The U.S. central banking system, the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

The Federal Reserve’s Beige Book offers a high-level, anecdotal glimpse of current economic sentiment in each of the central bank’s 12 regions. For journalists, it can serve as an extensive tip sheet with insights on local, regional and national story angles.

The Beige Book is valuable for journalists reporting on economic issues, because national and regional economic conditions can change rapidly. The March 2024 edition offers story ideas for reporters covering business as well as those covering elections, education, health care and criminal justice.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

The book is compiled from reports from Federal Reserve district directors and interviews and surveys of business owners, community groups and economists.

The authors of the book refer to individuals surveyed as “contacts,” and they are quoted anonymously. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts culled from surveys and wide-ranging conversations among “a diverse set of sources that can provide accurate and objective information about a broad range of economic activities,” according to the book.

Economists and analysts at district banks seek to cultivate contacts who can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with contacts representing a variety of industries and company sizes.

Research from the Federal Reserve Bank of St. Louis suggests the anecdotes in the Beige Book accurately reflect what’s happening with employment and inflation the U.S. economy. After performing a simple textual analysis of every Beige Book from 2000 to April 2022, those authors find, for example, that mentions of rising prices tend to closely track with official inflation data.

“Of course, the Beige Book — with its emphasis on qualitative and anecdotal information — is written with the belief that those anecdotes provide a deeper understanding of the economy, which simple word counts cannot capture,” write St. Louis Fed senior economist Charles Gascon and research associate Devin Warner in their June 2022 analysis.

The Beige Book published on March 6 includes information gathered during January and February. Across districts, inflation has moderated in recent weeks, but firms overall are increasingly reticent to pass higher transportation and health insurance costs on to customers, “who became increasingly sensitive to price changes.”

In several districts with major metropolitan areas, a spate of commercial real estate loans are coming due this year and over the next few years. Lenders worry mortgage holders, particularly those who borrowed money to buy office buildings, could default because some companies that closed their offices or moved to smaller ones at the start of the COVID-19 pandemic no longer need large downtown offices.

Keep reading for quick summaries and story ideas from the latest Beige Book release.

District 1, Boston

Dry January slump

Contacts from staffing agencies reported fewer sign-on perks for new hires and fewer retention bonuses for existing employees “as well as a trend away from remote work arrangements.” These could indicate that bargaining power is shifting from workers, who have benefitted in recent months from a tight labor market, to employers.

The office lease market is “expected to stay tepid,” and there is “ongoing uncertainty over the fate of office loans maturing in 2024.” In other words, commercial office mortgage lenders with maturing loans will expect to be paid back this year, or have borrowers refinance at higher rates. Are office owners going to meet those obligations, considering the relative dearth of leases?

According to other recent research from the Boston Fed, big banks are expected to feel more pain than small banks from mortgage defaults linked to expiring leases in central business districts.

Story idea: How does “Dry January” affect food and beverage sales in your area? Dry January is an annual public health initiative, started in the United Kingdom, in which people take a monthlong holiday from alcohol. One restaurant industry contact from Massachusetts blamed Dry January and New Year’s resolutions for “an exceptionally weak January.” Later this year, reach out to restaurants and bars to ask how they are gearing up to weather Dry January 2025. Do bars plan to expand their suite of non-alcoholic libations? Are they going to hold more events, like trivia nights or live music, to get customers through their doors?

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

‘Loss prevention measures’

Wages in District 2 grew at a “moderate pace” while statewide minimum wage increases — including a jump from $15 to $16 an hour in New York City, Long Island and Westchester at the start of the year — “caused some business to raise pay more substantially for some employees.”

Meanwhile, input prices — the costs of materials used to make products — also “picked up at a moderate pace.” Specifically, contacts “noted outsized increases in the prices of raw materials such as cocoa, copper, plastic and textiles amid ongoing sharp increases in insurance and freight costs.” This matters because higher input prices often result in higher consumer prices, if a firm thinks moderately higher prices won’t dissuade buyers.

As in District 1 hubs, New York City is facing a spate of office mortgages coming due in 2024, with “financial strain” in the office leasing sector “foreshadowing further increases in defaults in the coming year.” Outside of the city, however, office markets “remained more resilient” due to better balance between supply and demand.

Story idea: Public safety is a concern among business owners and community leaders in District 2, particularly given “a rise in hate crimes and ongoing high rates of retail theft,” which have “reduced the sense of security in public spaces, such as on public transit and in stores.” Some retail owners have tried to deter theft and now face “increased costs due to loss prevention measures.” What specific measures have local business taken? How are chain stores addressing loss prevention differently from mom-and-pop stores? How do longstanding businesses perceive current crime and theft levels compared with higher crime eras during the 1980s and 1990s, particularly in New York City? For example, crime rates for violent crimes, including murder and rape, and other serious crimes, such as grand larceny, are down 72% over the past three decades, according to data from the New York City Police Department. Certain types of violent crime have risen, however. Felony assault, for example, is up 75% compared with 14 years ago in New York City. There is a story to explore about which crimes are being committed at higher rates, when the increase began and how business owners predict crime levels will affect their economic prospects over the months ahead. (Note that police departments occasionally change their definitions of crime categories, which can affect historical comparisons.)

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

Moving out of the moving business

While supply chain issues among contacts “large and small” were “no longer a concern” in District 3, many contacts are still worried about labor shortages, along with “payment problems among low-income households.” Despite supply chain problems being largely abated, one large manufacturer “noted that shipping disruptions in the Red Sea and the Panama Canal would likely add to costs.”

Fully electric vehicles were unpopular in District 3, “selling slowly and piling up on dealer lots,” although “other models were selling well.” New car sales were also lower after seasonal adjustments, with auto buyers generally hampered by high vehicle prices and high interest rates.

Meanwhile, leisure travel was down across the district, “hurt by poor skiing conditions.” Residential real estate inventory remains “extremely low” and existing home sales fell from levels that were also “extremely low.” Construction activity, generally, also slowed.

Story idea: Sometimes downstream effects are as interesting as upstream ones. With high interest rates and high costs, home sales are “weak” in District 3. Those typically affected by weak home sales would include real estate brokers, buyers, sellers and builders. One overlooked group? Movers. One contact that does household moves reported that slow home sales had led to the shuttering of businesses in that industry, with conditions being “the worst they have ever been in my career, which dates back to 1968.” See if a moving company will let you shadow their drivers and operational employees for a day or two — there could be an interesting narrative to tell about the downstream effects of an upstream problem.

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Trained gig workers

In contrast to other districts, commercial construction firms in District 4 have been “increasing staffing levels to ramp up for new capital projects,” according to contacts in the industry, who report “strong demand for manufacturing space.”

In the restaurant business, some contacts “noted a recent uptick in the cost of chicken, beef and produce.” For now, restaurants seem be absorbing those costs rather than passing them onto guests, according to two contacts.

As in District 3, auto dealers in District 4 have seen sales suffer due to “high interest rates and high vehicle prices,” but one contact said there were more new vehicles available to sell, with new vehicle supply better than it had been in recent months. Some auto dealers were hopeful that spring would bring new customers, but most were not optimistic about improved sales in the coming months.

Story idea: Why are younger workers taking gig jobs, even after completing training for employment in other fields? That’s the situation in District 4, according to one workforce development contact. Check out this recent report, “The Gig Workforce isn’t just Delivering Dinner,” from Cuyahoga Community College and Team NEO, an economic development organization, to understand the types of jobs that make up gig work and the educational investments more likely to lead people into gig work. In Greater Cleveland, for example, about one-in-three gig workers come out of liberal arts and sciences programs while about one in ten come from nursing or business administration programs. The report is also a good place to start building a source list, such as Team NEO CEO Bill Koehler.

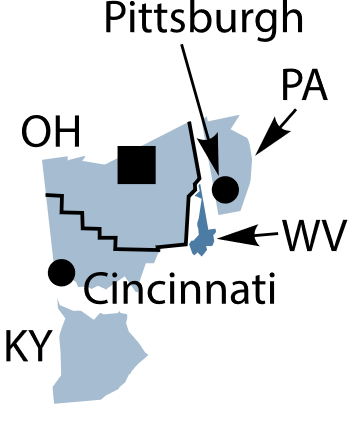

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Election economics

How’s the labor market in District 5? Depends on who you ask. An outdoor goods retailer said they were having a hard time finding workers, but added that’s not abnormal in retail. Meanwhile, one advertising firm “reported a complete [180-degree turn] from last year, and candidates are finding them now and not the other way around.” Finally, an engraver and an aluminum welder reported trouble finding qualified workers. The engraver finally found good help after a lengthy search, “which felt like finding a needle in the haystack.”

Shipping contacts reported more consumer goods coming through ports, and overall demand for water freight “was good this period despite disruptions in the Panama and Suez canals impacting schedules.” Spot rates were up quite a bit — those are one-time shipping rates to move a volume of goods without a longer-term contract — because “carriers were trying to offset higher costs associated with the longer transit times.”

Story idea: One “design firm” — no further details given — expected less demand for the coming year because bigger companies that usually solicit their services “become more conservative with their budgets” during election years “until the election is decided.” There is a potentially interesting explainer-style business-to-business narrative about the decisions big firms make affecting small companies that do contract work for them. Start by looking into the firms that employ large numbers of people — in the Richmond area, this includes CarMax, Altria Group and Dominion Energy. Ask whether they are cutting back on certain services this election year due to uncertainty over who will be president in 2025, along with outcomes of local races. From there, interview principals at smaller companies that could see decreased revenue to find out how they are planning to make it through 2024. If workers who have been laid off due to cutbacks are willing to talk, then so much the better — from a storytelling perspective.

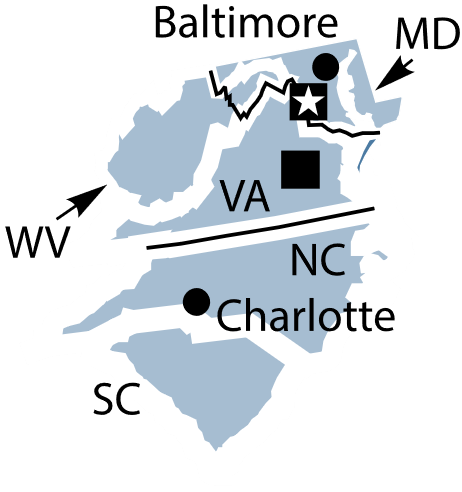

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Location, location, location

The end of household financial help that began during the pandemic, such as extended child tax and SNAP benefits, “continued to weigh heavily on many households,” with housing costs in particular representing “an acute burden for both consumers and providers of affordable housing.”

Many consumers remain “price conscious,” as they have been in other recent Beige Books, with retailers describing it as “an ongoing normalization of consumer behaviors.” But leisure business has been robust, with cruise lines in South Florida reporting “strong demand,” along with “a solid lineup of events for the second quarter” in New Orleans, such as conferences and festivals.

Story idea: District 6 home sales “in most major markets ended the year well below seasonal norms and remained significantly behind pre-pandemic levels.” Existing homes are hard to come by, particularly those owned by people who had locked in low mortgage rates prior to recent Federal Reserve hikes. This means demand for new homes is high, but home builders “indicated higher lot costs as a significant impediment moving forward.” Are lot prices in your coverage area much higher now than in recent years, even after accounting for regular inflation? Experts at realtor.com can help you gather data to assess the current state and recent history of lot prices.

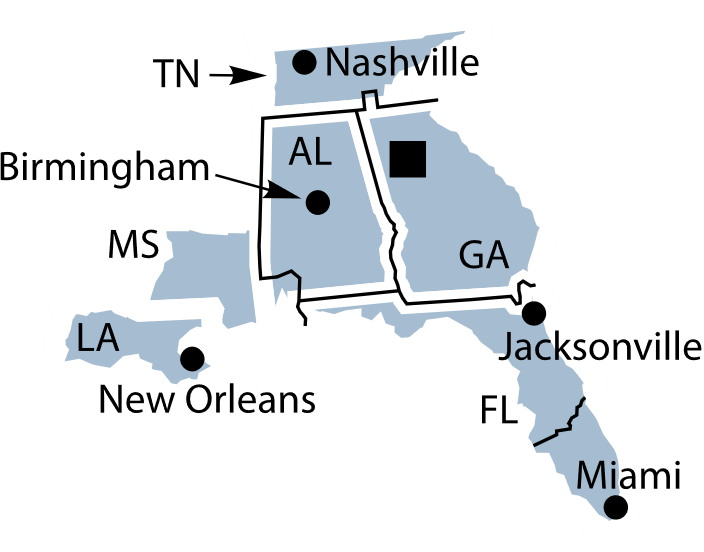

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Pandemic business struggles

A cold January hurt consumer sales in District 7, and a more temperate February “was not enough to offset the earlier decline.” Firms in general were willing to invest in their physical assets, “with contacts noting renovations or expansions of existing structures.” Keep in mind that capital expenditures represent a tangible investment in a company’s future and are often a sign that business owners are optimistic about the future.

But high interest rates deterred some firms from outlaying capital expenditures. Inventories were “comfortable” for many retailers, meaning those contacts think they have roughly an appropriate amount of goods to sell to meet demand.

Prices for corn, wheat and soybeans were down, though “the outlook for livestock producers improved.” Dairy farmers benefitted from lower feed prices in recent weeks, but profit margins “remained tight” amid higher labor costs.

Story idea: Organizations that support small business development reported that firms seeking help tended to be established, rather than start-ups. In particular, businesses that were founded during the pandemic “struggled with sustainability.” Take a look at which businesses were founded in your coverage area during the pandemic. Is there something specific about how they serve customers — entirely online, for example — that is making it difficult to adjust to the post-pandemic economy?

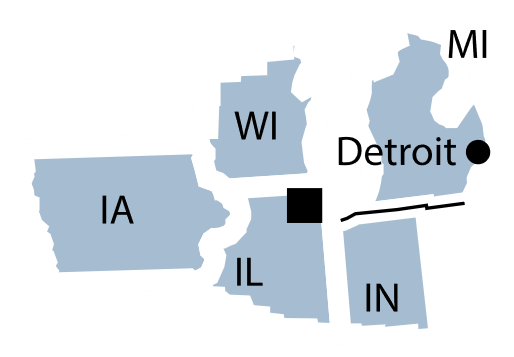

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

Pass the buck

Similar to District 3, an auto dealer in District 8 reports having to reset expectations on electric vehicle sales due to a lack of buyer interest. General retailers in downtown Louisville chalk up declining sales to “continued sluggish foot traffic.” Restaurants in St. Louis and Louisville likewise saw sluggish sales, “which they attributed to continued price increases.”

Real estate contacts in Arkansas and Tennessee reported strength in the lower end of the housing market, while the higher end was doing better in Mississippi and southern Indiana. As is the case across the country, businesses that want office leases can get them. Problem is, they don’t seem to want them. “In Louisville, two large tenants announced plans to vacate their downtown offices.”

But on the rosier side of commercial real estate, a contact in Memphis “reported that demand for retail space remains strong.”

Story idea: A contact in the District 8 theater industry “reported increasing costs and difficulty in determining if and how to pass those increases on to patrons.” Consumer prices rise or fall in relation to elasticity of demand, which simply refers to whether consumers still buy something when its price goes up. How do small businesses running on a shoestring — say, a theater — make practical decisions, like whether to eat higher costs or pass them onto consumers? What data do they use to inform price changes? How good is that information? What data do they wish they had but don’t? Or do they use experience and intuition as a proxy for good data?

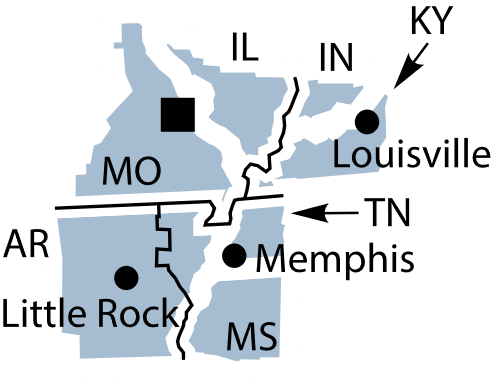

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

Localizing climate change

Most workers looking for jobs in District 9 were confident they would find one within three months. Recent hires who had weathered a spell of unemployment found jobs primarily in health care, education and manufacturing. Still, food costs during the day are eating into some workers’ budgets, with one worker lamenting that “I wish my $20 [sandwich] lunch went back to [costing] $10. It instead keeps going up.”

Unseasonable warmth hampered winter sports ventures, with ski hills in Montana and Michigan shuttering “due to lack of snow.” There was good underlying demand for winter leisure, though, with hotel bookings “20% higher to start the year,” according to one contact in the upper peninsula of Michigan, who added that “most guests cancel due to lack of snow. We are now showing a 25% decline. This is having a devastating effect on all local businesses.” Still, hope springs eternal for better tourism revenues during the coming season.

Story idea: Per the unseasonable warmth, there is an opportunity for journalists to localize the effects of climate change. While particular weather and climate patterns are often not attributable solely to climate change, overall warming across the planet is. Who are the workers affected by ski hill and other seasonal closures? Are they younger, older, experienced, first-timers, or all of the above? Where else do they turn for seasonal work? Have such closures become more frequent in recent years?

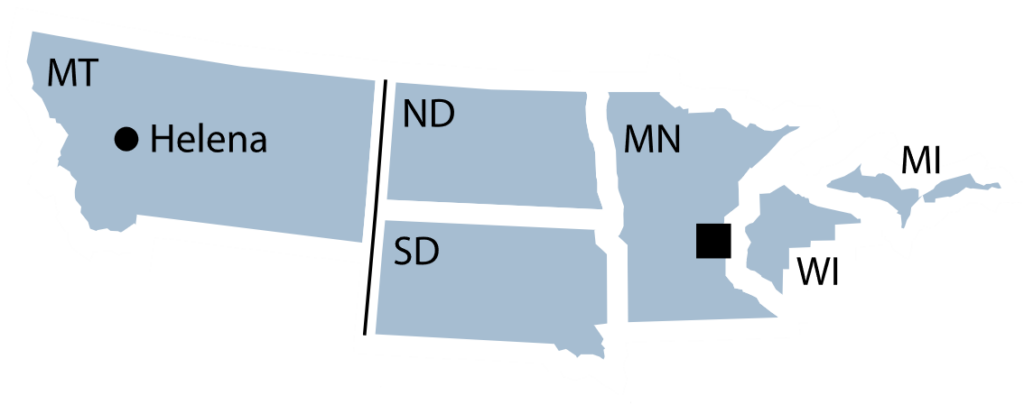

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

Rising household medical debt

The labor market remained tight in District 10, though many firms “also indicated the quality of applicants and recent hires improved recently.” Firms are also focusing on retraining existing workers — likewise, “wage increases were focused primarily on workers who expanded their capabilities, responsibilities and productivity.”

Prices were up “moderately” for goods and services, along with the costs of dining out and hotel rooms. “Amid the rising price sensitivity of consumers, several contacts indicated their emphasis on protecting price margins over coming months.”

There have been “very few property transactions” recently in commercial real estate, which makes it harder to estimate the value of properties that are for sale. Recent appraisals have been met with “skepticism” from buyers “not wanting to be in a position of trying to ‘catch a falling knife’ early in a [commercial real estate] downturn.”

Story idea: Households with low incomes had trouble accessing credit, and they also experienced increasing defaults on credit cards and payday loans. Meanwhile, defaults on medical debt also rose. While medical debt has been covered extensively by national news outlets, reporters covering District 10 regions can localize the issue. Recent consolidation of health systems in Kansas City and St. Louis “could mean bigger medical bills,” according to recent reporting from Spectrum News. Meanwhile, the Federal Reserve’s 2022 report, “Economic Well-Being of U.S. Households,” the most recent available, finds roughly one-third of adults would not be able to pay for a $400 emergency event. What challenges do people face in understanding and using financial assistance programs offered by health systems and clinics?

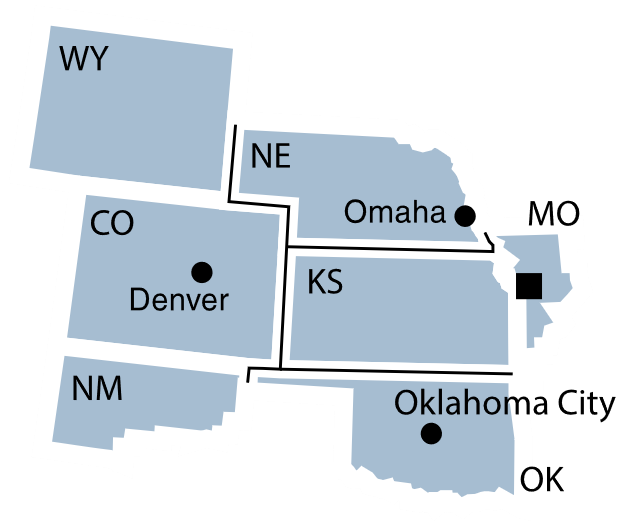

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Office leasing twist

Cold winter weather slowed output at oil refineries along the Gulf Coast, in North Dakota and other areas of the Midwest, resulting in “modest upward pressure on fuel prices.” Though oilfield output in District 11 “held steady,” looking ahead “contacts expect U.S. oil production growth to slow notably this year.”

Capacity issues due to drought in the Panama Canal region were “impacting container volumes at Gulf Coast ports.” But drought problems in Texas improved. “Recent rainfall improved pasture conditions, refilled ponds and boosted crop prospects.” Some farmers turned toward cotton and away from grain due to higher prices for the textile crop.

Story idea: As in other districts with major metropolitan hubs, office leasing “remained weak,” with “elevated” vacancies and “widespread” concessions. Also, in bit of a narrative twist, some prospective tenants are assessing the credit of their potential landlords instead of the other way around. Staff at the North Texas Commercial Association of Realtors and The Real Estate Council may be willing to answer questions about how prevalent this practice is, along with other questions on the state of the commercial real estate market in District 11.

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

Double-dip jobs

The local economic boost from Super Bowl LVIII in Las Vegas “exceeded expectations” and was “in line with that of the Formula 1 race held in the city last November.” But leisure and hospitality business abated across most of District 12 “due to expected seasonal fluctuations.”

Contacts in the health and agriculture sectors turned to automation and other “emerging technology solutions” to “boost productivity and improve efficiency.”

Wages were up a bit across District 12, in line with inflation. To retain workers in a tight labor market, “some employers fully absorbed recent increases in health insurance premiums and continued to offer hybrid or fully remote work.”

Story idea: Are people seeking remote work so they can get second jobs? One contact in Nevada reported “that employees preferred remote work because it allowed them to more easily take a second job,” but the report does not indicate the industry those employees work in. The U.S. Bureau of Labor Statistics last updated its state-by-state report on multiple jobholders nearly a decade ago. But experts at the University of California, Berkeley’s Labor Center may be able to provide recent data, insight on whether this is a regional trend and help journalists find employees who work remotely and have second jobs.

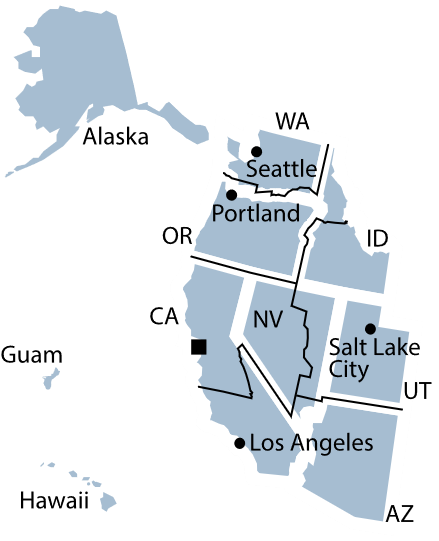

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary