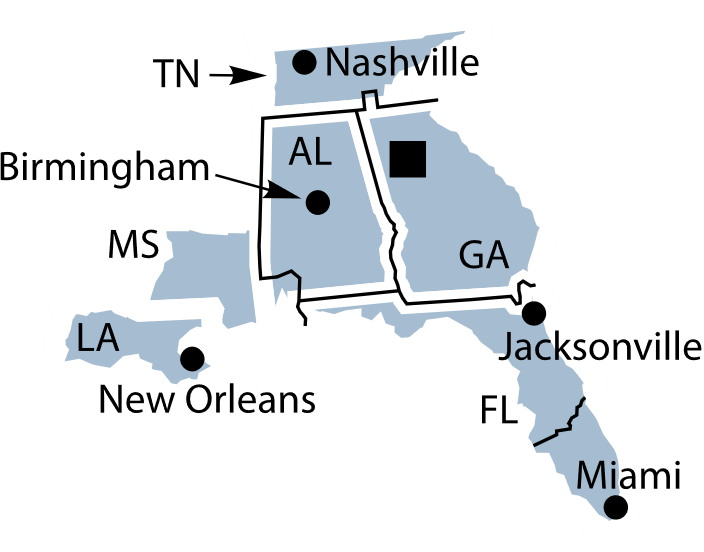

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Back to school

Customers in District 7 were generally willing to accept higher prices from consumer-facing businesses, but some contacts “said they were only able to pass on some of their higher costs,” driven in part by “higher costs for labor, energy, and shipping.” Shoppers with lower incomes “were trading down and buying more in-store brands, while higher income shoppers were buying more goods in bulk.”

Residential rents rose “modestly,” in contrast to other districts that include large cities. Similar to other districts, rising mortgage rates reduced the number of offers for home sellers, but home prices still increased a bit.

Farm income is expected to be “solid” for “most producers” for the rest of the year. Still, for some agricultural producers, intense rains “diluted fertilizer and created ponds in fields, hurting potential yields; in other areas there were concerns about dryness and heat.” Egg production and prices settled following bird flu outbreaks earlier in the year.

Story idea: Back-to-school shopping season is just around the corner, with several retail contacts indicating “that because of high inventories, the upcoming back-to-school season would feature more promotions than last year.” What discounts can your audience look forward to when they go out or online to buy books, pens, crayons and clothes, and how much of a savings do this year’s promotions represent over last year? On a related topic, read our coverage of academic research on state sales tax holidays.

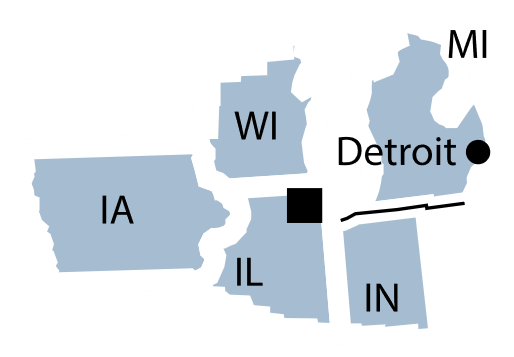

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

Supply chain holdup

Labor remained in high demand and low supply in District 8, with one staffing firm “struggling” to fill two or three positions per day, down from 30 or more before the pandemic. A number of employers have had to “settle for less-dependable workers,” yet “contacts in several industries reported recent signs of the labor market easing.” Notably, “one public school district doubled its summer school teacher pay to $50 per hour.”

Manufacturing firms are having a hard time meeting demand for new production orders because of supply chain problems in part caused by ongoing COVID-related lockdowns in China “and persisting scarcity in intermediate inputs. This trend of intermediate input shortages has been observed across various industries, including cement in concrete, cotton in textiles, and wet strength resin in packaging.”

Story idea: Supply chain issues persist around the country, but the situation in District 8 appears to be especially dire. In Mississippi, one “major manufacturer” relayed that the supply chain problems are equal to those at the start of the pandemic, going so far as to say that “the wheels have fallen off.” Which manufacturing sectors are being most affected? Are everyday consumers unable to get certain products? The Mississippi Manufacturers Association would be a good source, along with the Mississippi Economic Council.

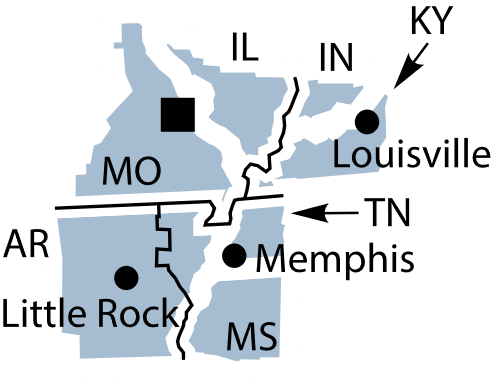

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

Extreme weather events

Some 36% of professional services firms in District 9 — think lawyers, architects and most other jobs that require a specialized advanced degree — bumped wages by more than 6% during the past year, with one financial services firm in Minnesota offering $5,000 “‘inflation bonuses’ to help offset rising consumer prices.”

Gas prices and inflation hampered foot traffic at two regional malls, according to contacts. Households with higher incomes were still spending at a fast clip, but households with lower incomes were having to make difficult spending choices. One supermarket contact “noted increased purchases of cheaper foodstuffs to offset higher costs overall.”

Story idea: Climate change isn’t just linked to high average temperatures. It also increases the likelihood of extreme weather events. (For more climate-related story ideas, read our coverage of how to find local stories in The Lancet’s health and climate change report.) While it is inadvisable for journalists to attribute a specific weather event to climate change, there are two recent, notable events that could form the cornerstones of a series on how extreme weather is affecting the district. Both have economic implications.

In the first example, tourism held strong overall in the district, but “a flood in the Yellowstone region of southern Montana was expected to have a major, negative impact on the region for the remainder of the summer season.” The second example shows the opposite extreme, with almost half of Montana’s winter wheat crop “in poor or very poor condition, as drought conditions persisted in the Golden Triangle region.”

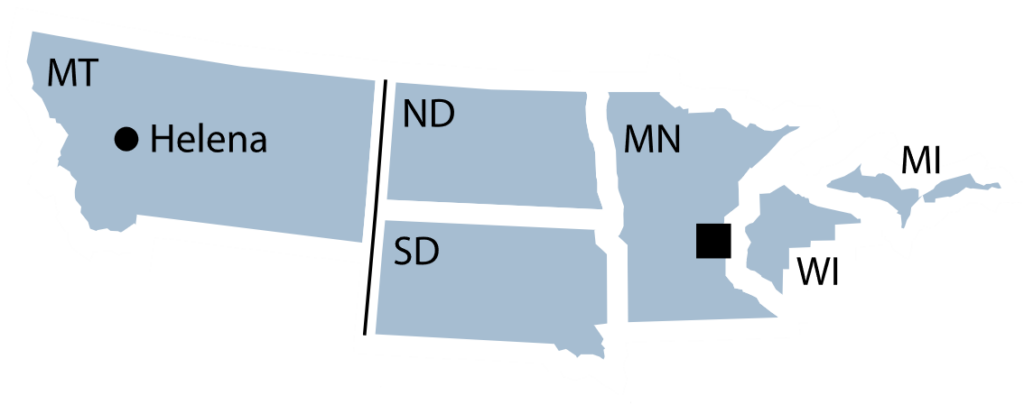

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

Super-dry wheat

Some employers have offered their employees gas cards “to offset rising gas prices,” with others making “direct payments to workers tied to driving expenses.” Consumer spending overall was down a bit, with restaurant contacts in particular noting spending shifts and restaurant patrons being “less likely to choose more expensive locations in favor of lower cost options.”

There was less single-family construction in District 10 during the reporting period, along with less demand for residential mortgages. Note that the employment effects of weakening construction demand tend to lag: “For example, demand for crews doing framing for homes, which occurs early in construction, softened a bit while demand for skilled trades associated with the finishing of homes remains healthy.”

Story idea: District 10 also offers a real-world example of how our changing climate — specifically drought — is affecting the economy: “The condition of wheat in nearly all district states was exceptionally poor and could hinder revenues for many producers.” What is the future of wheat in the district? Is wheat production sustainable there, or is this a harbinger of a bleak wheat future for America?

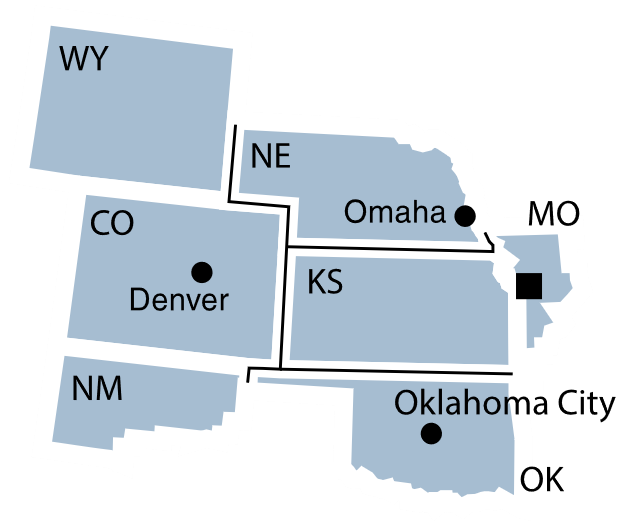

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Oil rig inexperience

Home sales “were off notably from earlier in the year,” with “eroded” housing market conditions overall and prices “largely flat.” Contacts observed that “both online and foot traffic slowed markedly.” Some sales were canceled “in part due to loan qualification issues” with the “negative” general outlook leading to less rosy sales forecasts.

Strong oil demand led to a higher rig count and more oil and natural gas production, but there were not enough workers and “supply chain constraints continued to limit the pace of drilling and well completion activity.” Engines, transmissions and other components crucial for fuel production were backlogged over a year, “and a severe shortage of steel tubular goods was reported.” While “uncertainty rose,” industry contacts were “largely optimistic,” overall.

Ranchers blamed “poor grazing conditions” for having to cut herd sizes, with agriculture contacts observing “that the strengthening dollar combined with higher transportation costs and logistics issues could negatively impact agricultural exports moving forward.”

Story idea: One oil field contact reports, “rig workers with no experience and working half the year were being paid about $85,000” because of the tight labor market. Oil rigs are already a dangerous environment. Are there safety implications at play with oil companies having to hire less experienced workers?

Workplace safety data lags and is, by definition, incomplete — not every injury or incident gets reported. But there are several places to find this type of data. Injury and fatality statistics from the U.S. Bureau of Safety and Environmental Enforcement are most recently available from 2020. The Occupational Safety and Health Administration also offers large data sets on serious injuries through November 2021 and less severe injuries through mid-March 2022. Both datasets include, but are not limited to, injuries workers sustained while performing oil extraction, refining and related activities. Oil pipeline firms are exempt from reporting less serious injuries to OSHA. The Bureau of Labor Statistics also conducts a variety of surveys capturing samples of workplace-related injuries.

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

Pampered, insured pets

With large tech firms like Apple, Alphabet and Meta slowing or stopping their hiring activity amid recession fears, several contacts in the industry noted hiring freezes “could make it easier for other businesses to attract experienced professionals in the field.” Also of note, several contacts observed “a pickup in unionization efforts in the retail and health-care sectors.”

Sales of durable goods, like furniture and appliances, “moderated noticeably.” Retail sales also slowed some, with “rising costs for food and fuel” being “particularly binding for consumers when deciding what to purchase.” Meanwhile, “pent-up demand for vacationing” led to strong sales for hotel rooms as well as international and domestic airplane tickets.

Agriculture in District 12 felt the ripple effects from Russia’s invasion of Ukraine, with increasing costs for “fertilizer, machinery, fuel and feed,” partially related to the war. As in other districts, supply chain problems remained a major concern, but “many contacts reported an easing of port backlogs and shipping rates despite increased fuel costs.”

Story idea: Demand for home mortgages and auto loans fell. Likewise, demand for insurance services “generally declined, with a notable exception being pet insurance.” What’s going on? Are people in District 12 having a pet insurance kick? The North American Pet Health Insurance Association may be a good first place to turn for statistics and cultivating pet insurance industry and consumer sources.

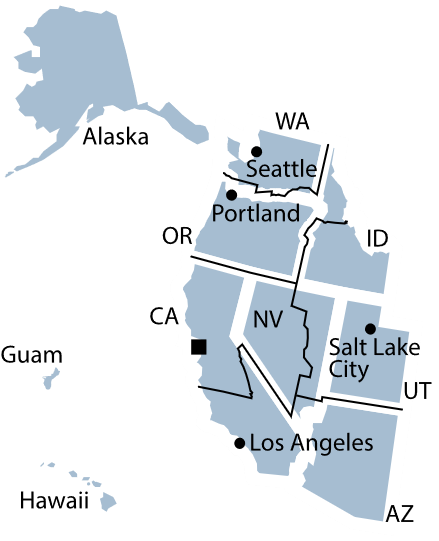

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary