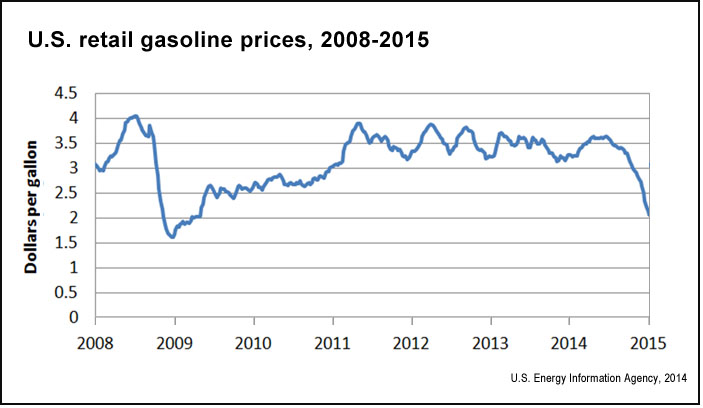

At the beginning of 2015 the average price of a gallon of gasoline in the United States stood at about $2.20, approximately $1.10 less than it had been a year earlier. In markets such as the Gulf Coast and the Midwest, it had fallen below $2 a gallon.

This sharp decline and the corresponding swoon in the price for a barrel of oil have tremendous global economic implications. However, its exact causes have been the subject of some puzzlement and confusion, as the timing does not have as obvious an explanation as previous collapses in price. For example, a gallon of gas dropped below $2 last in early 2009, as the Great Recession froze economic activity across the world and demand for oil plummeted.

The mainstream explanation for the price decline is that a surplus of oil is being produced around the world, with new sources coming on line. In addition, some markets are seeing more energy-efficient cars that require less gas, and the number of vehicle-miles traveled per capita has fallen in the United States. And OPEC — the cartel of many Middle Eastern, African and South American oil producers — so far has not decided to curb production.

The U.S. Energy Information Agency stated in mid-January 2015 that it “expects global oil inventories to continue to build in 2015, keeping downward pressure on oil prices.” The agency estimates that the average U.S. household will spend $750 less for gasoline this year, compared to 2014.

While there are clear cost savings for American drivers, the situation is likely to put pressure on the country’s thriving shale oil market — part of the recent U.S. “energy boom.” As The Economist explains in its December 2014 report, “The New Economics of Oil: Sheikhs vs. Shale,” U.S. fracking and energy firms could eventually see investment dry up in the short-term if oil prices remains this low. And lower prices for fossil fuels may well postpone the hard decisions needed for the country to transition to a more energy-efficient economy and to help reduce greenhouse-gas emissions and mitigate climate change.

Because gas prices play such an omnipresent role in contemporary society, their fluctuations have been the subject of enormous academic study, across many facets of life and economic measures — from public health and driving behavior to business economics and public policy. The following is a representative sample of research:

_______

Health

“Is There an Association Between Gasoline Prices and Physical Activity? Evidence from American Time-Use Data”

Bisakha Sen. Journal of Policy Analysis and Management, 2012, Vol. 31, No. 2, 338-366. doi: 10.1002/pam.21601.

Excerpt: “The findings from this study indicate that higher gasoline prices are associated with increased participation in and increased time spent on certain physical activities. Hence, they lend conditional support to the hypothesis that increasing gasoline prices may reduce certain [obesity-causing] behaviors. The results indicate that higher gasoline prices are associated with an increase in both participation in and time spent on overall moderately energy intense physical activity. Specifically, while higher gasoline prices show some associations with increases in recreational walking, bicycling and running, and in walking and bicycling to errands, the category of activity that show the strongest increases when gasoline prices increase is at least moderately energy intensive housework. This suggests that the main effect of gasoline prices on physical activity may not operate as much through substituting away from motorized transportation because it is now more expensive, but apparently operate more via the income effect — that is, the extra expenses on gasoline constrains the family budget and may lead families to cut back on certain other expenses such as hired help for household chores, repairs or yardwork.”

“A Silver Lining? The Connection between Gasoline Prices and Obesity”

Charles Courtemanchee. Economic Inquiry, Vol. 49, No. 3, July 2011, 935-957. doi: 10.1111/j.1465-7295.2009.00266.x.

Abstract: “I find evidence of a negative association between gasoline prices and body weight using a fixed effects model with several robustness checks. I also show that increases in gas prices are associated with additional walking and a reduction in the frequency with which people eat at restaurants, explaining their effect on weight. My estimates imply that 8% of the rise in obesity between 1979 and 2004 can be attributed to the concurrent drop in real gas prices, and that a permanent $1 increase in gasoline prices would reduce overweight and obesity in the United States by 7% and 10%.”

“Longitudinal Trends in Gasoline Price and Physical Activity: The CARDIA Study”

Ningqi Hou; Barry M. Popkin; David R. Jacobs, Jr.; Yan Song; David K. Guilkey; Ka He; Cora E. Lewis; Penny Gordon-Larsen. Preventive Medicine, 2011, Vol. 52, 365-369. doi: 10.1016/j.ypmed.2011.02.007.

Excerpt: “The CARDIA study enrolled 5115 black and white young adults from four U.S. metropolitan areas (Birmingham, AL; Chicago, IL; Minneapolis, MN; Oakland, CA), at baseline 1985-86 and followed over time 1992-1993 (year 7), 1995-1996 (year 10) and 2000-2001 (year 15)…. We observed a positive longitudinal association between gasoline price and total PA [physical activity.] Essentially, a 25-cent increase in inflation-adjusted gasoline price was associated with 9.9 EU [exercise unit] increase in total PA (p=0.03). For example, since 144 EU represents regular walking at ≥4 hours/week (≥240 minutes/week), 9.9 EU translates to about 7% of 144 EU or 240 minutes × 7% = 17 minutes walking per week, a substantial population-level impact. We also observed some evidence of substitution of home-based physical activity (e.g., jogging, walking and non-strenuous sports) as opposed to physical activities that require driving to a particular location (e.g., bowling and racket sports).”

“Pain at the Pump: Gasoline Prices and Subjective Well-being”

Casey Boyd-Swan; Chris M. Herbst. Journal of Urban Economics, 2012, Vol. 72, 160-175. doi: 10.1016/j.jue.2012.05.002.

Abstract: “In recent years, there has been growing interest in the health implications of rising gasoline prices. This paper considers the impact of gasoline prices on subjective well-being, as captured by survey questions on happiness and life satisfaction. Using rich data from the DDB Worldwide Communications Life Style survey, we document a negative relationship between gasoline prices and self-reported life satisfaction over the period 1985-2005. The estimated reduction in well-being, moreover, is found to be nearly twice as large among groups of likely car owners. Interestingly, although rising gasoline prices lead to an immediate deterioration in subjective well-being, analyses of lagged prices suggest that well-being almost fully rebounds one year later and changes very little each year thereafter. Our contemporaneous estimates imply that rising gasoline prices generate well-being losses comparable to faltering labor market conditions, and likely offset some of the physical health benefits found in previous research.”

Driving behavior

“Gasoline Prices and Their Relationship to Drunk-driving Crashes”

Guangqing Chi, Xuan Zhou, Timothy E. McClure, Paul A. Gilbert, Arthur G. Cosby, Li Zhang, Angela A. Robertson, David Levinson. Accident Analysis and Prevention, 2011, Vol. 43, 194-203. doi: 10.1016/j.aap.2010.08.009.

Abstract: “We examine the effects of gasoline prices on drunk-driving crashes in Mississippi by several crash types and demographic groups at the monthly level from 2004 to 2008, a period experiencing great fluctuation in gasoline prices. An exploratory visualization by graphs shows that higher gasoline prices are generally associated with fewer drunk-driving crashes. Higher gasoline prices depress drunk-driving crashes among young and adult drivers, among male and female drivers, and among white and black drivers. Results from negative binomial regression models show that when gas prices are higher, there are fewer drunk-driving crashes, particularly among property-damage-only crashes. When alcohol consumption levels are higher, there are more drunk-driving crashes, particularly fatal and injury crashes. The effects of gasoline prices and alcohol consumption are stronger on drunk-driving crashes than on all crashes. The findings do not vary much across different demographic groups. Overall, gasoline prices have greater effects on less severe crashes and alcohol consumption has greater effects on more severe crashes.”

“Gasoline Prices and Road Fatalities: International Evidence”

Paul J. Burke; Shuhei Nishitateno. Economic Inquiry, 2014. doi: 10.1111/ecin.12171.

Abstract: “This study utilizes data for 144 countries from 1991 to 2010 to present the first international estimates of the gasoline price elasticity of road fatalities. We instrument each country’s gasoline price with that country’s oil reserves and the yearly international crude oil price to address potential endogeneity concerns. Our findings suggest that the average reduction in road fatalities resulting from a 10% increase in the gasoline pump price is in the order of 3% to 6%. Around 35,000 road deaths per year could be avoided by the removal of global fuel subsidies.”

“Value of Time: Speeding Behavior and Gasoline Prices”

Hendrik Wolff. Journal of Environmental Economics and Management, 2014, Vol. 67, 71-88. doi: 10.1016/j.jeem.2013.11.002.

Abstract: “This paper presents an alternative methodology of deriving the VOT parameter and provides an opportunity to cross check empirical results from previous discrete choice settings. Our research design exploits the variation in gasoline prices and relies on the re-optimization of a motorist cost function varying her continuous choice of how fast to drive on an uncongested highway. We find that speeds modestly reduce by 0.27 mph for a $1 increase of the price of gas per gallon. In calculating the corresponding VOT from the first order condition, we show that second order effects regarding traffic safety and the probability of obtaining a traffic ticket are important to obtain an unbiased estimate. Summarizing, we find a VOT around 50% of the gross wage rate.”

Business economics

“Automakers’ Short-run Responses to Changing Gasoline Prices”

Ashley Langer, Nathan H. Miller. Review of Economics and Statistics, October 2013, 95(4): 1198-1211.

Abstract: “We provide empirical evidence that automobile manufacturers use cash incentives to offset how gasoline price fluctuations affect the expected fuel expenses of automobile buyers. Regressions based on a database of incentives over 2003 to 2006 suggest that on average, manufacturers offset 40% of the change in relative fuel costs between vehicles due to gasoline price fluctuations. The results highlight that carbon taxes and emissions trading programs likely would generate substantial substitution within vehicle classes, and studies that ignore manufacturer discounting likely underestimate consumer demand for fuel economy. The results also have implications for the optimal design of feebate programs.”

“Who Is Exposed to Gas Prices? How Gasoline Prices Affect Automobile Manufacturers and Dealerships”

Meghan R. Busse, Christopher R. Knittel, Florian Zettelmeyer. NBER working paper no. 18610, December 2012.

Abstract: “Many consumers are keenly aware of gasoline prices, and consumer responses to gasoline prices have been well studied. In this paper, by contrast, we investigate how gasoline prices affect the automobile industry: manufacturers and dealerships. We estimate how changes in gasoline prices affect equilibrium prices and sales of both new and used vehicles of different fuel economies. We investigate the implications of these effects for individual auto manufacturers, taking into account differences in manufacturers’ vehicle portfolios. We also investigate effects on manufacturers’ affiliated dealership networks, including effects implied by the changes in used vehicle market outcomes.”

“An Empirical Investigation of the Impact of Gasoline Prices on Grocery Shopping Behavior”

Yu Ma, Kusum L. Ailawadi, Dinesh K. Gauri, Dhruv Grewal. Journal of Marketing, March 2011, Vol. 75, 18 -35.

Abstract: “The authors empirically examine the effect of gas prices on grocery shopping behavior using Information Resources Inc. panel data from 2006 to 2008, which track panelists’ purchases of almost 300 product categories across multiple retail formats. The authors quantify the impact on consumers’ total spending and examine the potential avenues for savings when consumers shift from one retail format to another, from national brands to private labels, from regular-priced to promotional products, and from higher to lower price tiers. They find a substantial negative effect on shopping frequency and purchase volume and shifts away from grocery and toward super-center formats. A greater shift occurs from regular-priced national brands to promoted ones than to private labels, and among national brand purchasers, bottom-tier brands lose share, mid-tier brands gain share, and top-tier brand share is relatively unaffected. The analysis also controls for general economic conditions and shows that gas prices have a much larger impact on grocery shopping behavior than broad economic factors.”

Policy and energy

“Gasoline Prices, Fuel Economy and the Energy Paradox”

Hunt Allcott and Nathan Wozny. Review of Economics and Statistics, December 2014, 96(5): 779-795. doi: 10.1162/REST_a_00419.

Abstract: “Policymakers often assert that consumers undervalue future gasoline costs when they buy automobiles. We test this by measuring whether relative prices of vehicles with different fuel economy ratings fully adjust to variation in gasoline prices. Vehicle prices move as if consumers are indifferent between $1.00 in discounted future gas cost and $0.76 in vehicle purchase price. We show how corrections for endogenous market shares and utilization, measurement error and different gasoline price forecasts affect the results. We also provide unique evidence of sticky information: vehicle markets respond to changes in gasoline prices with up to a six-month delay.”

“Gasoline Prices, Gasoline Consumption and New-vehicle Fuel Economy: Evidence for a Large Sample of Countries”

Paul J. Burke, Shuhei Nishitateno. Energy Economics, 2013, Vol. 36, 363-370. doi: 10.1016/j.eneco.2012.09.008.

Abstract: “Countries differ considerably in terms of the price drivers pay for gasoline. This paper uses data for 132 countries for the period 1995-2008 to investigate the implications of these differences for the consumption of gasoline for road transport. To address the potential for simultaneity bias, we use both a country’s oil reserves and the international crude oil price as instruments for a country’s average gasoline pump price. We obtain estimates of the long-run price elasticity of gasoline demand of between −0.2 and −0.5. Using newly available data for a sub-sample of 43 countries, we also find that higher gasoline prices induce consumers to substitute to vehicles that are more fuel-efficient, with an estimated elasticity of+0.2. Despite the small size of our elasticity estimates, there is considerable scope for low-price countries to achieve gasoline savings and vehicle fuel economy improvements via reducing gasoline subsidies and/or increasing gasoline taxes.”

“A Volatile Relationship: The Effect of Changing Gasoline Prices on Public Support for Mass Transit”

Michael J. Smart. Transportation Research, 2014, Vol. 61, 178-185. doi: 10.1016/j.tra.2014.01.011.

Abstract: “The determinants of public opinion toward public transit is a little-researched topic, though a better understanding of what makes consumers willing to support transit may reveal which attributes of transit consumers value most. One determinant of people’s willingness to support investments in mass transit may be the price of fuel for transit’s principal competition, the private automobile. In this paper, I examine the relationship between the cost of gasoline and stated willingness to invest public money in mass transit improvements. I hypothesize that fuel price volatility — in addition to price itself — is a determinant of support for more mass transit funding, controlling for other factors. As the price of gasoline becomes more uncertain, the public should, all else equal, support investment in mass transportation, a form of transportation that may provide some measure of protection from the price of fuel. Results suggest a strong effect of price volatility on consumers’ willingness to support transit expenditures.”

“A Time-series Analysis of Gasoline Prices and Public Transportation in U.S. Metropolitan Areas”

Bradley W. Lane. Journal of Transport Geography, 2012, Vol. 22, 221-235. doi: 10.1016/j.jtrangeo.2011.10.006.

Abstract: “This research examines the temporal aspects of the relationship between public transportation and gasoline prices in U.S. cities from January 2002 through March of 2009. Data are collected at monthly intervals for transit ridership, service, gasoline price and price variability for 33 metropolitan areas. These data are analyzed using time-series regression to estimate the presence of lagged effects of price and service on transit patronage. The results indicate a small but consistently significant amount of transit ridership fluctuation is due to gasoline prices. Repeated lags of gasoline prices of up to 13 months are influential on ridership. Every 10% increase in gasoline prices can lead to ridership increases of up to 4% per significant lag for bus and 8% for rail. There is considerable variability across cities in the magnitude of the effect on transit ridership, the impact by mode and temporal variability. The results are discussed in light of their implications for transit operations, using cost to influence travel behavior, and transportation sustainability.”

Keywords: greenhouse gases, global warming, driving, cars, obesity, research roundup, consumer affairs, fossil fuels, economy

Expert Commentary