The “American dream” may or may not be a single-family home in the suburbs, but the American reality is looking more and more like a multifamily rental property.

The Joint Center for Housing Studies of Harvard University (JCHS) publishes its “State of the Nation’s Housing” reports annually, and the 2015 edition reveals that housing in the United States continues to evolve in the wake of the housing bust, the slow economic recovery, and the demographic changes in the country’s population.

Overall, the report found that the housing recovery has stalled somewhat, with homeownership rates continuing to drop. Single-family construction is up slightly, but remains at historically low levels. By contrast, rental markets have grown substantially, and the construction of multifamily units has risen. Despite this, the demand for rental properties continues to outpace supply, leading to rising rents and greater burdens on those with the lowest incomes.

The report offers considerable levels of detail on those who own and rent, their ages and incomes, and the continuing evolution of rents, sales and construction in the United States. The JCHS has also made tables with more detailed figures available in Excel format and created an online data explorer.

The study’s key findings on homeownership include:

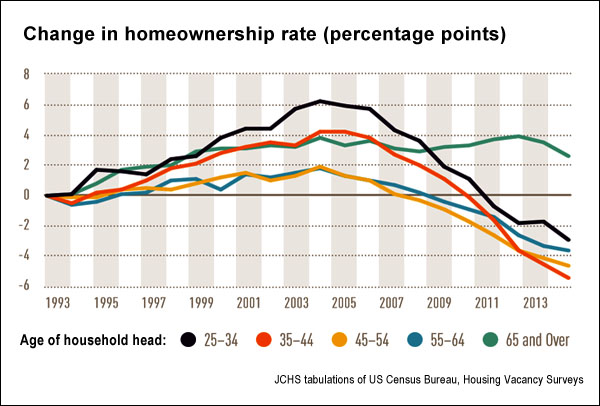

- Homeownership rates continued to fall since the last report, and are now at 20-year lows: Just 63.5% of U.S. houses owned last year, after peaking at 69% in 2004. They are now comparable to levels last seen in 1993.

- The homeownership rate for minorities continues to lag: It peaked at 51.3% in 2004, and has now fallen to 47.2%. Of all minority groups, African Americans have the lowest rate of homeownership, just 43.8%.

- The overall decline observed would have been much greater without the inclusion of those aged 50 to 65 (76.3% ownership) and over 65 (79.9%). “In sharp contrast, it was generation X (also known as the baby bust, born 1965–84) that took most of the hit from the housing bust.”

- A key factor in the decline in homeownership is the “steady erosion” of household incomes since the recession began.

- Restricted access to financing has also kept people away from the housing market: For those with credit scores between 660 and 720, home-purchase loans decreased 37%, while the decrease for those with higher scores was just 9%.

Home sales:

- New-property sales rose just 2% over last year, a sharp drop from the 17% increase over the previous period. The current number, 437,000 units, is 30% below historical averages in the 1970s, ’80s, and ’90s.

- Existing home sales dropped 2.9% from 2013 to 2014, to 4.9 million units. However, there were more traditional sales and fewer distress-related sales — 10% fewer cash sales and 15% fewer bank-owned properties.

- While prices have climbed slightly, 15 million U.S. homeowners have 20% or less equity in their houses, effectively locking them into their current properties.

- Distressed households tend to be concentrated geographically: In 10% of the nation’s zip codes, prices are more than 35% below their peak values prior to the housing bust. In such neighborhoods, up to 26% of the homeowners’ properties are underwater.

Rentals:

- As reported in the 2014 JCHS report, the U.S. rental market is booming, with 770,000 additional rental households added yearly since 2004.

- The age distribution of renters doesn’t always fit stereotypes: “While soaring demand is often attributed to the millennials’ preference to rent, households aged 45–64 in fact accounted for about twice the share of renter growth than households under the age of 35. Similarly, households in the top half of the income distribution, although generally more likely to own, contributed 43 percent of the growth in renters.”

- Single-family detached homes are increasingly being rented out to meet demand: The number of such properties in the rental market rose 3.2 million between 2004 and 2013.

- While the supply of rental housing is on the rise, it is being outpaced by demand. The result is both a lower vacancy rate — 7.6%, the lowest in nearly 20 years — and rising rents. The average rent climbed 3.2% over the last year, twice as fast as the average rate of inflation.

- Vacancy rates were even lower at professionally managed complexes, 4.6%, and rent increases were higher, 3.8%.

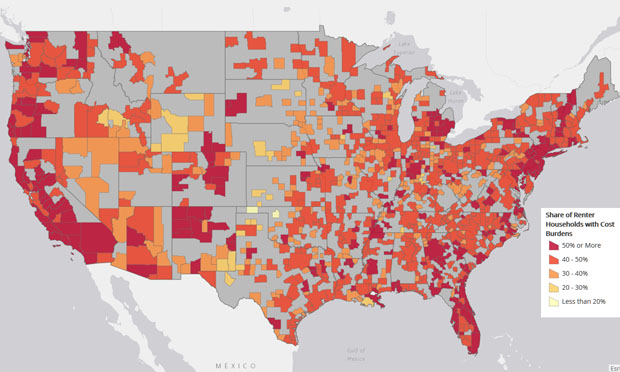

- The percentage of renters who are cost-burdened — paying more than 30% of their income for rent — has continued to rise. For households with incomes between $30,000 and $45,000, the rate is 45%, up 7 percentage points over the last decade. Approximately 20% of renters earning between $45,000 and $75,000 were cost burdened, up 6 percentage points over the last decade.

- In hot housing markets such as San Francisco, Los Angeles, New York and Boston, the rates of cost-burdened renters are even higher — up to 75% for those earning $30,000 to $45,000 and just under 50% for those with incomes of $45,000 to $75,000.

Construction:

- Single-family construction has been lagging in tandem with the weak home-ownership market: Starts rose only 5% over the last year, to just over 1 million units. While this constitutes a slight increase over the 2013 figure of 925,000, “until the recent downturn, this would have been the lowest total in the past half-century.”

- Construction of multifamily properties continues to grow strongly, up 16% in 2014 — and this was on top of the 25% rise over 2013. In all, “more multifamily units were started in 2014 than in any year since 1989.”

The authors find that the U.S. housing market is continuing to recover, but continued employment and income growth is central to that trend. Also essential is an increase in the supply of affordable housing, something that will require a “firm recommitment,” the report’s authors note, on the part of the federal government, states and municipalities.

Related research: A 2013 report from the Joint Center for Housing Studies of Harvard University, “America’s Rental Housing: Evolving Markets and Needs,” examines the demographics of those who rent, the housing stock and its condition, construction trends and public-policy challenges now and in the future. The authors note that, while renting can have many advantages over buying, the surge in demand, rising rents, and falling incomes have caused an increasing number of households to pay a crushing share of their income for housing.

Keywords: housing, rentals, homeownership, housing crash, financial crisis, consumer affairs, local reporting

Expert Commentary