The U.S. central banking system, the Federal Reserve, is a data-heavy organization. Economists at the bank regularly crunch numbers to inform national decisions, such as setting target interest rates. Meanwhile, economists at the Federal Reserve’s district banks — there are 12 across the country — analyze local and regional data to provide research insights on specialized topics, such as economic inequality.

Eight times yearly, the Federal Reserve’s Beige Book offers a high-level, anecdotal glimpse of current economic sentiment in each of the central bank’s 12 regions. For journalists, it can serve as an extensive tip sheet with insights on local, regional and national story angles. Here, we extend our semi-regular series of Beige Book rundowns with fresh story ideas from the July 12 edition.

The Beige Book was first publicly published in the 1980s with a beige colored cover. Find the archives here.

The Beige Book is especially valuable for business journalists, or any journalist assigned to cover business topics, because national and regional economies can change rapidly. The book is compiled from reports from Federal Reserve district directors and interviews and surveys of business owners, community groups and economists.

The book refers to individuals surveyed as “contacts” and they are quoted anonymously. There’s no particular number of contacts needed to produce the Beige Book, but each release is based on insights from hundreds of contacts.

Economists and analysts at district banks seek to cultivate contacts that can give a broad economic view — think the head of a trade group who regularly talks with many business owners — along with other contacts representing a variety of industries and company sizes.

Research from the Federal Reserve Bank of St. Louis suggests the anecdotes in the Beige Book accurately reflect what’s happening with employment and inflation in the U.S. economy.

After performing a simple textual analysis of every Beige Book from January 2000 to April 2022, the authors find, for example, that mentions of rising prices tend to closely track with official inflation data.

“Of course, the Beige Book — with its emphasis on qualitative and anecdotal information — is written with the belief that those anecdotes provide a deeper understanding of the economy, which simple word counts cannot capture,” write St. Louis Fed senior economist Charles Gascon and senior research associate Devin Werner in their June 2022 analysis.

The July 12 release of the Beige Book compiles information gathered in May and June of 2023. Housing demand remained elevated nationally, despite historically high mortgage rates. Labor demand was strong for high-skilled workers as well as in the health care, transportation and hospitality industries.

Inflation has cooled recently, and some businesses were reticent to raise prices as customers slowed their spending. Other firms reported steady consumer demand, allowing them to sustain their profit margins.

Keep reading for quick summaries and story ideas from the latest edition of the Beige Book.

District 1, Boston

Newfound efficiency on Cape Cod

Hotel rooms in Boston were pricey, even considering spring and summer are usually busy — rates were up 12% year-over-year. In Connecticut, tenants at one high-end office building declined to re-sign their leases once they expired, forcing the building into foreclosure.

Single family and condo sales slowed across the district because of a lack of inventory and rising interest rates. Even with “tepid sales,” housing demand is strong relative to the lack of supply, meaning “prices continued to rise, even as the pace of appreciation slowed gradually in recent months.” The state of play in the District 1 residential housing market won’t change until interest rates go down, contacts said.

One semiconductor producer expected a strong 2024, with higher demand coming in part from the spread of consumer products that use artificial intelligence.

Story idea: Some restaurants and hotels on Cape Cod have “achieved efficiencies,” meaning they are meeting demand while getting by with fewer staff after two straight summers of worker shortages. Talk to business owners in the New England leisure industry to find out exactly how they have managed to improve efficiency with fewer workers — and what do workers think? Are they working overtime? Were there technological investments and their work hours reduced? There could be an interesting business enterprise story here.

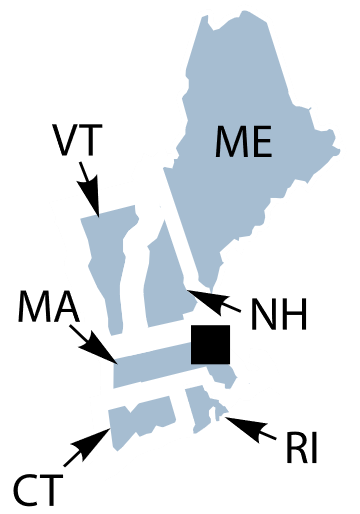

District 1 covers Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and most of Connecticut.

District 2, New York

Used cars underwater

The tourism industry in the Adirondack Mountains got an influx of seasonal workers thanks to the lifting of COVID-19-related visa restrictions. Prices for inputs — the components businesses use to make finished goods — remained high due to inflation, though prices receded in some industries. A contact in the construction industry said the prices of doors, windows and other key building materials were improving.

Residential rents in New York City “reached new highs” with upstate New York renters also experiencing an increase in housing costs. Small and midsized banks saw reduced demand for loans of all types.

Story idea: Used car values that spiked during the pandemic have come back to earth in District 2, with used car sales “subdued.” The loan-to-value ratio on some outstanding used car loans reached 120%, according to contacts, meaning the value of the loan is greater than the resale value of the car. A high loan-to-value ratio can be a precursor to delinquency. Talk with auto financers and loan holders and see if there is a story to be told about underwater loans in the used car financing market.

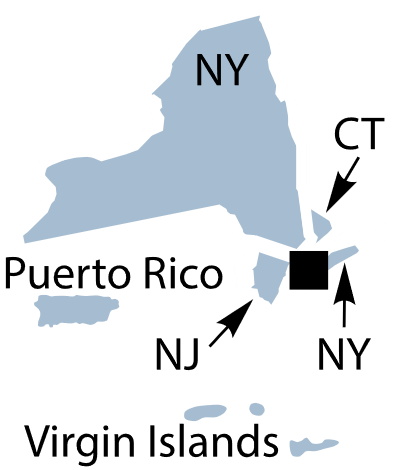

District 2 covers New York, western Connecticut, northern New Jersey, Puerto Rico and the U.S. Virgin Islands.

District 3, Philadelphia

211 specialist solutions

Few firms across District 3 carried out widespread layoffs, but some firms across industries did conduct targeted layoffs, were more selective in their hiring and reduced employee hours. Still, there were labor shortages in certain industries and jobs, such as housekeeping staff and cooks. Consumers overall were “more careful in their spending.”

Banks in the district saw a hike in mortgage origination, though home equity loans plateaued. Businesses faced tighter credit in the wake of bank failures during the spring and contacts “described an environment of elevated caution in which most banks want to extend credit only to customers with whom they already have a relationship.”

Story idea: In New Jersey and Pennsylvania, calls increased to 211, a phone number for finding government and nonprofit assistance with housing costs, utility bills and other resources. Nearly 95% of people in the U.S. have access to 211 across every state and Puerto Rico. Spend a day with specialists who field 211 calls for a solutions-based journalism story. Why do 211 specialists do this work? What are their personal stories? How does the process of connecting people in need with available resources play out? What do these specialists need to do their jobs better? The United Way operates 211 in New Jersey and Pennsylvania.

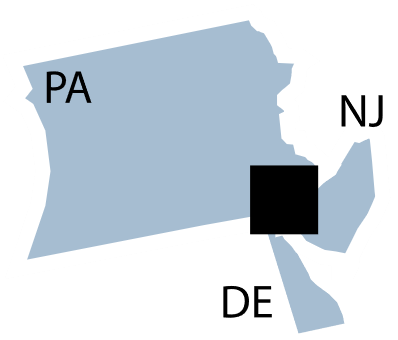

District 3 covers most of Pennsylvania, southern New Jersey and Delaware.

District 4, Cleveland

Food pantries in crisis

Business owners in District 4 were cautiously optimistic about their prospects over the rest of the year and many saw less of a chance than in the first half of the year that the U.S. would fall into a recession.

Consumer spending overall was strong, though one “large general merchandiser” said the reduction of pandemic-related Supplemental Nutrition Assistance Program benefits was constraining household budgets. Some firms paused expansion projects, except those subsidized with government funds, according to one banker.

Story idea: Since March, the number of families needing help with food increased 35%, according to contacts at District 4 community organizations. One contact at a food pantry said, “‘people are experiencing food insecurity more now than I have seen in my seven years with the organization.’” Are local government officials aware of this increase? If so, what are they doing to help constituents get enough food on their tables?

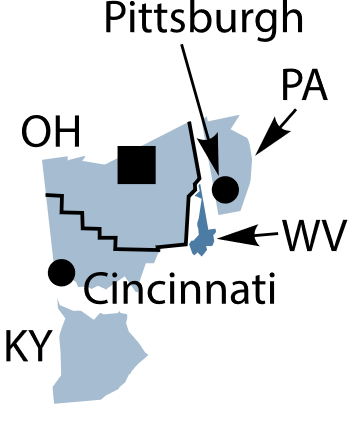

District 4 covers Ohio, eastern Kentucky, western Pennsylvania and northern West Virginia.

District 5, Richmond

Toothaches in dental care

Worker availability varied across District 5. One software company had an easier time hiring IT workers, but a tour bus company couldn’t find enough drivers and mechanics. Some businesses increased prices because of the rising cost of capital, driven by recent Federal Reserve interest rate hikes, while other firms said they could not pass along the full costs of capital to consumers, lowering their profit margins.

In residential real estate, some buyers were faced with bank appraisals not meeting the sales price, meaning they had to renegotiate with the sellers to a lower price, pay the difference in cash, or walk away from the purchase.

Story idea: A line from the District 5 report stands out: “A dental laboratory reported not meeting their numbers for the past six months due to a significant slowdown in the dental market.” Are District 5 residents seeking less dental care for some reason? Are they foregoing more expensive treatments, such as bridges and dentures, which labs usually fulfill? See what your dentist has to say and if they can put you in touch with others in the dental care field to find out what’s going on.

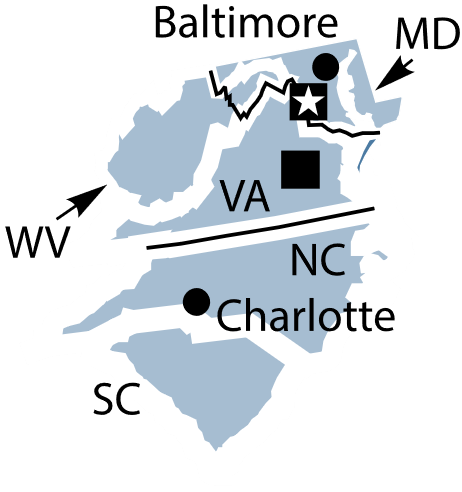

District 5 covers Virginia, Maryland, the Carolinas, most of West Virginia and the District of Columbia.

District 6, Atlanta

A glut of cheese

A downturn in domestic tourism was offset by business and international travel to District 6. Beach resorts dealt with falling occupancy while “those hoteliers reported some diminished pricing power,” meaning they had less ability to set room rates at higher levels while maintaining demand.

Rail freighters saw “significant” declines in year-over-year volumes while shipping ports likewise reported slowdowns in container traffic, “owing to inventory destocking by retailers and weaker global demand.”

The citrus market had low crop yields and weak profits, but cattle farms saw strong sales “as demand for beef remained high amid low supply.”

Story idea: Demand for milk fell due to “oversupplies of cheese.” What happened to make cheese producers supply too much cheese? This could be an interesting case study and explainer on how business inventories work — firms have imperfect information to predict their economic futures. Sometimes they stock up, anticipating higher demand, but that demand does not materialize. These decisions often have consequences that spill over and affect other firms, such as milk producers in this case.

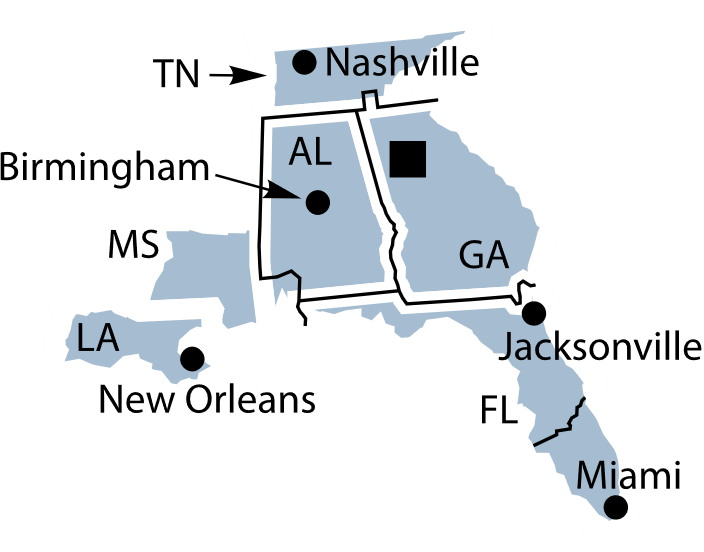

District 6 covers Alabama, Florida, Georgia, eastern Tennessee, southern Louisiana and southern Mississippi.

District 7, Chicago

Community development capital crunch

Amusement parks and tourist attractions saw an uptick in activity, with contacts in those industries reporting consumers in general unlikely to give up their leisure plans, instead cutting back elsewhere in their nonessential spending, if needed.

Some retail contacts reported having a bit too much product in stock, particularly those selling apparel, beauty items, and sports and outdoor goods. In residential real estate, cash deals were increasingly common as high interest rates reduced the number of buyers, one contact in Iowa said. Drought put farm crops behind schedule, especially corn, but it was “too soon to panic,” according to one agricultural contact.

Story idea: Here is a story on how the high cost of borrowing money is keeping neighborhoods from flourishing: Community Development Finance Institutions in District 7 report having trouble providing affordable loans to low- and moderate-income small businesses and homebuyers. CDFIs are usually banks or credit unions that focus on providing capital to low-income communities. Reach out to CDFI officers to find out what’s happening on the ground and whether they can put you in touch with clients to interview.

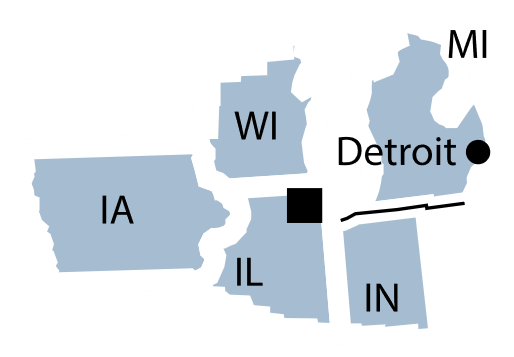

District 7 includes Iowa, most of Indiana, northern Illinois, southern and central Michigan and southern Wisconsin.

District 8, St. Louis

Bicycle boom in Little Rock

Across industries, labor costs were up and certain businesses that work on tight margins, such as supermarkets, couldn’t fully pass those costs onto customers. One grocery store contact “reported that they would pass about 25%-33% of higher costs to consumers.”

In Arkansas, one retailer reaped smaller profit margins as consumers focused on essential groceries rather than merchandise with higher margins. Also in Arkansas, a boat seller saw higher demand for low- and high-end boats while “sales for middle-market boats” had “collapsed.” In Memphis, “a major [electronic vehicle] manufacturing project” has meant more business for real estate and construction firms in the area.

Story idea: Has your news outlet covered the bicycle boom happening in Little Rock, Arkansas? “The Little Rock bicycling industry has seen significant growth in recent quarters, generating more than $150 million in total economic impact from jobs to tourism to taxes.” Interview local bike shop owners and see if their sales mirror overall growth. Why are people in the region taking up bicycling? Are recent infrastructure improvements part of the reason for this boom? Is there more growth in road biking than mountain biking? Is this industry also attracting dollars from outside the region?

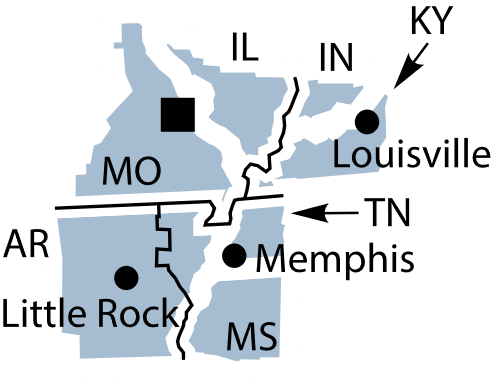

District 8 includes Arkansas, southern Illinois, southern Indiana, western Kentucky, northern Mississippi, central and eastern Missouri and western Tennessee.

District 9, Minneapolis

New kind of company town

While some firms have handed down layoffs in Minneapolis, most workers who lose their jobs “‘are doing OK finding new jobs on their own,’” said one contact in workforce development. Some professionals in the area were thinking of moving out of state for a time to take advantage of remote work policies.

Vacancy rates in downtown Minneapolis remained high. Two office towers there recently sold “at steep discounts.” Heavy equipment sales were down in District 9, with “more customers choosing to repair rather than replace equipment due to higher financing costs.”

Story idea: Here is something you don’t hear every day: “A restaurant in central Minnesota reported that it bought an apartment building to provide workers with nearby housing.” Whether this is a trend or one-off project, the details could be fascinating — it’s reminiscent of the company towns built during the Industrial Revolution. Unfortunately, “central Minnesota” is a large area, so it would take some digging through property records to find the restaurant. Analysts working at District 9 might be willing to provide more geographic precision.

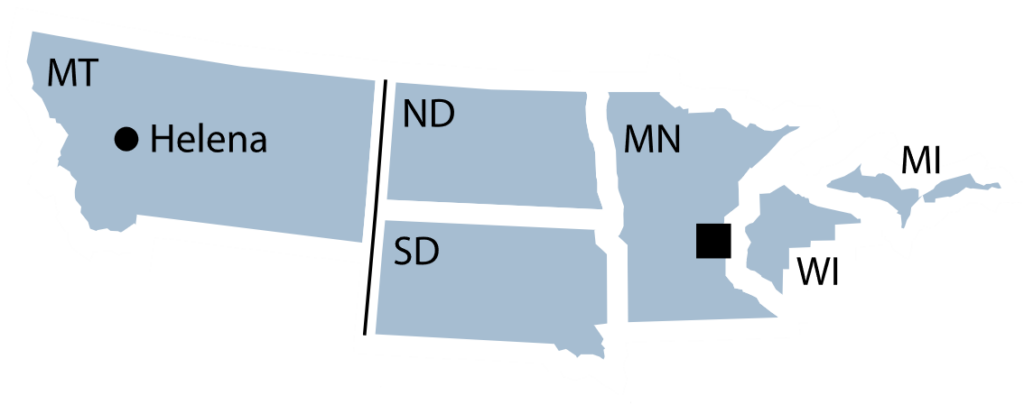

District 9 includes Minnesota, Montana, the Dakotas, Michigan’s Upper Peninsula and northern Wisconsin.

District 10, Kansas City

Small business credit woes

Firms in District 10 are generally not expecting to lay off workers, but some are reducing or pausing hiring. Manufacturers in particular slowed their production, with some expecting business conditions to “soften in the coming months, noting continued weakening in order back logs and a further deterioration in demand.”

Drought reduced grass and feed available for cattle producers, while 15% of corn and soybean acres and 30% of winter wheat acres “were in poor or very poor condition” across District 10. The energy sector saw a large decline in the number of active rigs, “as weak oil and gas prices continued to squeeze profitability.”

Story idea: Several small business contacts reported having missed credit card payments or paying only the minimum due, “which has negatively impacted their credit reports.” Some have even turned to online lenders and other non-traditional financial institutions that usually offer loans with less-than-favorable interest rates. Find out whether this trend holds true for local businesses in your coverage area — and whether it portends coming small business closures.

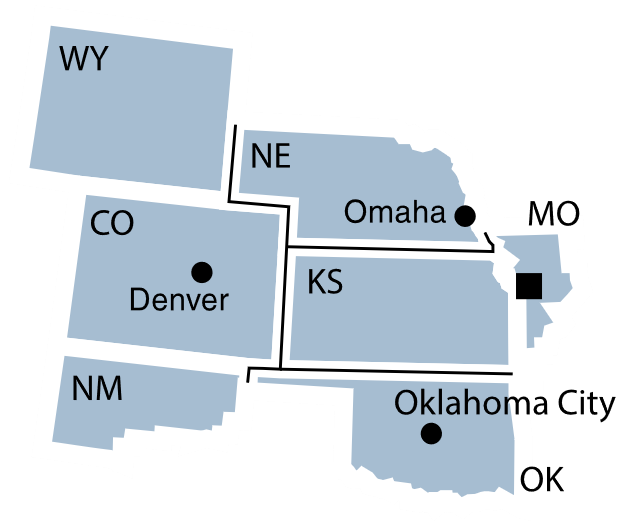

District 10 includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico.

District 11, Dallas

More than meets the eye

There was steady hiring in the service sector, but job growth “slowed to a crawl” in manufacturing. Bankers are “pessimistic,” with an eye toward business activity declining during the rest of the year and “an increase in nonperforming loans,” where borrowers miss payments for several consecutive months.

A survey the Federal Reserve Bank of Dallas conducted in June of more than 350 business executives found 44% were understaffed and wanting to hire, while 12% were understaffed but not expecting to hire. Retail sales were down for clothing stores and stores that sell food and beverages, while sales were up at pharmacies, building material retailers and garden supply stores.

Story idea: Houses are being built on time, by and large, but some sites are being slowed by a shortage of transformers. These are devices that may be used, for example, to convert power from a large generator into power that can be used for handheld tools. Here is a chance to localize an international story. Transformers are made using copper wire, and there is a global copper shortage expected to last for the rest of the decade.

District 11 includes Texas, northern Louisiana and southern New Mexico.

District 12, San Francisco

A clogged arts pipeline?

While tourism kept retail sales strong in Utah and Hawaii, in other parts of District 12 consumers increasingly turned to low-cost goods as state-level fiscal stimulus measures ended. Leasing for office space in downtown districts was hurt by slow sales at physical retail locations as well as “safety concerns,” according to one contact in Northern California.

“Expanded ocean freight capacity” meant more exports from District 12 to overseas buyers, “but lingering backlogs, the war in Ukraine, and a strong dollar limited access to some international markets.” In one example of the push and pull of forces inside and outside of markets, agriculture production got more costly because of higher labor and insurance costs, but more rain than usual “somewhat offset irrigation costs.”

Story idea: Striking TV and movie workers attract national headlines, but art institutions face “significant headwinds due to smaller audiences and declining donations.” The economy has been surprisingly resilient during this high inflationary period, meaning there should still be art patrons. Could a lack of arts education in schools be behind shrinking audiences for the arts? Many people learn about the arts in their elementary, secondary and high school curricula. The California Arts Education Data Project, part of a nonprofit that advocates for more arts education in the state, has information and analysis to get you started on this story. There is also academic research on the topic — for example, nationally, public charter high schools are least likely to offer arts education courses, finds a 2020 paper published in the Arts Education Policy Review.

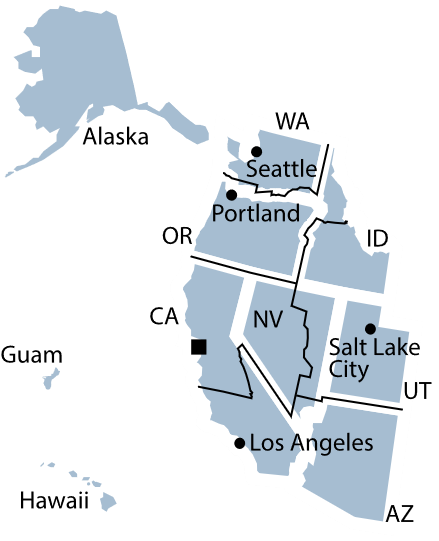

District 12 includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, Washington, American Samoa, Guam and the Northern Mariana Islands.

Expert Commentary