Many fault the bursting of the U.S. housing bubble for triggering the “Great Recession” of 2007-2008. Because of relaxed credit standards and exotic mortgages, tens of thousands of Americans purchased homes they could not afford; when the end came, the entire industry dropped 33% of its value. The recession forced policymakers to look back at decades of policies that subsidized homeownership, in particular the ability of homeowners to deduct mortgage interest payments from their taxes. The deduction cost the United States $90 billion in lost revenue 2010, and many are questioning whether the long-time infatuation with promoting homeownership was worth the investment.

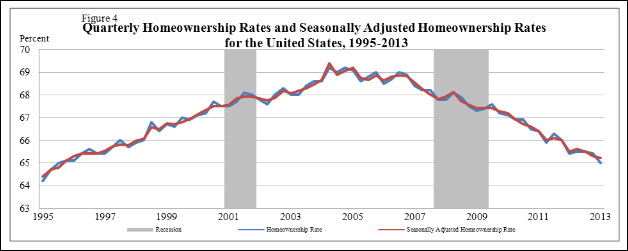

Roughly 65% of Americans own their own home, about the same as other developed nations. Ownership peaked at approximately 69% in 2004, and has been falling since. The rate is now the lowest it’s been in nearly two decades, as illustrated by this U.S. Commerce Department chart published April 2013:

Mortgage subsidies have long been justified by asserting that homeownership is a catalyst for a stronger economy, better schools and an invested, proactive citizenry. But are homeowners really better citizens? And are the payoffs for homeownership worth the billions of dollars invested each year by taxpayers? Social science researchers have often framed inquiries about democratic participation and cohesion around the ideas of social capital and collective efficacy. But the research on such questions has been mixed.

Looking at these issues through the lens of citizen activism, Brian J. McCabe of Georgetown University compares homeownership to voting rates in local elections, involvement in citizen organizations and participation in membership groups. His 2013 study, “Are Homeowners Better Citizens? Homeownership and Community Participation in the United States,” published in Social Forces, determines that homeowners do participate more and are driven to do so by a desire to protect that which, for many, is their largest financial asset.

The study’s findings include:

- The average American household keeps more than one-third of its assets in the principal home.

- Homeowners are 1.28 times more likely to become involved in a neighborhood group and 1.32 times more likely to join a civic association. However, homeowners are no more likely than renters to belong to a sports or religious group.

- The likelihood that a homeowner will vote in a local election is 65%, compared to 54% for renters. For national elections, the difference is much smaller: The probability that a homeowner will vote in a national election is 86% versus 83% for renters.

- Comparing short-term renters to long-term renters, the researcher finds that residential stability (staying in a home for more than five years) increases the likelihood of electoral participation, but does not affect participation in membership groups.

- Education remains the single most important driver of political participation and group membership, according to a 1995 study.

- “Preliminary analyses reported in this article suggest that low-income households do not experience disproportionately strong civic returns from homeownership. These findings raise a cautionary flag about the effectiveness of homeownership as a tool for spurring community participation for low-income households.”

While homeownership does increase citizen participation, the gains are only marginal compared to the amount of taxpayer money invested in homeownership, the author states. The study concludes that the “findings presented in this research do not easily lend themselves to normative conclusions about homeownership, civic participation and community life. Recognizing the importance of their financial investments, it is possible — even likely — that homeowners participate more actively to secure a set of benefits narrowly beneficial to their self-interest, rather than beneficial to the broader community.”

A related 2013 study from researchers at Dartmouth and the University of Warwick, “Does High Home-Ownership Impair the Labor Market?” suggests that having more homeowners can have a negative impact on the employment situation at the state level.

Tags: municipal

Expert Commentary