In 1996, Congress undertook a study of the country’s gambling industry via the National Gambling Impact Study Commission Act of 1996. The final report, released in 1999, recommended curtailment of certain gaming activities in the U.S. It also called for more research related to the mental health and social effects of gambling. Congress’ findings came amidst widespread debate on the positive and negative social and economic impacts of casinos across the country. In the last few decades, however, the gambling industry has gained importance as local and state governments have increasingly looked for new sources of revenue. Proponents of the industry claim these businesses will enhance local government revenues via casino fees and taxes. In addition, this industry is also seen as a way to improve employment and draw in dollars that would otherwise not be spent locally. However, there is little academic research on how the opening and operation of casinos impacts the fiscal well-being of counties and states. And, it is also unclear how the industry affects local government spending in areas such as policing, road enhancement and maintenance, and other public works and services.

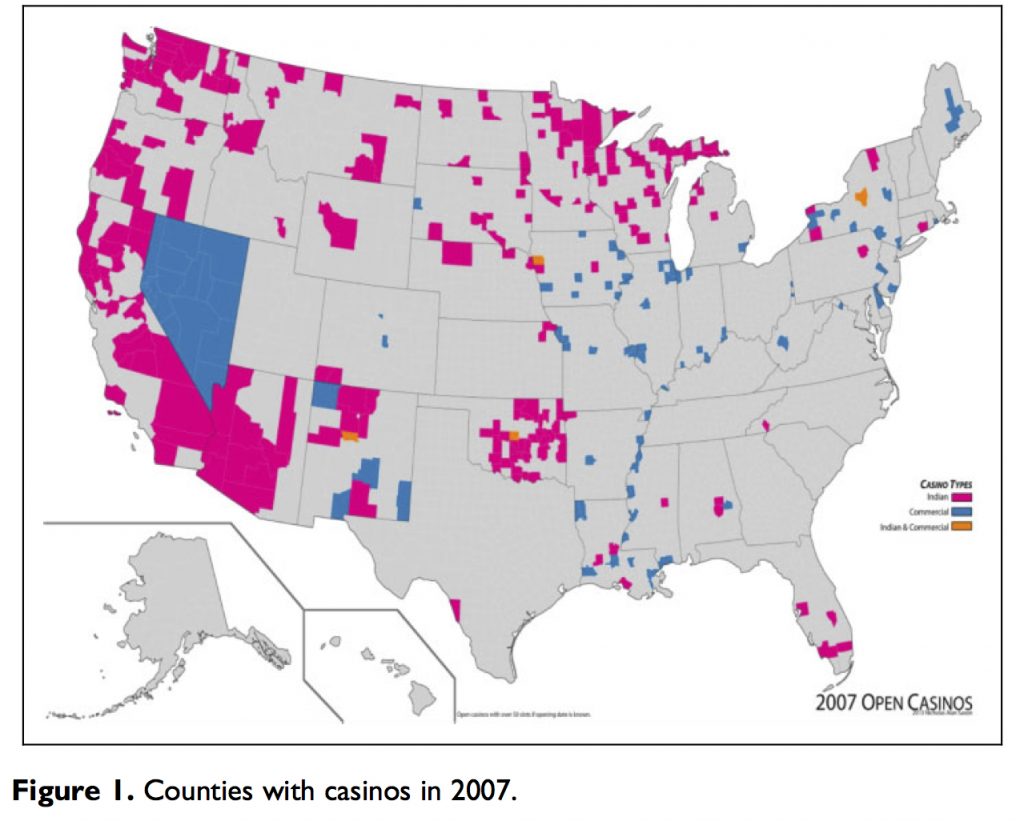

The 2015 study, “Fiscal Impacts of Legalized Casino Gambling,” from researchers at the University of Nevada, Reno, examines the impacts that legalizing gambling has on local and state government expenditures and revenues, including sales tax revenues and educational spending before and after legalized gambling. The research team looked at all U.S. county data from 1987 to 2007. As the authors explain, these years are important because the number of states that legalized gambling at this time increased from 2 to 33.

Key findings include:

- For all counties, when a commercial casino is opened, the county showed an increase of 7.8 percent in per-capita revenues and 8.1 percent increase in per-capita expenditures. However, for all counties with Indian casinos, the opening of Indian casinos, led to a decrease in per-capita county revenue by 3.6 percent and a decrease of 4.6 percent in per-capita county expenditure.

- Casino counties had significantly lower per capita sales tax revenues irrespective of the presence of casinos. Casino openings in those same counties had no significant association with county sales tax revenues.

- Casino counties showed a decrease in per-capita education expenditures by 6 percent when Indian casinos were opened in these counties. There is, however, no statistically significant impact on education expenditures when commercial casinos are opened in casino counties.

The researchers did not find that opening casinos improved the fiscal condition of the counties. However, when a positive effect of commercial casinos was found, it was primarily through revenue sharing legislation. In these cases, local laws mandated states to share revenues from casino taxes with counties. For these states, the opening of casinos increased the sales tax revenues by more than 75 percent and increased revenues and expenditures by more than 11 percent and 12 percent respectively. The authors found that “Whether the increase in county expenditures is due to the social impacts of casinos and increased demand for public services or simply governments spending their additional revenue cannot be determined with our data but is a subject worthy of further exploration.”

Related research: A 2015 study in Journal of Policy Modeling looks at how tax rates in a given state affects the decisions of casinos relative to the numbers of people they employ.

Keywords: Casino gambling, Indian casinos, local government, casino tax, fiscal impact, Native American casinos

Expert Commentary