The U.S. central banking system, the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

The Federal Reserve’s Beige Book comes out eight times per year and offers a high-level, anecdotal glimpse of current economic sentiment in each of the central bank’s 12 regions. For journalists, it can serve as an extensive tip sheet with insights on local, regional and national story angles.

The Beige Book is valuable for journalists reporting on economic issues, because national and regional economic conditions can change rapidly. The April 2025 edition offers story ideas for reporters covering business as well as those covering tourism, transportation, vocational training and food.

The Beige Book was first publicly published in the 1980s with a beige cover. Find the archives here.

The book is compiled from reports from Federal Reserve district directors along with interviews and surveys of business owners, community groups and economists.

The authors of the book refer to individuals surveyed as “contacts,” and they are quoted anonymously. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts culled from surveys and wide-ranging conversations among “a diverse set of sources that can provide accurate and objective information about a broad range of economic activities,” according to the book.

Economists and analysts at district banks seek to cultivate contacts who can give a broad economic view — think the head of a trade group who regularly talks with many company owners — along with contacts representing a variety of industries and company sizes.

The April 23 edition of the Beige Book includes information gathered during parts of March and April.

Across districts, international tourism is down and businesses are experiencing widespread uncertainty related to tariff policy. Firms across sectors are reporting higher costs to produce their goods, and many are planning to pass on as much of those price increases as they can to consumers.

As President Donald Trump in recent weeks has imposed tariffs then suddenly reversed course, the economic outlook for the rest of the year is uncertain, making it difficult for many businesses to commit to hiring workers or large purchases, such as for new manufacturing or technology equipment.

Keep reading for quick summaries and story ideas from the latest Beige Book release.

District 1, Boston

Canadian tourism woes

Recent bad weather “softened” home sales while the overall outlook in the residential real estate market “became considerably more uncertain and more pessimistic” with contacts concerned that inflation and tariffs were hurting demand. Meanwhile, on Cape Cod, the supply of foreign-born labor declined, particularly the availabiliity of immigrant workers for health care-related firms.

Retail and manufacturing sector contacts cautioned that tariffs “could result in significant passthrough to their output prices,” meaning higher prices for consumers. About half of manufacturers contacted said they would fully pass through higher costs related to tariffs to consumers. One manufacturer “shortened the duration of its price quotes to 30 days in anticipation of the need to adjust prices rapidly.”

Story idea: One big story heading into the summer in District 1 is potentially sluggish tourism revenues. While revenues for firms in the tourism sector increased a bit, “tourism from Canada slowed considerably,” while “contacts feared that summer travel from Europe and China could suffer as well because of negative reactions to U.S. tariff policies.” Start by reaching out to Abigail Phillips at the Massachusetts Office of Travel and Tourism for information on tourism expectations in the coming months and what the state is doing to help firms in the tourism sector weather the potentially slow summer.

Boston Federal Reserve Regional Data

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

‘Proper vocational training’

Firms that rely on imported goods were concerned about smaller profit margins and whether they would be able to pass through cost increases to consumers. Small retailers, such as grocery stores, restaurants and home goods sellers, saw reduced sales “and a diner in upstate New York noted customers were spending less on higher-priced menu items.” But auto dealerships upstate have done well in recent weeks “as customers looked to purchase vehicles before tariffs pushed prices up further.”

Some manufacturers saw “sharp declines in sales to Canada” while one furniture manufacturer saw lower order volume partially related to U.S. government spending freezes. Likewise, an information technology firm “noted the loss of several contracts with Canadian companies” while firms in the leisure and tourism sector near the border in upstate New York “saw declining visits from Canadians.”

Story idea: A salon in New Jersey “reported that training costs were high because workers did not have the proper vocational training.” Is there a recent decline in enrollment for vocational programs, particularly in cosmetology? The New Jersey Department of Labor and Workforce Development would be a good place to start exploring labor market data. They employ a roster of industry analysts who may be able to answer questions.

New York Federal Reserve Regional Data

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

Decline of restaurant week?

Auto sales were strong in District 3, with consumers trying to get in front of anticipated price hikes due to tariffs. Businesses in general across the district have tempered their sales forecasts for the coming six months, “with rising economic uncertainty weighing on prospects.”

Consumers were broadly more conservative with their spending, with “less frequent visits to businesses such as coffee shops, breweries and restaurants.”

The cancellation of government travel and conferences was a drag on the tourism industry. Demand from domestic consumers overall remained strong despite “a significant drop in visits and future bookings from international tourists.” One contact from a staffing firm interpreted federal government layoffs as a chance to snatch up qualified workers, though overall “reports of fewer hours, hiring freezes, and layoffs were more common than in recent periods.”

Story idea: Restaurant weeks in cities and towns across the country are organized by chambers of commerce or tourism bureaus to try to help local restaurants gain new clientele. The idea is that restaurants discount their meals for a week with the hope that customers will later return and pay full price. But one contact in District 3 “reported that a significant number of restaurants chose not to participate in an annual local restaurant week promotion because they couldn’t afford to discount their menu items.” Is restaurant week an unexpected casualty of Trump’s trade war, perhaps due to higher prices for imported produce and meat? The Pennsylvania Restaurant and Lodging Association could be a first good call to learn more.

Philadelphia Federal Reserve Regional Data

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Credit cards for basic needs

Businesses in the food and hospitality sectors noticed slower foot traffic, which they attributed to “economic and political uncertainty” while they also generally anticipated less consumer spending in coming months. As in other districts, some auto dealers in District 4 saw higher sales with customers anticipating tariff-related price hikes.

But the trouble for retailers lay in economic uncertainty, “and they worried that consumer spending would pull back further.” Likewise, bankers noted that some of their clients were holding off on big purchases “due to increased economic uncertainty.”

Investors pulled back from the stock market and bankers reported increases in core deposits. Core deposits include checking and savings accounts. The implication is that people are pulling their money out of equities due to recent stock market swings and putting that money instead into accounts they view as more stable and less risky.

Story idea: Community service nonprofits reported that low-to-moderate income households were increasingly using credit cards for basic purchases. If you’re covering District 4, check out this Federal Reserve table to see whether your local metropolitan statistical areas have higher than average debt-to-income ratios. As News 5 Cleveland (WEWS-TV) reported last October, those in debt sometimes turn to nonprofits like Money Management International for help. MMI also provides aggregate data on their clients’ debt situations and may be able to connect journalists with experts who can answer questions about household debt in District 4.

Cleveland Federal Reserve Regional Data

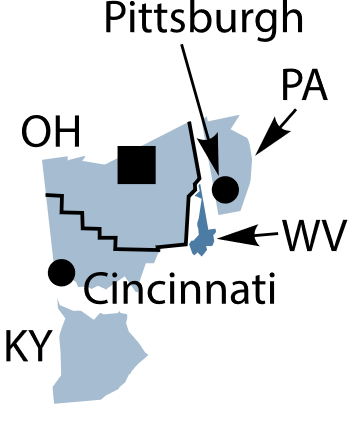

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Port call tax

While overall employment levels have held steady in District 5, “many federal government workers were laid off or put on administrative leave in recent weeks,” with federal contractors also facing layoffs, including at a research firm near the Capitol region that has reduced staff due to federal spending cuts.

As in other districts, firms generally were informing customers to expect price increases related to tariffs. Future business growth is also up in the air with several firms reporting that “until they had a better idea of how tariffs might impact them, they were minimizing new investments and planning for various cost scenarios.”

While manufacturers reported good revenues during the first quarter of the year, as the trade war has ramped up in recent weeks the economic climate for manufacturing is more tepid.

“A sheet metal fabricator wasn’t sure about future orders due to steel tariffs leading to price increases,” while a manufacturer specializing in military equipment called conditions “too chaotic” to decide on investments over the coming months.

Story idea: A proposed port call tax from the U.S. Trade Representative would impose hefty levies on vessels operated by firms based in China and “could quadruple cargo handling costs,” according to contacts who work in District 5 ports. Meanwhile, “some ports received multi-million-dollar tariff bills on Chinese cranes that were already ordered and enroute as tariffs were enacted and are now subject to the tariff.” What does the tariff bill in District 5 look like so far and what could it look like with a port call tax? It’s a difficult question to answer, but you can start the search by reaching out to academic experts at Old Dominion University’s School of Supply Chain, Logistics & Maritime Operations, which is based in Norfolk.

Richmond Federal Reserve Regional Data

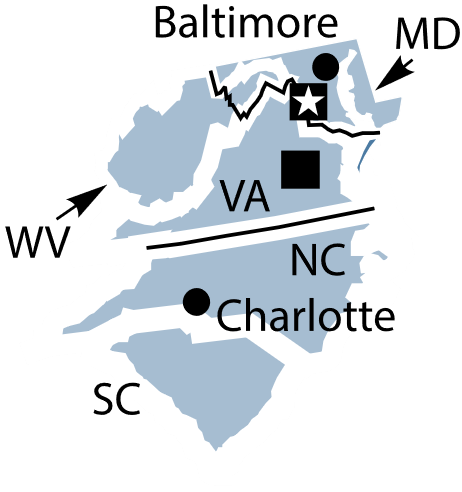

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

Tariffs and timber

Some firms, though not a majority of them, report fewer available workers as the Trump administration seeks to limit immigration, particularly for firms in construction and agriculture. Meanwhile “a small but increasing share of contacts noted plans for slight reductions in force as a result of softening demand or mounting cost pressures.”

As in other districts, many companies are planning to pass tariff costs in full on to consumers despite the risk of reduced sales, though “some consumer-facing firms noted increased price sensitivity among customers has led them to be strategic with targeted pricing.” Even firms not directly affected by tariffs are raising prices in part due to reduced competition from foreign firms. This means companies are raising prices because they face fewer overseas competitors with prices favorable to consumers.

Tourism business declined in District 6 while “large attractions” that “normally draw international visitors saw a drop in travelers from abroad, particularly Canada, and airports and airlines reported a notable decline in foreign passengers to the U.S.”

Story idea: Demand for timber is low in District 6 and lumber and wood product manufacturers faced high levels of uncertainty due to tariff policy. One manufacturer reported “zero faith in even a 6-month forecast.” While one stated goal of the current tariff policy is to “save manufacturing” in the U.S., there are stories to tell about manufacturers harmed by tariff policy, particularly those whose markets are mostly overseas. The Georgia Forestry Association, which advocates on behalf of forest landowners and forest product manufacturers, may be able to shed light on how tariffs are affecting District 6 timber producers and wood product manufacturers.

Atlanta Federal Reserve Regional Data

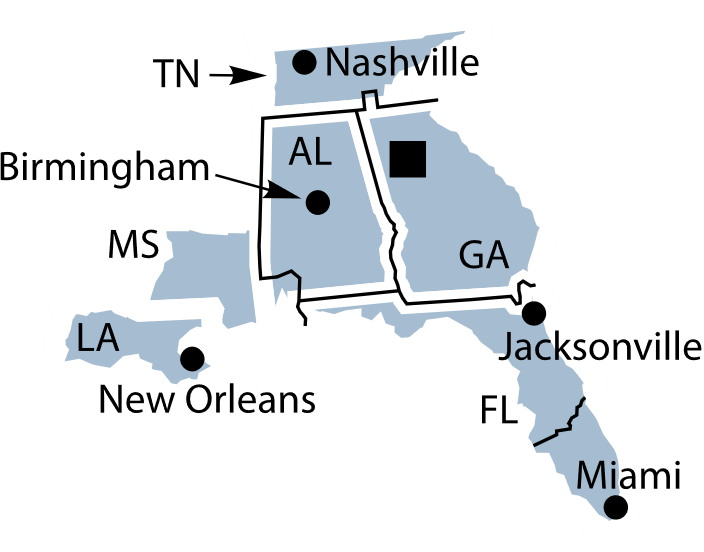

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Sourcing eggs and chicken

Annual wage increases for workers in District 7 have been in line with historical averages, following a number of years of atypically high wage gains. Manufacturers were having trouble planning for the future amid uncertainty about sale prices and input prices, with many linking that uncertainty to tariff policy and one machinery manufacturer reporting “that vendors were changing prices on a daily basis.”

Likewise, businesses in District 7 overall reduced their spending: “Capital expenditures fell slightly and expectations for spending over the coming year also declined. Multiple contacts reported hesitancy to make capital purchases due to uncertainty over the economic outlook.” Businesses buy things like new equipment or production facilities many months in advance, and they make those decisions based on their reading of both national and regional economic outlooks. When uncertainty is injected into the economy, forward-looking business decisions become difficult to make.

Story idea: While many news organizations have focused on how average consumers are managing high grocery prices, there has been less coverage of how inflation on staples like eggs is affecting lower-income consumers. In District 7, “food pantry leaders [noted] the particular challenge of sourcing adequate amounts of eggs and chicken, two common sources of protein.” Groups like the Illinois Hunger Coalition and Feeding Illinois should be able to point you to sources who can speak to the on-the-ground challenges of providing nutritious food as prices rises in part due to tariff policy.

Chicago Federal Reserve Regional Data

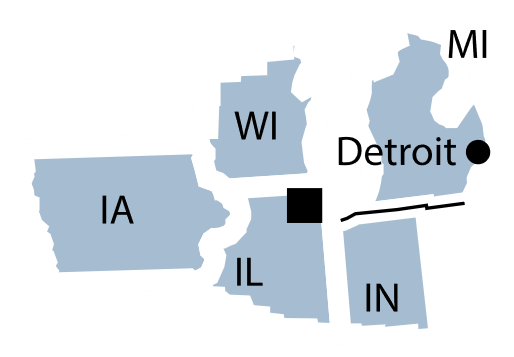

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

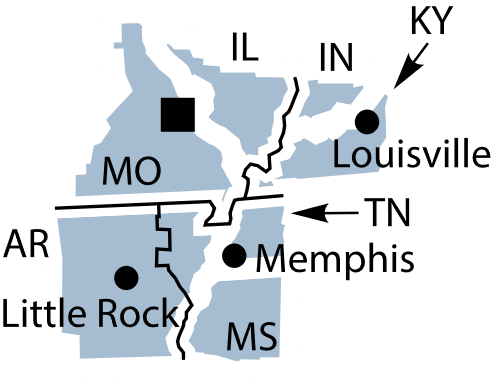

District 8, St. Louis

Kentucky bourbon blues

A range of businesses in District 8 reported uncertainty for their future outlooks related to tariff policy. One retailer had estimated their costs rising by less than 2% under their “worst-case-scenario estimates of tariffs” but, more recently, they anticipate a 5% hike in their costs. A manufacturer “reported that what initially looked to be a mild impact had worsened and was forcing them to evaluate sourcing options.” Meanwhile, larger retailers appeared to be banding together, telling suppliers they would “not accept” higher prices related to tariffs.

Rainy weather made some roads impassable and led to cancelled flights, hurting delivery firms. More broadly, transportation companies “remain optimistic that demand for materials will continue but they are concerned about tight margins.”

Bad weather has also delayed crop planting for agricultural producers, with one farmer in Arkansas reporting “not being able to sleep for three days due to the disruptions caused by the flooding.” Profits are expected to be negative for row-crop farms but “government supports are expected to offset losses.”

Story idea: A quintessential American spirit, bourbon is big business in Kentucky. It’s also no exception to tariff uncertainty: “A bourbon distillery indicated that planning ahead felt almost impossible when trade rules kept changing.” This uncertainty isn’t just liable to affect orders for capital expenditures, such as new equipment, it can also affect hiring decisions — meaning potentially sluggish hiring for the region’s bourbon producers. The European Union, Canada and Mexico are among the top importers of U.S. spirits. The James B. Beam Institute for Kentucky Spirits at the University of Kentucky would be a good place to find experts who can speak to the challenges the industry is facing and point you toward other sources.

St. Louis Federal Reserve Regional Data

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

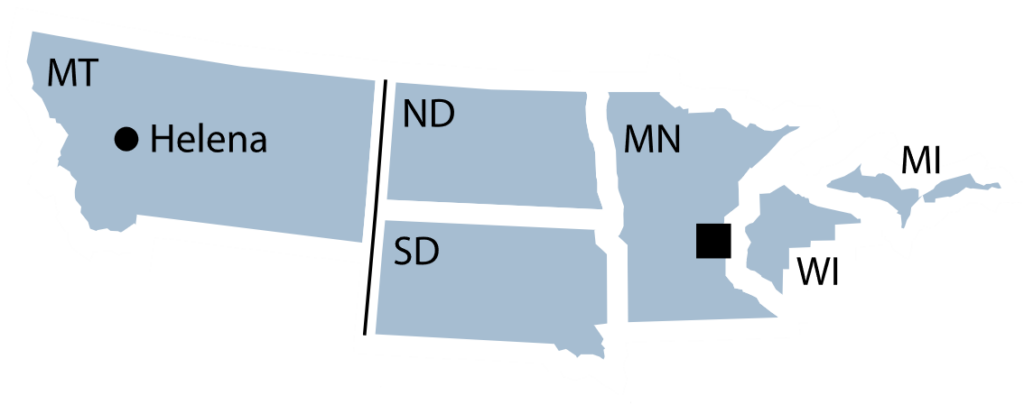

District 9, Minneapolis

Wage-inflation disparities

According to one metal fabricator, prices for steel and aluminum used in manufacturing and construction are increasing faster than they did from 2019 to 2021, around the time when Trump first put tariffs on those goods. Many manufacturers reported higher sales in March than the previous month, with some contacts noting “a bump in orders due to customers seeking to build inventories ahead of expected price increases.”

While the labor market overall in District 9 is in good shape for now, one contact in labor and workforce development said that “the labor market door is about to slam shut … and consumer confidence is going to plunge.” A contact in the building trades reported more “people on the bench” — meaning there are more qualified people looking for work than there is work to be done — due in part to cuts in federal projects.

Story idea: Are overall wages in District 9 failing to keep up with inflation? March marked the second month in a row that wage increases declined “noticeably,” while one staffing company reported that “year-over-year wage increases for a majority of job placements were running just over two percent.” Check out regional inflation data from the Bureau of Labor Statistics and talk to regional experts, such as economists at the University of Montana, for help understanding which industries are being affected by slower wage growth — and what this means for average households in District 9, considering suggestions throughout this Beige Book that firms plan to raise prices.

Minneapolis Federal Reserve Regional Data

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

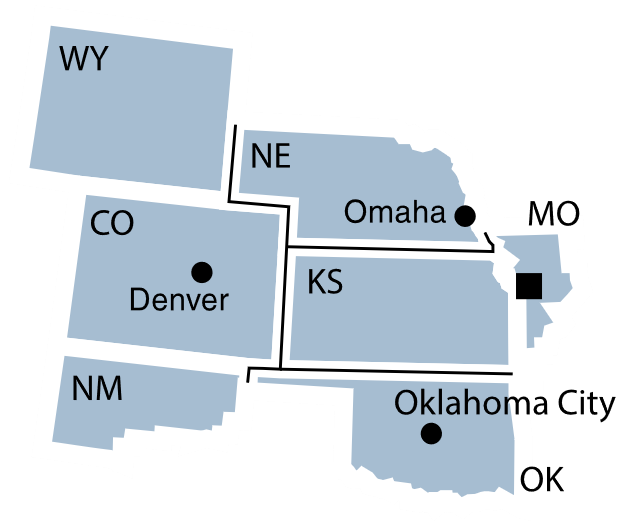

District 10, Kansas City

Food pantries and older adults

District 10 “expectations about business activity and consumer spending weakened considerably compared to the last report,” as was the case across much of the country.

Business uncertainty “rose quickly” as “concerns about tariffs weighed on decision making,” with many firms reporting they would probably have to raise prices for finished goods. Uncertainty also hit job growth with one contact commenting that “this is not the time to commit to adding labor,” though manufacturers suggested they would view workforce changes as a “last resort.”

Auto dealers lowered prices to move inventory and increase cashflow — the concurrent uptick in auto sales was “not expected to persist.” Spending on travel bookings was also down, with expectations for summer travel described by contacts as “a cliff.” The overall outlook for consumer spending “weakened further in recent weeks, with projected growth in household spending roughly flat on average.”

Story idea: Food pantries in District 10 reported that funding cuts from the U.S. Department of Agriculture would be “particularly impactful regarding services for seniors.” Food pantries also “expressed heightened funding uncertainty across government, corporations, and individuals and uncertainty about food price pressures.” Learn about the role the USDA has historically played in reducing hunger in our August 2023 explainer about the Supplemental Nutrition Assistance Program, and reach out to the Harvesters Community Food Network to understand the challenges facing older adults in District 10 who are food insecure.

Kansas City Federal Reserve Regional Data

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

Federal funding and tenants

Contacts across industries “voiced concern that heightened uncertainty stemming from on-again, off-again tariffs was making it increasingly challenging to plan,” while immigration policies, federal layoffs and spending cutbacks “were also cited as headwinds for growth.”

Airlines in District 11 — American Airlines is headquartered in Fort Worth and Southwest Airlines in Dallas — noted “softened” demand in part due to less federal government travel. Meanwhile, energy executives expect layoffs this year. Steel and machinery prices increased due to tariffs, creating a “drag on the energy sector, particularly for firms with ongoing construction projects for whom the materials were a sizable share of costs.”

Across the service sector, other than financial services, “numerous contacts stating that heightened uncertainty surrounding domestic and trade policy was hindering their ability to plan with confidence.” In financial services, loans broadly were more likely to be non-performing, meaning loan holders missed payments for several months.

Story idea: There is high demand for social services in District 11, but nonprofits — especially those that rely on federal funding — have had to trim budgets, freeze hiring, lay off workers and reduce their programming. And here’s one potentially lesser-known consequence of broad-based federal funding cuts: “One contact noted that landlords were less willing to rent apartments to tenants reliant on federal funds due to the current policy climate and funding freezes.” Elizabeth Mueller, a professor of community and regional planning and social work at the University of Texas at Austin and lead of the Mueller Housing Research Lab, would be a good source to learn how federal funding freezes have affected District 11 tenants.

Dallas Federal Reserve Regional Data

District 11 includes Texas, northern Louisiana and southern New Mexico.

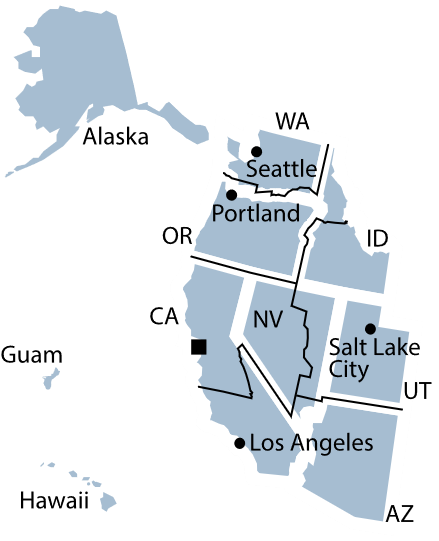

District 12, San Francisco

Warehouses for lease

Households and businesses alike in District 12 “were more cautious with their spending amidst elevated economic uncertainty.” Meanwhile, “the labor market outlook generally deteriorated,” with firms across industries reporting “recent and planned layoffs, with some citing lower demand from both private- and public-sector customers and others seeking cost efficiencies.” While wages grew slightly, minimum wage hikes at the state and local level pushed up some service sector wages further, particularly in California.

Imported goods and inputs — the things used to make finished goods — saw higher prices across a wide range of materials, “including aluminum, steel, lumber, electrical components, apparel, footwear, as well as various wholesale and retail food items.”

While many firms plan to pass on higher costs to consumers, “some expected to absorb cost increases to preserve market share,” meaning they aim to maintain the percentage of the market made up by their sales. Retailers and tourism industry firms in northern Washington and southern California “reported a material drop in cross-border tourism with Canada and Mexico.”

Story idea: In another example of the downstream effects of tariff policy, “leasing activity for warehousing, retail and wholesale space fell as tenants paused expansion plans.” Here’s an opportunity for an enterprise story on what warehousers are doing with increasingly empty spaces. Experts at the Urban Freight Lab at the University of Washington can help you understand the current state of the warehousing and wholesale industries, and potentially provide contacts for sources.

San Francisco Federal Reserve Regional Data

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary