Given the revolutionary history of the United States, the term “taxpayer revolt” has a lot of appeal. One of the best-known examples is the 1978 ballot initiative that led to the passage of California Proposition 13. Among other changes, the law capped state property-tax increases at 2% per year and 1% of value and required a two-thirds majority in both legislative houses for state tax increases. While California had long been known for budget gridlock, one of the act’s unintended consequences was a significant increase in budget volatility as the state shifted to less-reliable sources of funding.

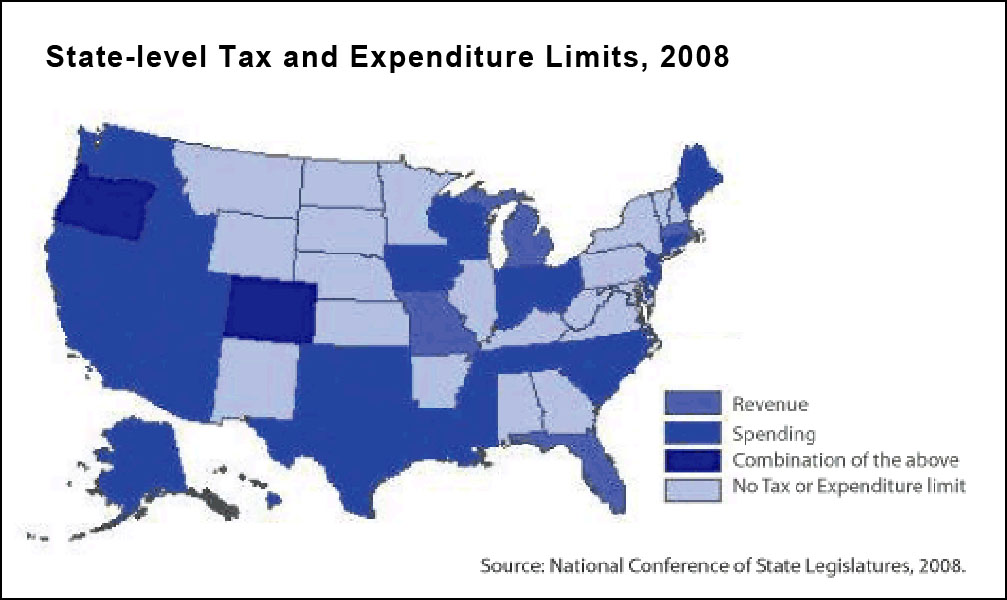

Since 1978, laws that mandate tax and expenditure limits, known as TELs, have been enacted in more than 40 states. While they differ in their details, the goal is generally to limit taxes by indexing them to external metrics such as inflation, population or income. Some laws include the possibility of voter overrides, like Massachusetts’s Proposition 2-1/2, others do not. All have had significant impact on how state budgets are built and the level of expenditures. The following Brookings Institution chart shows the variation in laws:

Because the U.S. now has more than 30 years of experience with measures limiting taxes and expenditures, they have been the subject of considerable research. The results have not been entirely positive: A 2012 study from the University of Wisconsin and the University of Missouri found that more-restrictive TELs dampened economic growth. Research from Syracuse and the University of Colorado indicated that some types of TELs can increase tax revenues. The conservative American Enterprise Institute found that, overall, such laws didn’t achieve their stated goal of limiting government expenditures.

A 2013 study in Public Works Management Policy, “Do Tax and Expenditure Limits Hinder the Condition of Public Infrastructure? The Case of the Nation’s System of Bridges,” looks at the relationship between states with TELs and the condition of their highway bridges. This is more than just a question of a smooth commute: U.S. roads, rails and airports regularly get failing grades, yet infrastructure investments have been found to have a positive relationship with economic growth.

The scholars, at the University of Wisconsin, the University of Missouri, and Northern Illinois University, based their work on panel data of all 50 states from 1992 to 2009. Given the diversity of TELs in the United States and their shifting nature, the study specifically worked to see if the imposition on state governments of more-restrictive TELs led to a deterioration of transportation infrastructure. Its findings include:

- While TELs are intended to force state governments to show fiscal restraint, the result is an under-investment in our nation’s bridges. This “suggests that one unintended consequence of TELs is the creation of bottlenecks in the economic growth and development process via underinvestment in our nation’s infrastructure.”

- There is significant evidence that states with more-restrictive limits on government revenues have a higher percentage of bridges that are structurally deficient.

- However, revenue-restrictive TELs are also associated with a lower percentage of functionally obsolete bridges. While this appears to be a positive development, “it might actually be the case that TELs prevent maintenance and upgrades, which ultimately leads to some functionally obsolete bridges being reclassified as structurally deficient bridges,” the researchers state.

- Interestingly, the percentage of state government direct expenditures on highways was not found to have a significant relationship with the condition of bridges. “Given the results for revenue TELs and bridge conditions, it is reasonable to argue that shares of direct expenditures do not reflect the absolute level of expenditures…. Expenditure on highways may also mask the mix of expenditures on roads as opposed to bridges.”

- The researchers looked at other variables that could affect bridge condition, such as the number of registered vehicles per capita, population density, poverty rates and crop production. These were found to have mixed or insignificant effects.

“The viability of the economy is dependent upon a viable stock of public infrastructure, particularly transportation infrastructure such as roads and bridges,” the researchers conclude. “State governments are fundamentally responsible for the maintenance of the nation’s network of higher volume roads and bridges. Many of these states have put in place fiscal constraints, in the form of TELs, which could hinder their ability to reinvest in the transportation network.”

A related 2012 study, “The Impact of State and Local Tax and Expenditure Limitations on State Economic Growth,” looks at the influence of tax and expenditure limits on state growth rates. The scholars base their work on data from all 50 U.S. states from 1969 to 2005. “[The] results suggest that stronger TELs imposed on state governments have a dampening effect on state economic growth and TELs imposed on local governments have a weak negative impact on growth,” they state. “The results do not support the argument that legislatures can use tax and expenditure limits as a mechanism to promote economic growth.” Also of interest is another 2012 study, “Impact of State-Level Tax and Expenditure Limits (TELs) on Government Revenues and Aid to Local Governments.” Among other findings, the research indicates that revenue and expenditure limits can lead to increases in tax and nontax revenues, while procedural limits tend to lower tax revenues.

Keywords: economic development, infrastructure, regulatory issues, California

Expert Commentary