The central bank in the U.S., the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

The Federal Reserve’s Beige Book offers a high-level, anecdotal glimpse of current economic sentiment in each of the central bank’s 12 regions. For journalists, it can serve as an extensive tip sheet with insights that can spur local, regional and national story angles.

During COVID-19, the Beige Book is especially valuable for business journalists, or any journalist assigned to cover business topics, because national and regional economies are changing rapidly. The book is compiled from reports from Federal Reserve district directors and interviews and surveys of business owners, community groups and economists.

Individuals surveyed are called “contacts,” and they are quoted anonymously. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts culled from surveys and wide-ranging conversations.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

Economists and analysts at district banks seek to cultivate contacts that can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with other contacts representing a variety of industries and company sizes. As a general overview of the economy in each district, the Beige Book is a contrast to other Federal Reserve informational products. It’s not the place to turn for specific, detailed data, like average mortgage rates. But each Beige Book edition, released eight times a year, contains story ideas.

According to the March 2 release, employer demand for workers remained strong nationally in the early part of this year as the quit rate remained historically high with almost 4.3 million workers leaving their jobs in January. Regarding inflation — which hit 5.2% in January, according to the core Personal Consumption Expenditures Price Index, the Federal Reserve’s preferred measure — the central bank characterizes prices as increasing at a “robust pace” across the country. The reasons? The Beige Book explains it’s a combination of rising costs for transportation, raw materials and labor. Still, companies “reported an increased ability to pass on prices to consumers; in most cases, demand has remained strong despite price increases.”

The latest edition of the Beige Book compiles information gathered from Jan. 4 to Feb. 18. Note that Russia invaded Ukraine on Feb. 24, so commentary on stateside consequences from that invasion would not appear until the next Beige Book, due out April 20.

Keep reading for quick summaries from the March 2 Beige Book release, along with story ideas for each district.

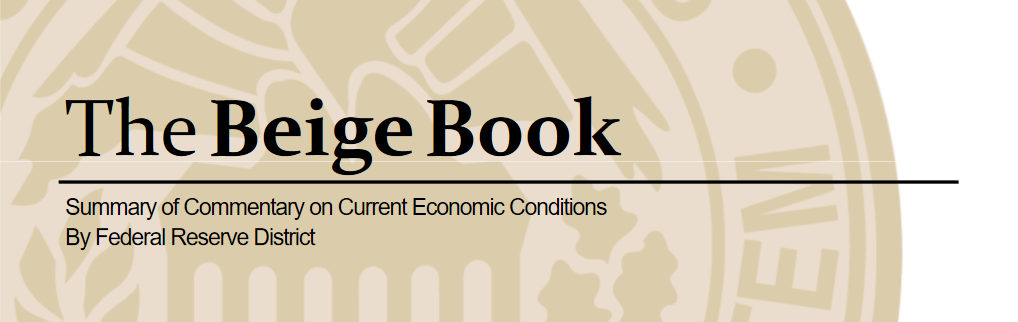

District 1, Boston

Recreational vehicle boom

New and used car prices held high, but had “softened somewhat at recent auctions,” according to a New Hampshire contact in the auto industry. Meanwhile, firms that rely on computer chips for their goods reported “extortive” pricing from suppliers.

Restaurants saw their input prices — think the meat, dairy, produce and labor needed to make a dish — increase faster than at any time over the last four decades. Menu price hikes followed, but not enough to keep pace with input prices. The omicron variant of COVID-19 kept many people from going out to eat, especially in the Boston area. Lower restaurant profits followed.

Home and condo closings were down compared with last year. The condo sale slide was an about-face from the last Beige Book. “Several contacts interpreted the latest results as a return to normal seasonal patterns, together with the fact that in late 2020 the market had been unusually busy.”

Story idea: “Sales of RVs defied typical seasonal trends and remained robust throughout the winter,” according to the Beige Book. Reach out to local sellers of recreational vehicles to find out if they are part of the trend, or bucking it. Is there a coming “Summer of the RV” in New England, or will high gas prices keep them off the roads?

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

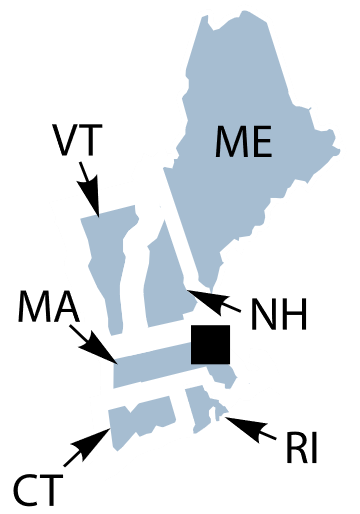

District 2, New York

Zombie home rehab

A January hourly minimum wage hike of $1 in New Jersey and $0.70 in New York (outside of New York City) led employers in manufacturing, distribution and leisure and hospitality to proactively increase employees’ wages, “not just for workers at the [minimum wage] threshold but for those somewhat higher in the wage distribution as well to mitigate wage compression.”

Wage compression happens when the pay gap between lower-paid and higher-paid workers shrinks. As a simplified example, if a newly hired cashier suddenly makes as much as longer tenured cashiers, those long-term cashiers might take their customer service experience to better paid opportunities.

Omicron seriously hurt profits in the service sector, especially in New York City. But subway ridership ticked up in January and February, compared with December. City and statewide loosening of COVID-19 restrictions happened around the same time the Federal Reserve stopped collecting information for this Beige Book. Lifting vaccine check requirements for bars and restaurants, coupled with spring weather and falling Omicron case rates, could portend rosier profits ahead for the leisure and hospitality sector.

Trade show activity in New York City is also primed for a bump in March, according to the Beige Book. Still, overall jobs in the city might not rebound to pre-pandemic levels until 2025, according to a January report from the New York City Independent Budget Office.

Story idea: Residential home inventory is still low in upstate New York. “Housing affordability is a growing concern in the region, and efforts are underway to rehabilitate ‘zombie’ homes in some areas and convert some commercial space to residential.” Zombie homes are properties that have fallen into disuse and disrepair. Explore your local streets and see if there are renovation projects conducive to an article or series on zombie home rehabs.

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

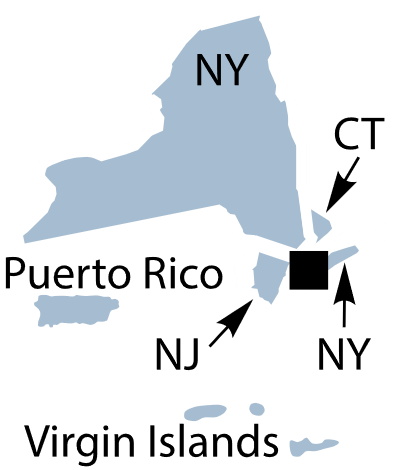

District 3, Philadelphia

Unrealized economic potential

Contacts from retailers and restaurants reported that rising costs for procuring and producing their wares were a threat to the modest overall growth they enjoyed during the period, while supply chain issues were “better” than the previous period, but remained “fragile.”

The multifamily housing market remained hot, partly because developers scrambled at the end of 2021 to qualify for an expiring 10-year property tax abatement for new housing in Philadelphia. “Contacts noted that the nearly 23,000 permitted units will not all be built, but that completing even a fourth of the total would put downward pressure on apartment rents and condo prices.”

Story idea: Banks, accountants and lawyers said clients from firms they serve remain uncertain about their business futures. “Many are flush with cash and making no big plans, except for automating where possible.” The big challenge: finding and paying for workers. What are state and local governments doing to help? It’s an important question because if firms can’t meet their customers’ demand for goods and services, that equals unrealized production and economic growth — including tax revenue, which can be directed to pay for education, housing, infrastructure or a host of other needs.

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Educators cut class

Omicron hurt customer-facing businesses in early January, but “such disruptions quickly abated as the month progressed.” Generally, firms reported high employee turnover because more workers wanted to work remotely, make more money, pursue other careers or find firms offering better working conditions.

Some manufacturing firms heightened production by investing in technology to replace human workers, in response to employee turnover and higher wages. Freight logistics contacts complained of a lack of drivers and vehicle parts. “One contact said that a third of the firm’s drivers reduced their driving hours when awarded a higher wage, thus driving fewer miles while earning the same salary.”

Story idea: A contact from a university “expressed great concern that educators were leaving the profession in large numbers because the current work environment was ‘not what they had signed up for.’” No other details are given. Is teaching classes online “not what they had signed up for”? Are these mostly adjuncts and their pay is too low? Is there something else happening? Is the contact from a state or private university? Regardless, if higher education faculty are indeed leaving in droves, that’s worth exploring. Twitter feeds of local professors may indicate whether they have recently left their posts. If so, they may be willing to do an interview to share why they departed. Faculty union leaders or members of a university governing body would also be good sources to turn to. The Ohio Department of Higher Education provides a variety of data and reports — some recently updated, some not — that can serve as an introduction to the state’s university and college system. State-funded universities are subject to Ohio’s Public Records Act.

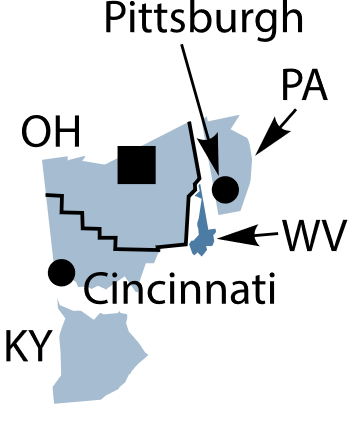

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

No degree needed

Companies that introduced flexible work arrangements still sometimes lost staff to firms offering higher wages or full-time remote work. There were a “small number” of non-manufacturing firms worried that customers would scoff at price hikes related to high shipping and energy costs.

Inventory was low and profitability high for auto dealers. Outdoor venues and ski resorts also did well, though tour bookings were down along with business air travel. Restaurants were busy “but many had to limit service because of a lack of staffing.”

Story idea: “Some employers were willing to loosen requirements on education and experience in favor of on-the-job training to fill open positions.” One firm that had required a bachelor’s degree in computer science was able to fill those roles with applicants without a bachelor’s degree. Talk to firms that have decided to bend a bit on their education requirements to see how those employees are working out and whether this warrants a rethinking of education requirements for certain jobs.

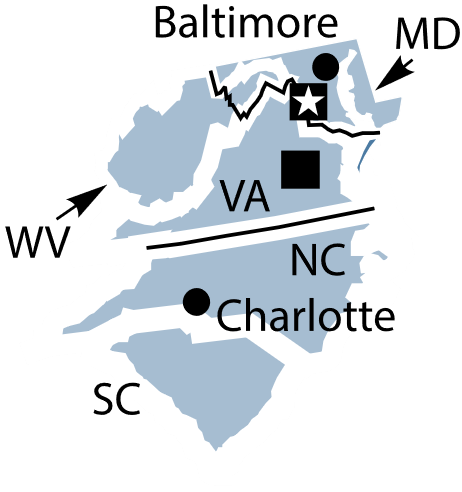

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Shift surfing wave

Firms, on average, expect their per-unit costs to increase 3.7% year-over-year, according to the Atlanta Federal Reserve’s Business Inflation Expectations survey. “Many contacts continued to describe supply chain issues, particularly a dearth of available labor, as the driving factor behind rising costs.”

Transplants from the Northeast and West Coast kept home keys turning, with housing demand continuing to outstrip housing stock. Mortgage lenders loosened their credit worthiness standards for jumbo mortgages, though credit quality “remained healthy” among borrowers, generally speaking.

On the shipping front, sea ports, many of them in Florida, “experienced growing container volumes and new cargo vessel business as shipping lines shifted to east coast ports to avoid congestion on the West Coast.” Citrus farmers in Florida suffered a recent cold spell and “while damages are still being assessed” the cold weather is “expected to have a material adverse impact on citrus crop yields.”

Story idea: A contact from a high-end restaurant group reported letting staff “shift surf” across locations, to offer a more favorable work-life balance and to allow workers to seek specific shifts, like dinnertime, when they might reap better tips. But the program “ultimately resulted in staffing shortages at some establishments.” Every business decision is a push-and-pull. There are stories to be told exploring the pros and cons of workers now wielding a modicum of leverage over employers.

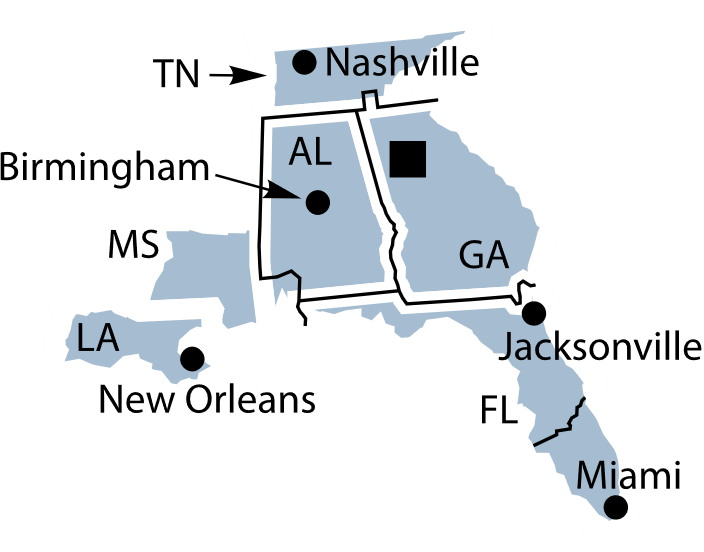

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

‘Planting decision dilemma’

Lawn and garden and appliance sales were robust. Home furnishings and electronics sales, however, fell a bit. Light vehicle sales rose, but sellers could have sold more if they had the inventory to keep up with demand. Many households shifted from “eating out to eating at home, as grocery sales moved up and food service demand declined.”

Home construction activity edged up, with one homebuilder reporting that “strong demand made it feel like the spring building season had already started.” Commercial residential construction orders kept demand for building materials slightly elevated.

Story idea: Corn and soybeans are major agricultural crops in District 7. Crop prices increased, but so did costs for fertilizers and herbicides critical for their production. “One contact pointed out a planting decision dilemma: Seeds that are more readily available do best when used with herbicides that are in short supply.” Corn in particular uses more fertilizer than other crops. Reach out to corn and soybean farmers big and small to find out how they have managed this paradox.

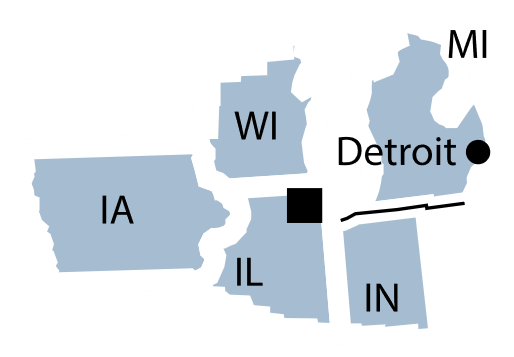

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

Change takes time

Wages are up in District 8. Some 65% of contacts report that they raised employee wages in recent weeks. Small firms, which operate on small margins, are having a hard time meeting market wages. Firms experiencing labor shortages are also having to pay for more overtime. One manufacturer estimates a “5% to 20% increase in labor costs from overtime and hazard pay.”

General retailers are still dealing with supply chain issues, with one Arkansas retailer only recently receiving a shipment that had been due in April 2021. One Louisville auto dealer reported having a hard time completing trade-ins of used cars for new ones because new vehicle shipments never came through. But another auto sales contact “expects prices to fall as inventories build up” over the coming weeks.

Story idea: Here’s an important reminder that price changes don’t happen out of thin air: “One retail contact reported that a shortage of in-store staff to physically change price tags has been an impediment to raising prices and that they had to enlist corporate employees to change price tags.” How much time does it really take to change price tags in a typical retail outlet? It’s a telling microcosm of the challenges that come with small business ownership.

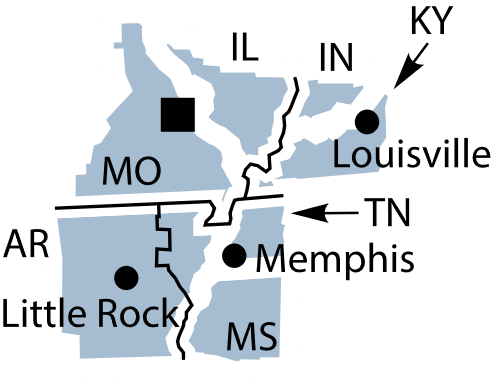

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

Bullish minority entrepreneurs

District 9 businesses also struggled with staffing problems. There were “a surprising number of firms” that saw staffing levels fall because of turnover and “an inability to fill openings.” One transportation company contact in South Dakota said that the “amount of work I have to turn away due to lack of staff is staggering.” Wages pushed higher, “driven by recruitment and retention challenges, rather than workers’ inflation concerns.”

On the homebuilding front, residential construction levels didn’t change since the last Beige Book. One builder in Wisconsin was optimistic about business in 2022 but added that “if inflation is not curbed and supply chain issues are not resolved, the outlook is very pessimistic.” Building permits for single-family homes in Minneapolis-St. Paul was higher year-over-year, but permitting fell across other parts of the district.

Story idea: A positive story angle: Minority and women-owned business enterprise contacts are bullish on their business prospects. “A professional working with minority entrepreneurs in the Twin Cities said that the volume of microloans issued for new and existing businesses remained strong.” What is the current landscape of minority and women-owned businesses, in terms of where they are popping up and how they might transform the business environment in the Twin Cities and across the district? Two places to start talking to people: the Minority Entrepreneur Initiative at the University of Minnesota and the nonprofit Women Entrepreneurs of Minnesota. A database of active business names and addresses is available for $30 from the Minnesota Secretary of State. A search for individuals or organizations linked to business records costs $35 per search. Minnesota open records law states: “Money may be collected by a responsible authority in a state agency for the actual cost to the agency of providing copies or electronic transmittal of government data.”

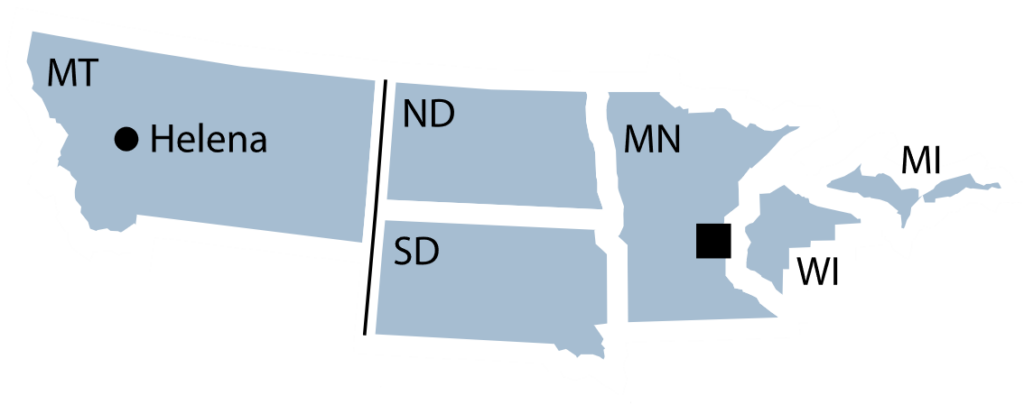

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

Eroding bargaining power

Goods related to leisure activities have been snatched up at a high rate, though some retail contacts were concerned consumers had already bought years’ worth of those items. (How many Jet Skis does one household really need?) Many of those retailers are now “‘hedging their bets’ with regard to ordering inventory for the coming year, even though consumer demand remained high.”

Omicron slowed spending in general but it rebounded swiftly, and hospitality contacts “reported growth in plans to renovate and upgrade spaces to attract customers.” Building contractors are as busy or busier than before the pandemic, but “difficulties in sourcing materials are leading to costly redesigns or delays for their customers.”

Story idea: Fewer firms submitted bids for public and private sector building contracts, “eroding their bargaining power that would otherwise mitigate price pressures.” How is the lack of bidders for building projects affecting municipal coffers? Are other projects being shelved because of higher building costs? Check in with city and county contracting officers to find out.

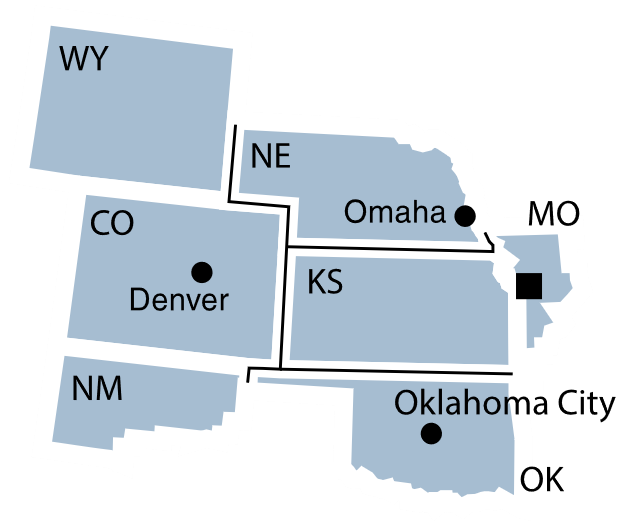

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Service sector staffing

Firms reported that the lack of applicants for open jobs worsened during the national Omicron surge in January. Key employees in the service sector were able to negotiate large pay increases. One bank raised its minimum wage to $18 an hour, “slightly mitigating retention issues.” Firms overall were more optimistic in February than in January, but still faced challenges. “Headwinds include uncertainty surrounding the path of the pandemic, supply-chain stresses and inflation.”

Much of the district dealt with severe drought. Demand for beef remained strong as cattle prices rose. Prices too rose for agricultural commodities (think any product that has to do with the earth, like fruits and vegetables, textile materials and meat) but costs to produce those goods also increased. There’s fear among producers that profits will shrink and “good yields will be important for their financial position this year.”

Story idea: While business in District 11’s service sector suffered along with the rest of the country, staffing services that place employees in the service sector “saw a pickup in revenues and broad-based, robust demand.” Why? Are workers turning to staffing agencies in order to help them secure positions that meet their needs for pay, working conditions and other considerations? Reach out to local staffing agencies to see if they’ve recorded more business, and what their applicants are looking for in their next job.

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

Mom-and-pop renaissance

Firms looking to fill high-skill jobs in accounting, architecture, technology and other areas “continued to compete intensely for talent.” Despite hiring difficulties, professional services by and large reported more client demand.

While overall retail demand remained strong, some stores “noticed that sales of high-end or discretionary goods declined somewhat due to price increases.” In Alaska and Utah, some employers had an especially hard time hiring, with candidates “who missed scheduled interviews and newly hired workers who failed to show up on the first day at their new job.”

Renters in multifamily buildings in major cities generally saw their rents increase. Residential real estate sales and construction “remained strong,” but one lender in Arizona reported that “lending conditions within traditionally underserved communities remained quite tight.”

Story idea: “In the Mountain West, a contact mentioned that local and regional firms expanded into locations vacated by national brands.” Travel around your coverage area and observe. Are more storefronts sitting vacant that were once occupied by national retailers and restaurant chains? Are local or regional businesses planning on taking their place? If so, it could signal a renaissance of sorts for mom-and-pop stores — or, at least for regional retailers with a more refined understanding of community needs than national brands typically offer.

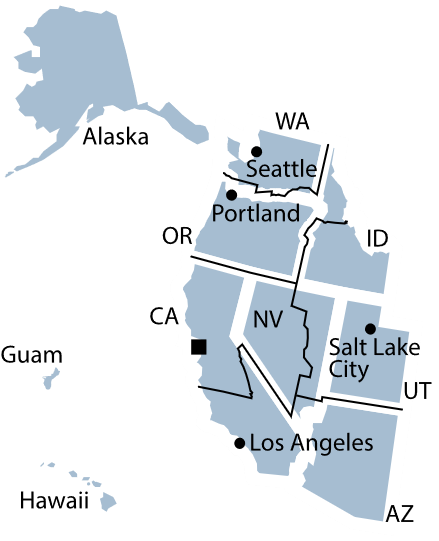

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary