Despite the fact that U.S. income inequality and poverty are playing a bigger role in political discourse, many subtle aspects of collective economic “health” continue to be under-appreciated. The Great Recession had a substantial impact on many individuals and families, and the effects are still being felt. But there are many positive counter-trends now at work, as the United States sees a comeback in many regional housing markets, the unemployment rate falls and certain aspects of the economy improve. In characterizing the state of the U.S. “economy,” it is difficult to reconcile conflicting short-term, medium- and long-range trends, and for media to balance them in an accurate way.

A paper from Stanford University, “State of the Union: The Poverty and Inequality Report 2014,” synthesizes economic data and academic research to paint a full picture — a “unified analysis” — of key indicators of the nation’s economic health that may not receive the same visibility as GDP, aggregate growth patterns or stock market trends. Produced by the Stanford Center on Poverty and Inequality, which receives some federal funding, the report enlisted subject-area academic experts on issues such as the labor market, health, education and income trends. Overall, the data suggest a “broadly deteriorating poverty and inequality landscape.”

The report’s findings include:

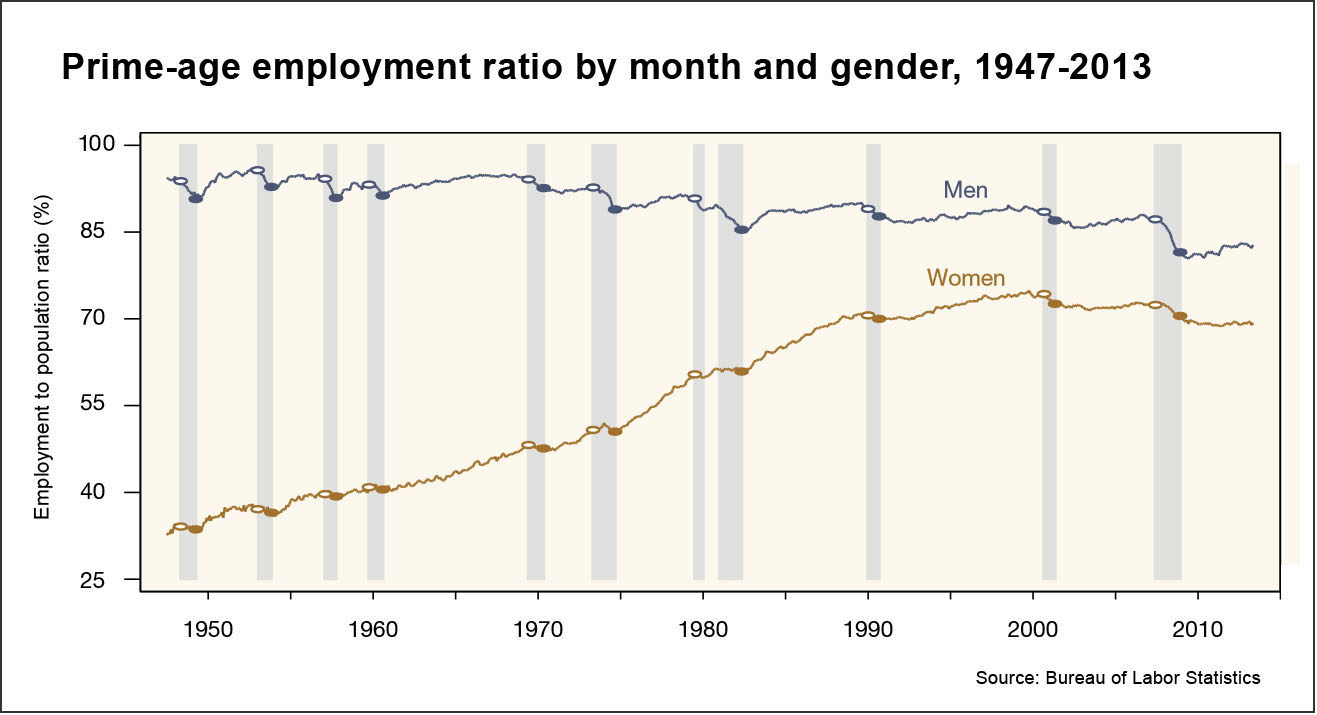

- The economy is not delivering enough jobs, and the labor market appears to be failing by the best available measure. The way to quantify this is to look at the “prime-age employment ratio,” which is the ratio of employed 25-54 year-olds to the population of that age. In tough economic times, the official unemployment rate often hides the fact that many people have stopped looking for work. By that measure, the U.S. economy is having severe trouble: “November 2013, six years after the start of the Great Recession, the proportion of all 25-54 year olds who hold jobs (i.e., ‘prime age employment’) was almost 5% lower than it was in December 2007, both for men and women alike.”

- Poverty remains a significant problem: “The official poverty rate increased from 12.5% in 2007 to 15.0% in 2012, and the child poverty rate increased from 18.0% in 2007 to 21.8% in 2012.”

- At the same time, official poverty rates don’t capture the effect of government support such as food stamps (now called SNAP, or Supplemental Nutrition Assistance Program) or the Earned Income Tax Credit; if those are accounted for, the current rate would fall from 15% to 11%. A 2014 working paper done for the National Bureau of Economic Research suggests that, contrary to claims that social welfare programs have failed, social safety net programs reduced poverty by 14.5 percentage points between 1967 and 2012.

- The overall poverty rate has essentially stagnated since the 1970s, a function of two cross-cutting trends, “an economy that has increasingly left more of the poor behind and a safety net that has successfully kept more of them afloat. The primary reason that poverty remains high is that the benefits of economic growth are no longer shared by almost all workers, as they were in the quarter century after the end of World War II. In recent decades, it has been difficult for many workers, especially those with no more than a high school degree … to earn enough to keep their families out of poverty.”

- The role of the recession is “more complicated than is often appreciated, with different measures of inequality yielding different conclusions about the effects of the Great Recession.” This is because the social safety net and policy responses to the Great Recession performed reasonably effectively, while the capital income sources of the affluent “decline sharply.” Indeed, “although the Great Recession brought about an increase in inequality for standard household income measures, it led to a flattening in consumption inequality as well as a decline in the income share going to top-income households.”

- However, “there is no disagreement about what is happening in the recovery period. Since mid-2009, all measures show that inequality is rising. For example, the share of income of the top 1% had rebounded by 2012, indeed it nearly returned to the high levels from before the Great Recession. The latest, but still early, evidence on the recovery from the Great Recession also points to a very slow rebound of median incomes.”

- There has been some progress in educational inequality, even as challenges remain: “The record on black-white educational inequality is mixed, with black-white disparities in academic achievement declining by approximately 40% over the last four decades, while disparities in college completion have increased over the same period.” In essence, racial minorities are doing better at the K-12 levels but are struggling to achieve better results in higher education.

The report also looks at issues such as health inequality and trends in overall wealth inequality. The authors note that the “distinctively American approach is to blame our post-market institutions for the current state of affairs. The safety net is blamed for failing to make a dent in poverty; our schools are blamed for failing to eliminate income or racial disparities; and our healthcare institutions are blamed for poor health among the poor. We accordingly propose all manner of narrow-gauge safety net reforms, narrow-gauge school reforms and narrow-gauge health care reforms; and we imagine that, if only we could find the right such reforms, all would be well.” However, the “very same critical scrutiny might also be applied to our economic and labor market institutions,” which are failing increasingly broad swaths of the American public.

Related research: A 2014 paper for the National Bureau of Economic Research, “Is the United States Still a Land of Opportunity? Recent Trends in Intergenerational Mobility,” finds that, contrary to prior research and popular belief, economic mobility has not drastically changed in recent decades. “Our analysis of new administrative records on income shows that children entering the labor market today have the same chances of moving up in the income distribution relative to their parents as children born in the 1970s,” write authors Raj Chetty, Nathaniel Hendren, Patrick Kline, Emmanuel Saez and Nicholas Turner. However, they also note that the “lack of a trend in intergenerational mobility contrasts with the increase in income inequality in recent decades.” In a companion paper produced as part of Harvard’s and UC Berkeley’s “The Equality of Opportunity Project,” the research team shows how mobility varies widely according to U.S. geographical region — and how mobility rates in some regions remain persistently low, substantially lagging other developed nations.

Keywords: economy, poverty, financial crisis

Expert Commentary