The debate over same-sex marriage revolves around a host of contentious issues, from the definition of marriage and the meaning of family to the influence of religion. But the legalization of gay marriage also has pocketbook and even budgetary implications: Since the U.S. Supreme Court ruled the Defense of Marriage Act (DOMA) to be unconstitutional, the federal government now recognizes same-sex marriage for the purposes of federal taxes and benefits in those states where such unions are legal.

The financial implications of this ruling are anything but straightforward. In the federal tax system, marriage can bring a subsidy or a penalty to married couples, depending on their individual income levels and potential tax deductions. Calculating the impact for heterosexual couples is a surprisingly difficult exercise, but estimating figures for same-sex couples is further complicated by the lack of accurate data on such partnerships.

The momentum is clear: An increasing number of states have legalized same-sex marriage, more than 50% of U.S. residents support such unions, and even the majority of those who oppose them see recognition as “inevitable” Consequently, estimating the impact of such changes on state and federal tax receipts and individuals’ tax bills is an important part of the policy picture.

A 2014 study published in the Journal of Policy Analysis and Management, “Revisiting the Income Tax Effects of Legalizing Same-Sex Marriages,” uses recent data from the American Community Survey (ACS) 2010 to provide the first comprehensive and current look at the state and federal tax consequences of legalizing same-sex marriage. New data sources allow the authors — James Alm of Tulane, Sebastian Leguizamon of Vanderbilt, and Susane Leguizamon of the University of Kentucky — to use household level information including income, number of children and mortgage payments, to construct their estimates instead of having to rely on stylized ideas of the average same-sex couple. The authors were then able to use a tax simulator constructed by the National Bureau of Economic Research to generate estimated federal and state tax liabilities before and after marriage, for each of the 536,452 same-sex couples identified in their study.

The findings include:

- One out of four same-sex couples (24%) are single-earner couples, with a low of 5% in North Dakota and a high of 41% in Arkansas. Three out of four (76%) are two-earner households.

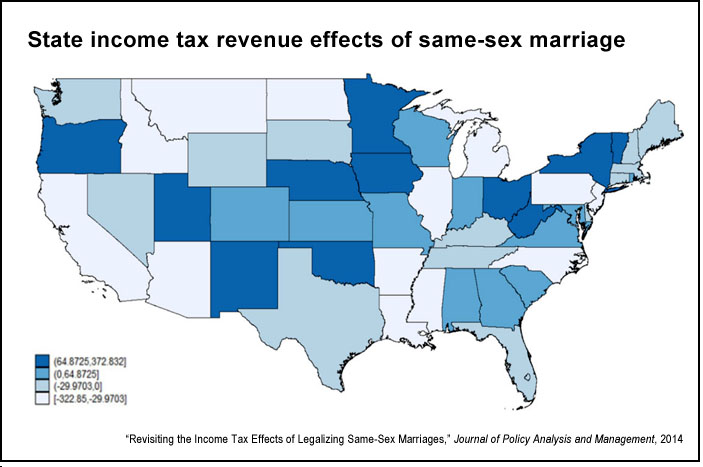

- Twenty-three states would realize a net fiscal benefit from legalization of same-sex marriage, the greatest gain being in New York, with an estimated $16 million in additional revenue. California would lose an estimated $29 million, and 20 other states would also experience a decline in revenue. The remaining seven states do not levy an income tax and therefore would be unaffected.

- The aggregate impact on revenue across all states would be negative, but small relative to the size of overall state revenues, ranging from a loss of $2.6 million to $18 million.

- At the household level, one-earner couples in California on average see the largest decrease in their state tax liability upon marriage, about $950, while those in West Virginia and Utah see the largest increase in tax liability, roughly $200. Two-earner couples fare the best in Hawaii with a reduction in estimated liability of $380, while those in New York would see the largest increase of around $630.

- At the federal level the government would lose revenue, with the decline estimated to be between $187 million and $580 million. While not insignificant, it is just 0.02% of total revenue for the U.S. federal government in 2013, $2.8 trillion.

- There is considerable variation across states in the federal income tax consequences. On average, same-sex couples in Connecticut will pay slightly over $1,000 more in federal taxes if they choose to wed, while couples in Pennsylvania will pay about $800 less. (Differences in federal taxes across states are explained by differences in family structure, income and deductions.)

- One of the main uncertainties in the estimates is the assumption about how many same-sex couples would marry were such unions legalized across the United States. The authors assume 100% of cohabiting same-sex couples would marry following legalization. However, if only 50% of cohabiting same-sex couples marry the impact on revenues would halve — states would experience an overall reduction in revenue of $1.3 million to $9 million, and at the federal level revenues could fall by between $95 million to $237 million.

- The above estimates only account for cohabiting same-sex couples. An alternative calculation could assume that same-sex couples would chose to marry at the same rate as heterosexuals (51% according to the Census Bureau), regardless of their current cohabitation status. This would lead to an estimated 960,000 same-sex married couples, almost double the estimate used in the study and increasing the losses to state revenues to as much as $36 million and federal revenues could lose almost $1 billion annually.

The authors note that some care must be taken when interpreting the state income-tax effects, as the sample size in some states is very small — for example, in Wyoming there are only three same-sex couples in the study’s data. However, for most states the size of the sample is not an issue, and even after eliminating the influence of states with a small number of observations, the overall direction and implications of the study remain unchanged.

“Given the enormous, and increasing, range of family types in the United States — traditional single-earner households with a stay-at- home spouse, two-earner families, nonmarital cohabitation among opposite and same-sex couples, extended families, unrelated individuals living together — it may well be time to recognize that the tax laws of such a diverse society should treat all families the same,” the authors state. “The choice to make the individual the unit of taxation would ensure that tax liabilities are independent of legal marital status.”

Related research: A 2014 selection of research, “Same-sex Marriage and Children’s Well-being,” looks at the psychosocial and educational outcomes for children raised by same-sex parents. The studies analyzed found that children of gay and lesbian couples had generally positive outcomes, including greater “resilience with regard to social, psychological, and sexual health” and higher “social, school/academic, and total competence,” and that overall, “children raised by same-sex parents fare equally well to children raised by heterosexual parents.”

Keywords: Gay and lesbian issues, law, equal rights, marriage, taxation, consumer affairs

Expert Commentary