First authorized in 1965 as part of President Lyndon B. Johnson’s War on Poverty, Title I grants provide federal aid to school districts to pay for support staff, classroom supplies and even clothing to help children from low-income households succeed academically. This is an example of a federal program that takes into account the size of one specific demographic group when calculating funding: students whose family incomes fall below a certain financial threshold, as defined by the U.S. Census Bureau.

In fiscal year 2017, the federal government distributed more than $15 billion in Title I grants to school districts based on the number of low-income children each district serves, relying on poverty data calculated by the U.S. Census Bureau’s Small Area Income and Poverty Estimates (SAIPE). (Note that the federal government’s fiscal year runs from Oct. 1 to Sept. 30.) Title I funds are apportioned by school districts based on the number of low-income students each public school reports, although, per the Department of Education, school districts “also must use Title I funds to provide Title I services to eligible children enrolled in private schools.” Read more about Title I on the U.S. Department of Education’s website.

As this tip sheet from the National Center for Education Statistics explains, there are four types of Title I grants, each with its own formula for calculating allocation amounts. Most Title I money is distributed through so-called “basic grants.” School districts decide how to divvy up the money among schools serving high numbers of low-income kids.

“Districts have a lot of leeway in whether to spread Title I funds more thinly or to concentrate them in fewer of their highest poverty schools,” explains Nora Gordon, who studies Title I grants as an associate professor at the Georgetown University McCourt School of Public Policy.

Localize your state’s Title I funding stakes with these interactive maps

The 2020 decennial census will be crucial in helping direct the distribution of some $1.5 trillion a year in federal funding for programs like Title I , Medicare, Medicaid, Head Start and the National School Lunch Program. Federal officials use census data in two ways: to determine individual and organizational eligibility for these programs, and to apportion funding.

Journalist’s Resource is publishing a series of shareable data visualizations and data sets designed to help you better understand the broad influence of census data at the national, state, regional and program level — and to help you better understand the importance of an accurate headcount. Per the U.S. Department of Education, “Federal funds are currently allocated through four statutory formulas that are based primarily on census poverty estimates and the cost of education in each state.”

To illustrate where Title I funding goes and the estimated average amount of funding per eligible child, the following interactive map shows how much funding went to each state in fiscal year 2017, divided by the state’s number of low-income children aged 5 to 17, which is the age range SAIPE uses in its estimates.

Funding was calculated by Andrew Reamer, a research professor overseeing the Counting for Dollars project at the George Washington Institute of Public Policy. Funding for 2017 — the most recent year for which data was available when Reamer conducted the research — was guided by 2010 decennial census data. “It takes time for the government to obtain and publish the latest year for every program,” he tells Journalist’s Resource. In any case, he says, the distribution numbers for 2018 and 2019 are also guided by 2010 decennial census data and are not likely to change much from year to year.

We obtained the state population of children living in poverty through SAIPE. Those numbers are based on Census Bureau’s American Community Survey (ACS), which uses decennial census data to project population numbers between decennial census years. The ACS is a yearly survey of around 3.5 million households to gather information on age, sex, race, housing, education, employment and income.

As this analysis shows, Vermont, Wyoming and North Dakota received substantially more Title I money per eligible child in fiscal year 2017 than did other states. Vermont and Wyoming each received more than $3,000 per child compared with the national average of $1,489. This mirrors findings from a U.S. Department of Education report released in 2019. That report, “Study of the Title I, Part A Grant Program Mathematical Formulas,” looked at fiscal year 2015 data and concluded that “the total Title I final allocation per formula-eligible child in the United States was $1,227 but ranged from $984 in Idaho to $2,590 in Vermont.”

Note that some states receive more in total funding but less in per-student funding.

Looking at individual school districts

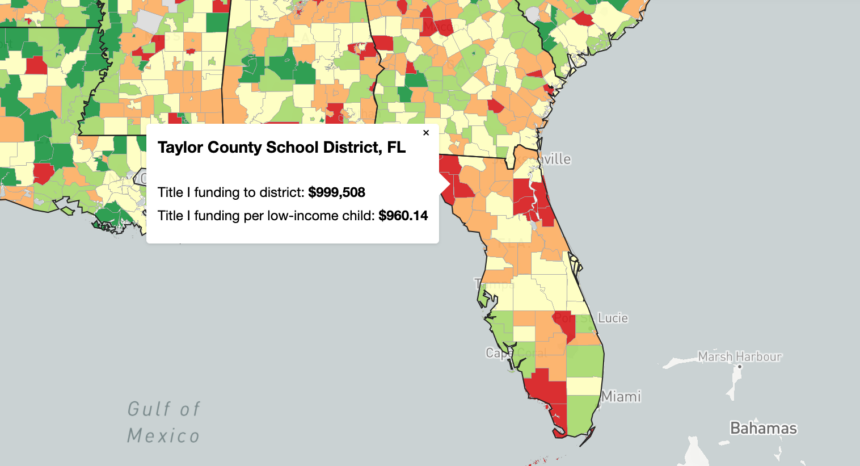

A national map isn’t enough to tell the full story, however. We can highlight differences by exploring the amount of Title I funding going to each school district. These differences are especially important when considering how much Title I funding school districts potentially miss out on when low-income children are undercounted.

In fact, children aged 5 to 9 were among the age groups with an estimated net undercount in 2010, according to a 2017 Census Bureau study. There was a 2% undercount in 2010 for that age group, finds a study published in 2013 in the journal Population Research and Policy Review. Children aged 4 and younger were undercounted at a rate of 4.6%. Where researchers think children under age 5 are likely to be missed is the subject of a report the Population Reference Bureau released recently, “Research Identifies New Strategies to Reduce Undercount of Young Children in U.S. 2020 Census.”

Ron Jarmin, director of the U.S. Census Bureau, has acknowledged the difficulty past censuses have had counting children, calling it a “critical issue.” For more on miscounts, read Journalist’s Resource research roundup on how census undercounts and overcounts can hurt U.S. communities.

Children are among the demographic groups most likely to be undercounted, according to the Census Bureau. U.S. District Judge Jesse M. Furman specifically cited concerns over Title I funding in his decision to reject adding a citizenship question to the 2020 census. If the citizenship question were added, Furman wrote, some schools serving lower-income communities would lose out on funding.

The following map shows how much funding each school district received in federal fiscal year 2018, which ran from Oct. 1, 2017 to Sept. 30, 2018, based on the most recently available data from the U.S. Department of Education.

It also includes estimates for the amount of funding per child living in poverty in each state, based on poverty and population estimates from SAIPE as of Jan. 1, 2018. It’s worth noting that there is error inherent in any estimates. As explained on the Census Bureau website, “All statistical estimates contain error, and there has never been a complete census of income and poverty for all school districts in the nation.”

Navigate to a state and school district and click on the map to explore the amount of Title I funding received in fiscal year 2018 per low-income student.

School districts in New York City, Los Angeles, Chicago, Philadelphia, Miami and Detroit are among those that receive the most Title I dollars annually. But as U.S. News & World Report pointed out in 2016, this analysis can also reveal that smaller districts with more low-income children receive comparatively less per eligible student than their larger neighbors.

Our analysis shows that school districts serving at least 10,000 low-income students received $1,772 in Title I money per eligible student while districts serving smaller populations of low-income children averaged $1,481 in fiscal year 2018.

Getting to the school level

It’s important to note that these numbers don’t provide information about the Title I money received by individual schools, warns Georgetown’s Gordon. School districts decide which schools receive Title I dollars.

“Districts rank schools based on some measure of economic disadvantage, like free lunch eligibility, because census data don’t go down to the [individual school] level,” she explains. “That’s how they decide who gets how many Title I funds.”

Gordon points, for example, to the Baltimore Sun’s 2019 story, “Baltimore school with large immigrant population loses vital funding source,” which raises issues about how districts allocate Title I funding to individual schools.

“While Congress allocates funds to districts on the basis of how many poor children live there, most schools run schoolwide Title I programs, so the per pupil — rather than per-poor-pupil — numbers are likely more salient at the building level,” she explains. For more insights on how districts allocate funds to schools, Gordon recommends reading “Study of Title I Schoolwide and Targeted Assistance Programs: Final Report” from the American Institutes of Research.

Gordon notes that the federal government has adopted policies aimed at preventing districts from experiencing massive drops in funding in the event of a large undercount. The Title I law contains a “hold harmless” provision that says schools won’t lose more than 15% of their Title I funds in a given year if their eligibility numbers drop.

Gordon says our school district-level analysis can be illuminating to reporters hoping to approach school administrators or elected officials about changes in federal funding or school eligibility for Title I.

Additional resources

- This report from the Department of Education looks at Title I funding by school district for fiscal years 2002 through 2019.

- The U.S. Census Bureau’s Small Area Income and Poverty Estimates (SAIPE) reports offer details on the estimated number of children living in poverty in each school district.

- This technical report explains how the federal government calculates SAIPE.

- School district shapefiles, geospatial data used to build maps, can be found at the Department of Education website.

- Many states have created explainers on how schools can spend Title I dollars, like this one from the New York State Education Department.

- Journalists can find further details on Title I grant formulas in the U.S. Department of Education’s 2019 report, “Study of the Title I, Part A Grant Program Mathematical Formulas.”

- This 2017 report from the Congressional Research Service — Congress’s think tank — offers an 88-page history of Title I formulas.

Expert Commentary